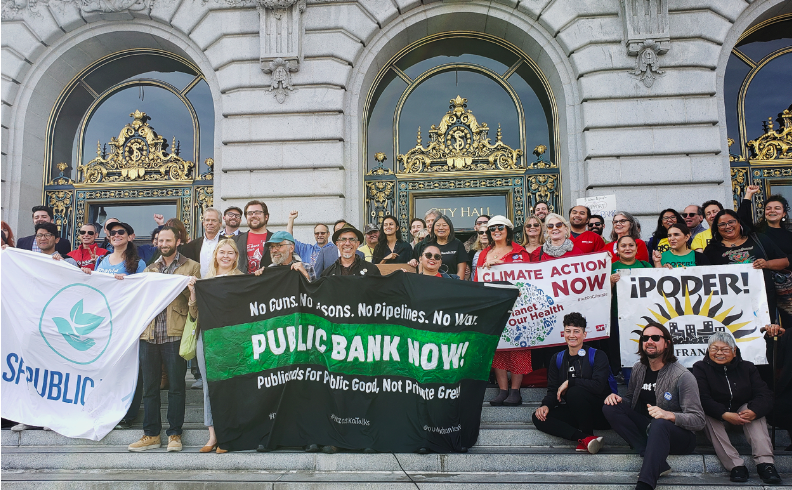

I am writing in response to Rick Girling’s May 17th article about a public bank for San Francisco, modeled on the success of the publicly-owned Bank of North Dakota. I am the founder and CEO (until 2017) of Accion Opportunity Fund, a Bay Area-based non-profit community development financial institution that has invested more than $1 billion into small businesses, affordable housing and community facilities.

I am always happy to see efforts to invest local money into local infrastructure and small businesses—and to put the profits back into the community. I am 100 percent in agreement with the goals of the Public Bank Coalition, and I support the idea of creating a public bank. I do, however, believe the leaders of the movement need to be realistic about what they are promising.

Take affordable housing. Rick’s article says “a public bank could assure financing for permanently affordable, energy-efficient housing.” The fact is that, because of the Community Reinvestment Act, banks are already competing like crazy to lend to any affordable housing deal in San Francisco that is being undertaken by a reputable developer. As for deals that a bank might find too risky, like predevelopment loans or loans to acquire vacant buildings, San Francisco and the Bay Area are well-served by non-profit CDFIs like Community Vision, LIIF, Enterprise Community Partners and LISC. None of them, as far as I know, are constrained by lack of lending capital.

The scarce resource when it comes to affordable housing is public subsidy, not debt that needs to be repaid. It’s true that removing any profit motive might make the public bank able to offer slightly better pricing, but saving a few basis points on a construction loan doesn’t move the needle much. It’s even questionable that the public bank’s rates would be lower, because banks motivated by CRA are so eager to get these deals that they are subsidizing their interest rates.

I have heard the argument that the public bank would take risk on housing deals that even non-profit CDFIs would not, and that it would make the loans with far less hassle for the non-profit developer. I question this. When has a program operated by a governmental entity ever been operated with less hassle to the end-user? Furthermore, the Bank of North Dakota has been consistently profitable, with a return on assets in recent years that has been twice or even three times the return earned by similarly sized banks. I’m not sure how it has done that by doing riskier deals than non-profit CDFIs do, or by relaxing underwriting or documentation procedures.

In fact, in the case of the BND, that literally can’t be true because the BND, with rare exceptions, doesn’t even make loans directly to borrowers. It participates in loans made by (you guessed it) banks. I believe that a public bank in San Francisco would have little impact on the volume of affordable housing being developed in the city. It could partner with community banks, credit unions and CDFIs and ensure that some of the profits made on affordable housing deals go back to the public, but that’s about it.

The backers of the public bank (of which I am one) are also promising that it will provide financing for small businesses that are currently being denied by banks—like people of color and women. This is what my colleagues and I at Accion Opportunity Fund have spent the last 30 years doing, with possibly more success than any other organization in the country.

It is absolutely true that banks do a terrible job at providing credit to those businesses. It’s also true that, for historical reasons that should be obvious (systemic racism and sexism) businesses owned by BIPOC and female entrepreneurs tend to be smaller than those owned by their white male counterparts. This means, in general, that the only loans they can afford to pay back are going to be smaller loans. Making money on small loans is very hard, unless you charge exorbitant rates, so it’s true that part of the reason banks don’t make them is that they are “solely focused on profit maximization.”

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

But taking away the profit motive doesn’t provide anywhere near the amount of subsidy needed to make small loans and cover all of the cost involved. Again, San Francisco is served by several very good non-profit CDFIs that specialize in making these loans: Accion Opportunity Fund, Working Solutions, Main Street Launch, MEDA and Pacific Community Ventures. None of them have a profit motive and all of them need to do substantial outside fundraising to do what they do. I do not believe any of them are lacking liquidity to lend.

The BND participates in loans made by North Dakota’s community banks to enable them to make larger loans, not smaller ones. It would be great if the San Francisco public bank would lend money at low rates to CDFI microlenders, so they would have an alternative to borrowing from big banks, but that wouldn’t help them reach more borrowers. What would help is for the city to truly help the microlenders do outreach to small businesses. What if every time a small business owner renewed their business license, they got a list of all of the microlenders active in the city, with a quick summary of what they offer and their minimum credit requirements?

The idea of taking the city’s money out of the behemoth banks and putting it in a public one is very appealing and should be done. But I don’t really see how it would lead to more affordable housing or more loans to underserved small businesses. In North Dakota, as I mentioned, more than half of what the public bank does is participate in loans originated by small community banks in the state, giving them the ability to originate larger transactions than they otherwise could. Most of the rest of what it does is buying mortgage loans and making student loans. Both of those activities present intriguing possibilities, but I don’t know enough about those markets to opine.

My final concern about the public bank doing direct lending relates to whether a governmental agency will be able to make credit decisions without succumbing to political pressure. Would there be pressure to lend to businesses or non-profits with a lot of political juice? Conversely, would the bank be able to withstand public pressure to not foreclose on a delinquent non-profit, or minority-owned small business? I would be more comfortable if it were to limit its activity to co-lending with other financial institutions, or lending directly to CDFIs.

To sum up, I am all for putting San Francisco’s idle cash to better use than enriching the shareholders of the big banks, and doing it through the creation of a public bank. I believe, however, that those of us who support the idea need to be realistic with the tax and fee payers of San Francisco about what the bank can actually achieve.