SPUR study, flawed as it is, shows a serious problem. Will someone wake up the Planning Commission?

By Tim Redmond

UPDATED BELOW

JANUARY 27, 2014 – The San Francisco Planning Commission got a report on vacant high-end housing last week, although nothing happened and all the panel suggested is that the situation ought to be monitored.

The report came from San Francisco Planning and Urban Research Association, which used census data and American Community Survey data to conclude that there are roughly 9,000 units of housing in the city that are occupied only as occasional pieds a terre.

Another 9,000 units are held off the market for other reasons, the report says.

We’ve done similar research, using different data; we only checked 5,212 condos in 23 buildings, and found at in some cases as many as 60 percent were owned by people who didn’t live there. Overall, 32 percent of the new units had absentee ownership.

I’ve got some disagreements with the SPUR report, which I think may not reflect the full extent of the problem. And the report doesn’t call for any specific action.

But let’s stipulate for a second that SPUR’s data is completely accurate (and even SPUR doesn’t try to do that). If there are 18,000 housing units in San Francisco that are habitable and not available for rent or ownership for people who work in the city — that’s a serious problem, no?

Particularly since the mayor’s strategy for addressing the housing crisis relies in significant part on building 30,000 new units. If many of those units remain largely unoccupied, his strategy isn’t going be very successful.

Planning Commissioner Michael Antonini said that the SPUR report was nothing to worry about, since the percentage of units that exist largely as occasional occupancy in SF is lower than, say, Napa or Miami. But seriously: The fact that people who own vacation homes in other places (the Russian River, say) is very different from large numbers of units in a place like San Francisco being used for something other than housing.

UPDATE: Commissioner Kathrin Moore called me today to note that she wants the Planning Department to do its own study, because she found the SPUR report biased and flawed. “We can’t make policy based on someone else’s data that we don’t trust,” she said. “I want the department to give us their own data, which we can then work from.”

I freely admit, and we’ve said all along, that the 48hills analysis was only part of the picture. Some of the units we identified as owned by absentees might be rented out. We took a sample, and focused only on new buildings.

There is simply no perfect source of data on who is living in high-end housing in San Francisco. The city doesn’t register housing. Nobody checks if units are empty. Any investigation of vacant units is going to have some drawbacks.

That said, the SPUR report has some serious flaws.

The data for the ACS is based on a relatively small sample size (perfectly adequate for national and even local trends, but not so good for much smaller questions). As both SPUR and ACS admit, people who don’t live in a unit are less likely to be contacted, interviewed, and counted.

By definition, anyone who owns a pied a terre and isn’t there very often won’t be around to get the survey in the mail, won’t be interested in responding, and will be undercounted.

Then the report suggests that there’s not such a big problem with international rich speculators buying up trophy properties in San Francisco … because if you look at Trulia data, most of the searches come from within the United States.

I’ve spoken to some realtors who deal with high-end properties in San Francisco. They think that’s beyond silly.

No Russian billionaire who wants to move his money into a pied a terre in San Francisco is going on Trulia. He (or his lawyer) is contacting a top-level real-estate firm, which isn’t checking Trulia either. A lot of these places never actually go on the market.

Pacific Union, I’ve been informed, has recently started doing “China initiative” webinars. If there wasn’t a lot of international money coming in, why would one of the town’s leading high-end realtors, be targeting Chinese investors?

I spoke with Gabriel Metcalf, the head of SPUR, and asked him about all of this. He agreed with me that the data (including his organization’s data) isn’t complete and there needs to be a lot more study of this issue.

And he agreed that while the report somewhat downplayed the problem, if indeed, there are 18,000 units held off the market, that’s a significant number, and a serious issue, and there ought to be a policy solution.

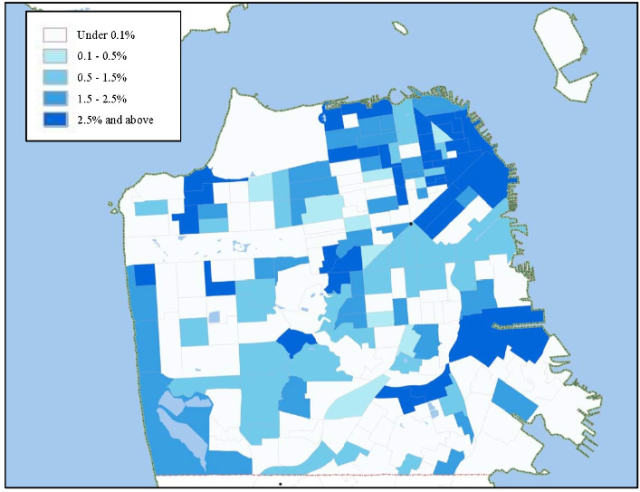

Sup. Eric Mar is talking about that – he’s exploring the question of a vacant-units tax or fee, which would apply to all empty housing. (While 48hills looked at new buildings, there are probably pieds a terre in every rich neighborhood in the city.) I don’t think you could set that tax high enough to deter billionaires from buying property that they will never live in – but you might slow it down a bit around the edges, and the city would be sending a message that this is not an appropriate use for scarce housing stock.

It might also – if set at the right level – bring in a significant amount of money for affordable housing.