The very rich and their friends in high office are once again flying their private jets into Davos so they can talk about climate change and global inequality. It’s an annual sick orgy of contradictions, an example of everything that’s wrong with world politics.

Part of the problem is that, with all the panels and all the economists and all the talk, nobody every says what the participants need to hear:

All of the problems they are addressing will continue unless the people in those rooms accept that they are going to have to give up a tiny bit of their wealth.

So today, as the billionaires and their pals party in Switzerland (and high-five over holding up any policy changes), the Institute for Policy Studies, Oxfam, and Patriotic Millionaires released a report that makes clear that a relatively minor tax on great wealth would generate enough money to solve a lot of the world’s problems:

The world faces multiple crises – from economic hardship and ecological decline, to social unrest and threats to democracy. Governments need to make bold investments to protect the rights and livelihoods of citizens and to build fairer and more sustainable societies. This report shows that the revenue to fund such investments is available if we begin to tax the world’s wealthiest people, who, as a group, have seen their fortunes rise rapidly over the last ten years. But beyond the objective of raising revenue, taxing the wealthiest among us gets to the root of our crises – that of widening inequality. For this reason, it is essential to use wealth taxation to redistribute wealth and power in our societies. To fundamentally close gaps in extreme wealth and reduce the total numbers of billionaires and multimillionaires to address the catastrophic levels of inequality and its consequences.

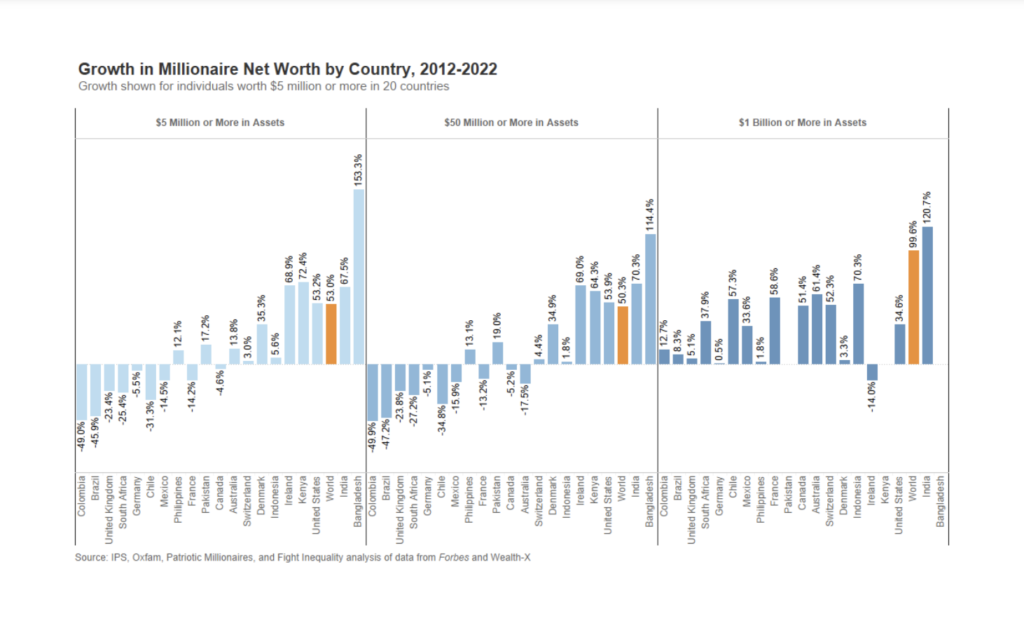

Here’s a remarkable chart: Even during a global pandemic, with massive death and suffering, the very rich, the billionaires, made huge gains. In some places, the ordinary millionaires took a financial hit; even the pretty rich, who have $5 million in assets, had some problems in a few countries.

The billionaires? They all got richer.

The data shows that the wealthiest have seen their wealth explode over the last decade. The total number of people in the world with at least $5 million in net wealth has grown by 52.9 percent. Individuals with a net wealth of $50 million or more have grown at a similar rate of 50.3 percent. Meanwhile, the global billionaire class has more than doubled, 103.5 percent to be exact. And billionaire wealth has skyrocketed by 99.6 percent. This is a gain of more than $5.9 trillion.

The climate crisis has driven a crucial debate about economic inequality in the Global North and Global South; at the last climate summit, the idea of the wealthier countries paying the developing countries climate reparations was actually on the agenda.

But the amounts of money under discussion were tiny, a few billion dollars here and there.

The new report suggests that the sort of money actually needed to save the planet and prevent massive loss of life is easily in reach:

The potential revenue from a net wealth tax on the wealthiest is substantial. Globally, we modeled the annual revenue from an annual progressive wealth tax of 2 percent for those who have a net wealth of $5 million or more, 3 percent for $50 million or more, and 5 percent for those with more than $1 billion. We found that an annual tax of this nature could have raised more than $1.7 trillion in 2022 alone. Approaches to taxing wealth and levels of wealth taxation would be country-specific, and thresholds would vary from country to country – these estimates are only indicative. Nevertheless, this shows just how much revenue could be raised.

Now we are talking real money.

Economists around the globe are typically free-market types and don’t support radical approaches to wealth redistribution, but that’s starting to change, the report shows:

Economists say inequality is rising and see their country’s tax system as both a cause and possible cure. As part of this report, we conducted a survey of economists’ views on inequality and tax. 135 economists from 40 countries responded. Their responses showed that:

—87 percent of surveyed economists think that the current cost of living crisis is increasing inequality in their country and 95 percent of surveyed economists say they are concerned about rising inequality in their country.

—71 percent think that rising inequality in their country is partly caused by falling taxes on the rich, and 73 percent think that the rich pay fewer taxes in proportion to their income than the average citizen in their country.

—71 percent think there is scope for increasing the taxation of rich people in their country over the next five years.

This, however, is not on the agenda at Davos, and is not on the agenda of Congress or the White House, and is not on the agenda of the Democratic Party in California.

Lots of politicians talk about being “progressive” (at the last Board of Supes meeting, newly elected Sup. Joel Engardio said “we are all progressives”), but unless they get this point, it’s just a lie.