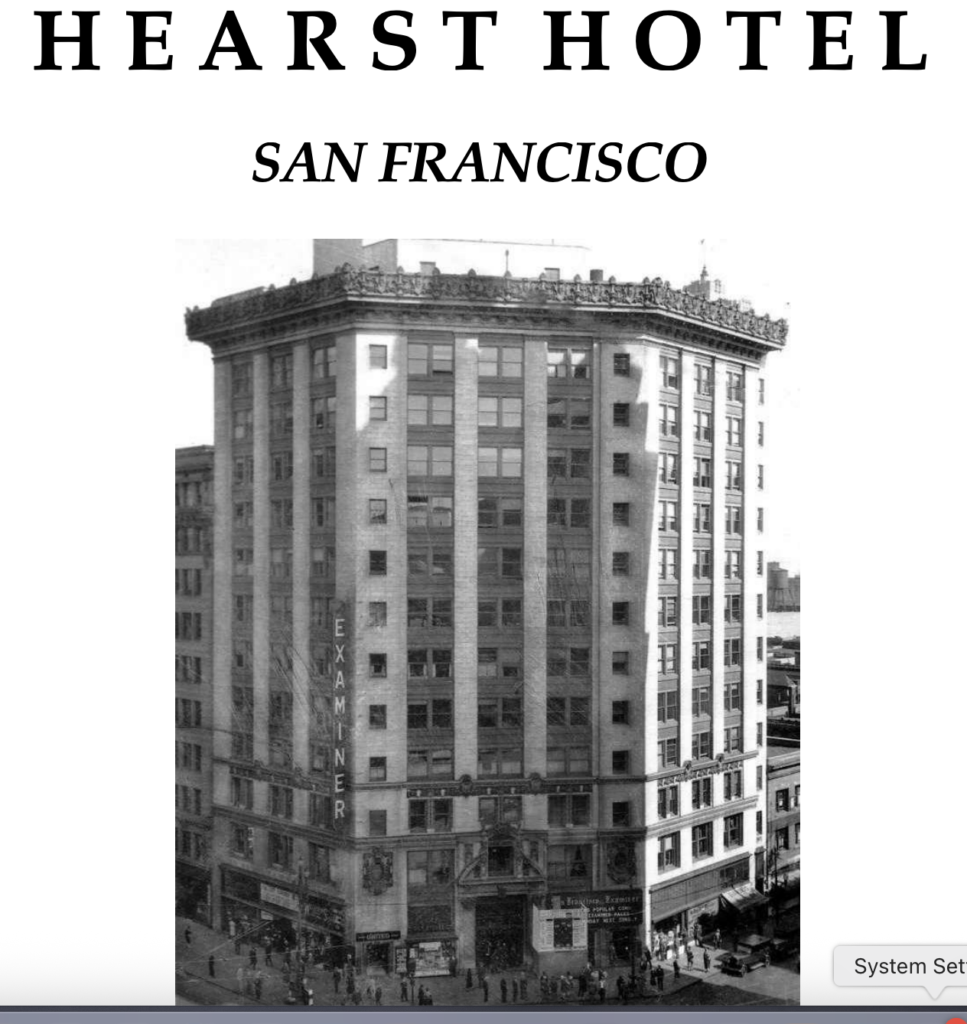

Mayor Daniel Lurie wants to give a private developer $40 million to help build a hotel on Third Street in the old, and historic, Hearst Building.

In essence, the city would advance the project the money that it would have received in hotel taxes for the next 20 years:

JMA Ventures, through its affiliate Bespoke Hospitality, LLC (Developer), has a long-term lease to develop and operate the property at 5 Third Street and 17-29 Third Street, three mostly vacant, internally connected commercial buildings collectively known as the Hearst Building. The Developer has obtained Planning Department approvals to develop a mixed-use hotel project on the property with up to 170 hotel rooms, restaurant and bar spaces, office, retail, seismic and structural upgrades, and restoration of historical building features. To help finance construction of the hotel, the City would provide incentive payments equal to the actual General Fund TOT revenues generated by the new hotel, up to $40 million in net present value, for a period of up to 20 years.

This is the first time I can remember in years when the city has actually offered a cash incentive to a private developer for a commercial project. The city used to do this under the Redevelopment Agency, and more recently has done similar things at Hunters Point and Treasure Island, but in those cases the money was used to reimburse the developer for providing public infrastructure like roads and sewers.

This is just about helping a developer make more profit.

And there’s a problem that nobody seems to be discussing.

Under Section 67.32 of the San Francisco Sunshine Ordinance, the city can’t give any money to a private entity unless that company releases all its financials for the project:

The City shall give no subsidy in money, tax abatements, land, or services to any private entity unless that private entity agrees in writing to provide the City with financial projections (including profit and loss figures), and annual audited financial statements for the project thereafter, for the project upon which the subsidy is based and all such projections and financial statements shall be public records that must be disclosed.

I can find no such documents that exist in the public record today.

The city has done an economic impact report, saying that the project

would provide net General Fund revenues of approximately $713,000 compared to the existing land use, after accounting for the TOT incentive payments to the developer. The project would also annually generate approximately $157,000 in net revenue to the Municipal Transportation Agency (MTA) Fund and $367,493 in TOT for arts and culture purposes (which is unaffected by the incentive agreement).

But essentially the city is giving money to a for-profit developer to guarantee a rate of return of almost 18 percent:

According to the Developer, without the City subsidy, the proposed project would generate an annual rate of return of approximately 3.8 percent, which does not meet industry standards. The proposed subsidy would enable the project to generate an annual rate of return of approximately 17.9 percent, which is feasible.

I have filed sunshine requests for the developer’s finances, but I seriously doubt those documents will be available before the Budget and Finance Committee meets to consider this precedent-setting proposal Wednesday/4.

Ethics Commission filings show that Bespoke paid lobbyist David Noyola $10,000 a month for two months in late 2025, and that he met Dec. 11 with Sup. Matt Dorsey, who is sponsoring this legislation with the mayor.

The members of that committee are Chair Connie Chan and members Dorsey and Danny Sauter. You can get their contact information here.

The Board of Supes will decide Tuesday/3 whether to put on the June ballot a measure that would impose lifetime term limits on the mayor and board members.

Six supes are already supporting it, so it’s likely this will wind up on the June ballot. Sup. Shamann Walton tried to amend it to include not only the mayor and the supes but all other elected officials; that motion failed.

And since I don’t know anyone with a lot of resources who is going to spend the time and effort to oppose it, this will probably pass, further empowering the chief executive in a city where that office is already too powerful.

This is happening as Lurie is trying to prepare a comprehensive City Charter amendment package for next fall—and from the makeup of the panel drafting the amendments, it’s clear that this will give the mayor even more power, undermine citizen initiatives, and further entrench Big Tech and Big Real Estate as the powers that be at City Hall.

When I first saw this, I was pretty sure it was a joke: Somebody is messing with the very rich and the astroturf groups they fund in San Francisco. Nobody could seriously be discussing a “march for billionaires,” could they? This must be another version of Billionaires For Bush.

Maybe it really is a hoax, but if it isn’t, this wildly embarrassing—and the language in the text is not that different from what the opponents of the Billionaire Tax are saying. So either way, it’s worth discussing.

Let’s take a look:

Most made their fortunes building companies that employ thousands and solve real problems. Their wealth is largely stock in those companies, not vaults of cash.

California benefits enormously when entrepreneurs choose to build here. We’re currently watching them leave.

The Billionaire Tax Act has already pushed the founders of Google to leave the state, taking their economic contributions with them. By taxing unrealized gains and voting shares, the act would make it difficult for founders to retain control of their startups.

These billionaires didn’t steal from you.

The website lists some folks who, the authors claim, have made the world a better place by inventing new products and services. On the list: Jeff Bezos (Amazon), Brian Chesky (Airbnb), Larry Page and Sergei Brin (Google)—and then, very oddly, since there is only one woman on the list, Taylor Swift.

There are, of course, a few folks missing: Elon Musk (Tesla), Tim Cook (Apple), Mark Zuckerberg (Facebook), Peter Thiel (Palantir) … all of them, along with Bezos, have strongly supported Donald Trump, who is rapidly trying to destroy US democracy and create an authoritarian state.

Taylor Swift does not support Trump. She also has, maybe, a net worth of $1.6 billion, less than one percent of what these others have.

Airbnb has led to the eviction of tens of thousands of tenants. Amazon has wiped out tens of thousands of small businesses. Palantir is helping Israel devastate Gaza.

More important: The billionaires did, indeed, steal from you—legally. Thanks to tax cuts, the very rich have taken $47 trillion from the lower 90 percent since 1975.

It’s fair to ask if the world is really a lot better off with Amazon, Facebook, Airbnb, and Palantir. But let’s not even go there.

Do founders really need the incentive of $100 billion to make new products? Suppose, like Taylor Swift, they had $1.6 billion, and the rest was taxed? Do you suppose Swift will quit writing songs and performing because she doesn’t have $100 billion?

The United States has seen a century of major new inventions, some of which did make the world a better place, including, for example, the Polio virus, which Jonas Salk refused to patent, saying that the people of the US had paid for his research and the vaccine, which saved millions of lives, belonged to the public. The US was the center of innovation in the post-war era, when the semiconductor and telecommunications began to transform global technology. The US sent men to the moon. At that point, marginal taxes on the very rich reached 90 percent.

Taxing some of the massive, unprecedented fortunes of these mega-billionaires would do nothing to stifle productivity or invention. It would just, well, make the world a better place. And that wealth that is “largely stock?” They just borrow against it, live an excessive high life, and pay no taxes.

Does anyone seriously think Bill Gates would have decided not to bother founding Microsoft if he was only going to wind up with $10 billion, not $100 billion? Nah, maybe I’ll drive a cab; not worth the effort if I have to pay some taxes.

If this is indeed a hoax, well done: Have fun. Maybe some folks will arrive with signs and make fools of themselves. If it’s not, I am stunned—but feel free to show up and let the billionaire allies hear what you think. The “march” starts Saturday/7 at 11 am at Alta Plaza Park.