The mayor talks about what’s being built — but not what’s being lost

By Tim Redmond

MARCH 11, 2015 — San Francisco isn’t coming anywhere near close to its affordable housing goals and is actually close to losing ground, a new study shows.

The Anti-Eviction Mapping Project has tracked the gain in new below-market housing – the units that the city has managed to build – but also the loss – the number of affordable rent-controlled units destroyed by evictions and TIC or condo conversions.

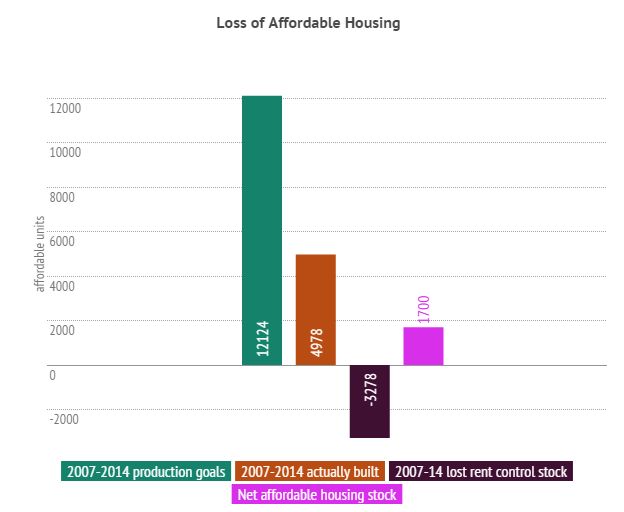

The data shows that the city has lost nearly as many units as it’s gained. Since 2007, 4,978 affordable units have been produced. In the same period, 3,278 have been lost.

That leaves a net gain of just 1,700 units.

The city’s stated goal was to build more than 12,000 units during that period. But between the limited money put into affordable housing, and the rampant loss of rent-controlled apartments, the actual increase was only about 14 percent of the goal.

That’s disturbing, to say the least. And it calls into question how effective the mayor will be at reaching a goal of 30,000 new housing units at 30 percent affordability.