I’m not surprised that part of Mayor London Breed’s solution to the affordable housing crisis is allowing developers to build less affordable housing. That, and increasing density and height on the west side of town, and cutting the “red tape” that developers say is slowing housing. This has long been her approach.

Let’s just be clear from the start here: San Francisco has an affordable-housing crisis. If you’re rich, there’s plenty of high-end housing the available, including rentals.

The state even recognizes that, to an extent: Our state goal of 82,000 new units includes 46,000 affordable ones, which is more than half the total.

So how does lowering the amount of affordable housing the developers have to build help the crisis?

In theory, lowering the inclusionary requirements could give builders and incentive to start actual construction on the 45,000 units already approved and ready to break ground.

The mayor is also talking about getting rid of the Conditional Use process—but she can’t do that by herself, since it’s in the Planning Code. A change would require a majority of the Planning Commission and six votes on the Board of Supes. She suggests it would spur more construction.

Still, it feels as if this is all the generals fighting the last war. You could argue that height limits on the west side and community input delayed, and maybe discouraged, more market-rate housing ten years ago. I would still argue that more market-rate housing would have done nothing for the current crisis anyway; more market-rate housing doesn’t bring down prices.

But none of that matters in 2023. Construction is stalled right now because of a lack of financing, not by a lack of upzoning. Remember: 45,000 units are already approved. They are already what conservative free-marketeers call “by right,” which means they need nothing but a ministerial building permit.

Nobody’s building them.

This is simple capitalism. When interest rates were at one percent, lenders who could get five percent from investing in housing were ready to go. Now that the Federal Reserve has pushed rates way up, it costs more to borrow money for housing at a time when the cost of construction materials is soaring.

Developers don’t build housing as a public good; they’re looking for profits, substantial profits, which means even higher prices.

Meanwhile, downtown has emptied out, high-paid tech workers can work from home, and the city’s population is actually declining. We may actually see rents start to fall—not because the city has allowed more rental housing, but because the tech boom that drove up rents has slowed down and fewer people are moving to San Francisco.

So people demanding by-right approvals and pointing to the supposed success in Seattle are ignoring current reality. (Oh, and by the way, housing prices have not dropped in Seattle as more was built; housing there has only gone up, and is still way out of reach for most residents.)

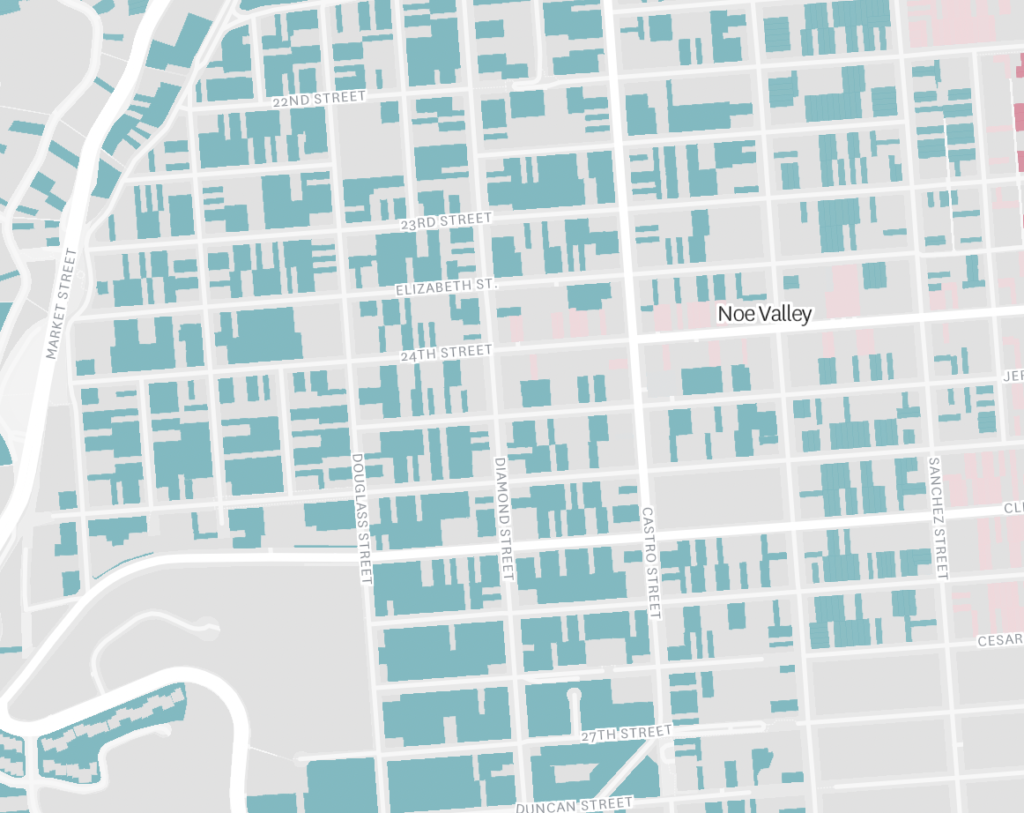

It’s interesting to look at the maps that the Chron created out of Planning Department proposals for upzoning the west side (which appears to start around Noe Valley). In almost every case where increased density is allowed, there is already existing housing, and I don’t see how it’s going to get more dense without massive demolitions:

John Elberling and the folks at TODCO have a proposal that would tie any reductions in the inclusionary requirements.

Their suggestion:

Hopes that ‘trickle down,’ supply-side, market economics, or somehow, state, federal, or charitable funds will meet the City’s dire need for more affordable housing development are irresponsible “magical thinking.” Over the years Inclusionary Housing has provided thousands of new affordable homes for San Franciscans. We cannot cut back or stop that now. So instead, assure there is no loss of lower-income housing funding or production in advance—by making approval of new funding a pre-requisite condition for any reductions in Inclusionary Housing requirements. And any reduction must be limited to just 5 years for two reasons: First, to incentivize pending “pipeline” projects to go forward ASAP without pushing up land prices for the longer term again. And second, to ensure there will be a second opportunity to require advance affordable housing funding for any continued reductions.

Specifically, Propose a $500+ Million affordable/homeless housing development general obligation bond for Voter approval in November of 2024. No reductions in Inclusionary Housing requirements would be made unless a bond is approved first. That amount will fund development or acquisition of 1,000-2,000 new affordable housing units. The necessary 67 percent voter approval is not assured, but it is clearly achievable. TODCO’s late-November poll of City voters (by Binder Research) shows 69 percent are willing to support such an affordable housing bond.

The city would need to pass a bond that size every three years for the next several decades to create the amount of affordable housing we need.

There’s also talk of a major regional affordable housing bond in the range of $10 billion or more.

All of this could wind up on the ballot in 2024.

Meanwhile, the mayor is joining the Yimbys in an argument that makes no sense in San Francisco in 2023. If it ever did or ever will.