“San Francisco restaurants are on the edge.”

“Small business owners are pleading.”

Sounds bad.

Worse: They are going to be hit by a new tax that goes into a “slush fund for politicians to spend on whatever they want.”

COVID has devastated the restaurant industry. Hundreds of small businesses are closing their doors. The last thing the city ought to do is make their lives more difficult.

Right?

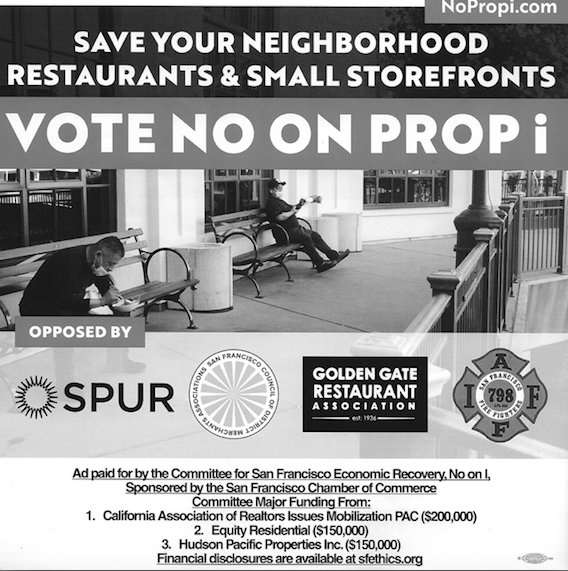

Except that those statements are from mailers opposing Proposition I – which has absolutely nothing to do with small businesses or restaurants and creates no “slush fund” at all.

It’s a pretty stunning example of political lies, even by the standards of the real-estate industry, which is funding this.

Prop. I would raise real-estate transfer taxes on sales of more than $10 million. It’s pretty simple: If you sell a building worth between $10 million and $25 million, the tax you pay would go from 2.75 percent to 5.5 percent. At $10 million, that’s an increase from $275,000 to $550,000. That tax on sales of more than $25 million would got from 3 percent to 6 percent.

The seller pays the transfer tax.

That’s all Prop. I does. I’ve read the entire language of it. There’s no “fine print.”

The tax would go to the city’s General Fund. That’s because taxes going into the general fund only need a 50 percent vote. The supervisors have already approved trailing legislation that would earmark the money for rent and mortgage relief for tenants and landlords.

So the tax would impact people who sell (not buy) high-end real-estate. It would help people who can’t make rent – and small property owners who can’t pay the mortgage without collecting rent.

It would have little or no effect on the price of that real estate; again, it’s a tax on the seller, not the buyer. (Conceivably, buyers will ask higher prices for property because they have to pay higher taxes, but that’s highly speculative at best; big commercial and residential property sells at what the market will bear, and transfer taxes have never had any measurable impact on that.)

How could this possible affect restaurants (unless they own and want to sell very high-end property, which at best would be very, very rare?) I don’t know.

So I emailed Laurie Thomas, the executive director of the Golden Gate Restaurant Association, which is listed as one of the groups backing the mailer. Here’s what she told me:

The GGRA (Golden Gate Restaurant Association) is against this and against State Prop 15.

The issue is that any increase in property costs will flow through to leases, at a time when no restaurants can afford any additional costs.

This can happen through NNN pass throughs in leases, and more likely in a higher lease costs for renewals and/or new leases.

Given all the uncertainly and the likely hood of our industry seeing a 50% plus failure rate (maybe more if we don’t get federal relief for 4 months or more), and new taxes now, particularly set on lower price points in expensive cities is not thinking through things well.

We would have preferred a much higher building sale price point, or ideally leave things as is for now and reaccess (sic) post the next 2 years.

I still don’t understand: Prop. 15 would impact the property taxes that big commercial property owners pay, and conceivably those with “NNN” or “triple net” leases – meaning they have to pay any increases in property taxes or utilities – could see their rent go up.

But Prop. I has nothing to do with the price of a lease. It has nothing to do with an increase in “property costs” since it’s a tax on the seller, not the buyer.

I asked her again, and she said:

I think its not as clear a problem as Prop 15 is (ie, directly hitting leases thru the NNN passthrus),

But we are worried that costs will go up, and it can trigger higher costs to leases as buildings will cost more to cover the transfer costs that the seller will have to owe (ie, the seller will raise the prices, etc..)

Also – the usage is unregulated – just goes to the general fund.

Bottom line is our organization and the restaurants it represents is really no on any taxes right now.

Okay: No new taxes. But this particular tax will not cause any restaurant’s rent to go up. It will hit only the very wealthy who buy and sell very high-end property. And the usage is, indeed, regulated – it’s already earmarked for rent and mortgage relief.

In fact, Prop. I will probably be good for local restaurants. The tenants who will get rent relief and the small landlords who will get mortgage relief are the customers of the members of the GGRA. If nobody has any money to spend, they aren’t going to order out food.

So what’s going on here? The No on I campaign is funded primarily by the California Association of Realtors and other big real-estate interests. Somehow, the Golden Gate Restaurant Association has become their front group.

Which is bad for the restaurants, who are now part of a big lie that will hurt their economic interests.

Thomas told me the “fact sheet” she based her decision on was provided by the No on I campaign (that is, the real-estate industry.) “It’s clear you have a different opinion,” she said. “Let’s leave it at that.”

Okay, let’s leave it at that.