A report published last week by theBoard of Supervisors Budget and Legislative Analyst showed that one of every ten residential units in San Francisco—more than 40,000 homes—is vacant. With more than 8,000 unhoused persons in the city, this means that there are more than four times more empty homes than homeless people in San Francisco.

This morning on the steps of San Francisco’s City Hall, District 5 Supervisor Dean Preston and community leaders announced they will seek to place an Empty Home Tax on the November ballot.

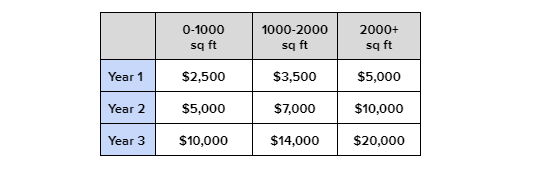

The measure would levy a significant tax on units that landlords are holding off the market. Revenue from the measure would be dedicated to homelessness prevention strategies, such as rent subsidies, and to the acquisition of rental units for affordable housing.

Preston said he estimates the measure will make 5,000 homes available in the first two years.

“This time is not the time for half measures,” said Shanti Singh, leader of the San Francisco Chapter of the Democratic Socialists of America. “We are here to send the message that housing belongs to the people, not to proprietors.”

Since 2015, the number of empty homes in San Francisco has increased by 20 percent, and the city’s homeless population has grown about as much in that time.

“Within four blocks of my house there are 25 empty units that I’ve counted,” said long-time North Beach resident and community organizer Theresa Flandrich. “People are getting evicted and have trouble finding homes in the same neighborhoods that they grew up in and have lived all their lives. Can we open up the buildings that have vacancies to be homes for our neighbors?”

The report published last week by the BLA indicates that a significant number of the currently empty units in the city were built within the last ten years, and up to 22 percent of these have never been occupied. This, Preston said, indicates that the active development happening in the city by real estate giants is not helping to alleviate the housing crisis, but rather contributing to it.

“They are buying homes in San Francisco as if they were buying shares in the stock market,” said Preston. “We are not the first city to do this, but we will be the first city in America to do it right.”

The measure proposal would not target all homeowners; it would apply only to buildings with three or more units, and it includes a range of exemptions for good-faith vacancies.

The Empty Home Tax is modeled after a successful residential vacancy tax passed in Vancouver B.C. in 2016. Half of the funds collected would be distributed in rental subsidies for seniors and low-income families as an effort to prevent homelessness in the first place. The other half would be directed to a new program for the city to acquire buildings for affordable housing.

Supporters of the measure will have to collect about 9,000 valid signatures by July 11. Preston and his team will be working together with the San Francisco Chapter of DSA, as well as Faith in Action Bay Area, a local congregation of community leaders and organizers.

“It is time for San Francisco to stop being indifferent to elderly people, minorities and low-income families,” said Brenda Cordova, president of Faith in Action Bay Area. “These individuals and families have worked in the city and have paid taxes, they deserve to live with dignity.”