In what should surprise nobody who is paying attention to the reality of the local housing market, a new report by People Power Media shows that San Francisco has allowed far too much new housing that most residents can’t afford, and that new market-rate housing has been associated with gentrification and displacement.

The detailed report uses a new housing database that’s more accurate than what the City Planning Department uses, since it looks not just at what’s been permitted but what’s been constructed. PPM is a member of the Race and Equity in All Planning Coalition.

The report shows that:

● The City built only about half of what was needed for affordable housing and double what was required for unaffordable, market rate housing, based on analysis of both publicly reported data and data from our New Housing Dataset.

● The City over-reported its numbers for affordable housing, and is inconsistent about the numbers they report regarding fulfilling housing production goals. Median income households in nearly all People of Color Neighborhoods in San Francisco pay more than they can afford for Rent. The opposite is true in all of the Predominantly White Neighborhoods, where new market rate housing is in line with median household incomes.

● Essential workers and minimum wage workers who work in San Francisco cannot sustainably afford to live in the new housing that developers are building in the City where they work.

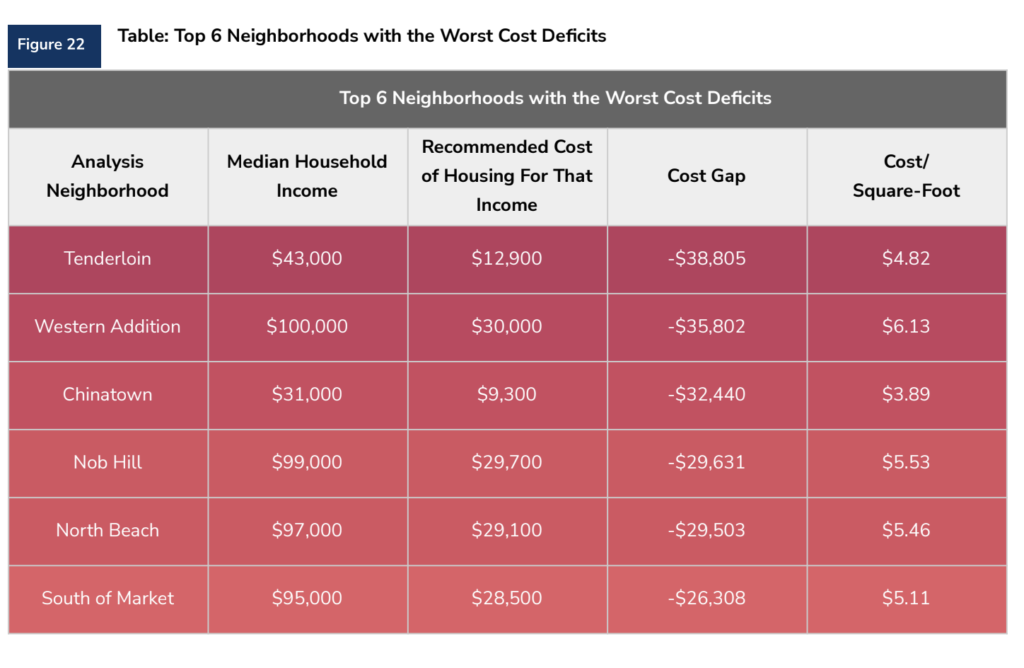

● The neighborhoods with the worst cost gaps are the Tenderloin, Chinatown, North Beach, Nob Hill, South of Market, and the Western Addition.

The report also states that between 2015 and 2022, developers put up market-rate housing all over the city, not just on the East Side; that most of that housing is not affordable to working-class people—and that new market-rate housing is associated with the displacement of existing vulnerable communities:

● New developments increase the prices for both market rate housing (based on comparables) and affordable housing (due to increasing Area Median Income).

The report concludes that

Rather than using zoning and regulatory mechanisms solely to encourage market rate development, the public sector as the sector that is accountable to the long term needs of its constituents, must prioritize resources and programs for building and preserving permanently affordable housing at a scale sufficient to meet the needs unmet by market rate developers.

The researchers discovered that some of the data the city has submitted to state regulators is flawed or incomplete:

Since some entitled or permitted projects or buildings are never completed, or they completed construction after the end of 2022, the City’s reported numbers do not actually reflect what was built during the period of this study. Our Comprehensive Data in this report focuses on what was actually, physically built during these eight years.

The city artificially inflated the number of affordable units built, in part by including Accessory Dwelling Units that actually rent at market rate.

Using neighborhood-level income data, the reports looks at the areas in the city where the gap between median income and the cost of housing is the highest. It demonstrates that in neighborhoods that have high populations of people of color, the gap is enormous—and the new housing that has been built has done little or nothing to help.

In fact, the report states, the new luxury housing can make the situation worse:

How the Sales Comparison Approach plays out is that if an existing older apartment building is going up for sale, and it is adjacent to a new market rate building, the sales price of the older building would be compared to that of the expensive new market rate building and other buildings around it. The higher the value of the buildings that surround that property, the higher the comparables. Thus, with property values assessed in this way, it creates a dynamic in which introducing a market rate building with several new units marketed at higher prices causes the prices of surrounding buildings in that neighborhood to increase whether they are old or new. The surrounding buildings’ values all increase when the new building comes online. The higher prices in the new, market rate building– the increasing rents and home prices, the influx of wealthy people, and the displacement of people who cannot afford the rising housing costs– are all contributors to the dynamics of gentrification.

Rents for affordable housing in San Francisco are set by a household’s income, as measured compared to the Area Median Income. If the AMI rises because more rich people move into luxury housing in the city, that raises the price of even subsidized housing:

As wealthy people move into San Francisco, as well as the surrounding areas, AMI levels increase for the whole region. Real incomes below the median don’t increase, but incomes above the median do increase. The increase in people with high incomes pulls the median income up. HUD uses AMI levels when calculating rental or sales prices of affordable housing.

That’s consistent with what the National Bureau of Economic Research found recently: The price of housing in urban areas has less to do with the supply than with the number of rich people moving into the area.

The study concludes that simply removing obstacles to luxury housing, which is the main strategy that the city and the state are taking right now, won’t solve the affordability problem.

Again, that’s consistent with the data. If San Francisco wants to take displacement, affordability, homelessness, and the housing crisis seriously, it needs to rely much more on public-sector solutions, and not on the private market.

From a People Power Media press release:

“This new report affirms what our advocacy has always said: San Francisco’s housing crisis is not about a lack of housing—it’s about a lack of affordable housing. The market is producing housing as a commodity, not as a basic human need. That’s why it’s failing to serve the people who live and work here,” said Jeantelle Laberinto, community organizer at People Power Media.

“The policies in our current housing cycle are set to repeat the outcomes of the last: all of the power is being handed over to the market – and this is what the market does. It prioritizes profit over people and fails to provide housing for San Franciscans. As long as developers and investors drive our housing production, we will continue to see housing that excludes communities of color, low-income residents, and essential workers,” saidDyan Ruiz, co-founder of People Power Media.

Mayor Daniel Lurie’s new zoning plan relies almost entirely on private-market deregulation. This detailed, meticulously researched study suggests that approach is doomed to fail—with some terrible consequences for existing vulnerable communities.