In 2019 and 2020, The journal Urban Studies published a sharp debate over housing affordability and local regulation.

It started when geographers Andrés Rodríguez-Pose and Michael Storper (RS) challenged the prevailing Yimby/supply-side position, arguing that “there is no clear and uncontroversial evidence that housing regulation is a principal source of differences in home availability or prices across cities.”

In reply, planning scholars Michael Manville, Michael Lens, and Paavo Monkkonen (MLM) defended the “conventional wisdom.” Among other things, they criticized RS’s focus on the inflationary effects of demand, specifically the demand associated with the “influx of high-income people” into an area. By contrast, MLM held that “affluent people will buy older housing if new housing is not available (driving its prices up), and that new housing will channel affluent people away from older stock (slowing its appreciation).” In a seemingly even-handed gesture, they added:

One way to counter this argument…is to say that housing markets are strongly segmented, and that building new housing for affluent people will as a result have no impact on prices paid by others.

This counterargument, and its merits and demerits, probably deserves an article of its own. Indeed it has a recent article of its own—Been et al.’s (2018) essay on “supply skepticism,” which we are surprised RS neither discuss nor cite.

“Supply Skepticism” does deserve attention. The article is regularly cited for authority by supply siders (for example: here, here, here, and here. Its authors—Vicki Been, Ingrid Gould Ellen, and Katherine O’Regan (BEO), all professors at New York University—chide “[e]conomists and other experts who favor increases in supply,” but who “have failed to take…supply skeptics seriously.” They warn that “left unanswered, supply skepticism is likely to continue to feed local opposition to housing construction and …increase…land use regulations that limit construction.” Their essay, then, is “meant to bridge the divide between the arguments made by supply skeptics and what research has shown about housing supply and its effect on affordability.”

What they offer, however, is less a dialogical bridge than a funhouse ride in a supply-side theme park.

BEO concede a skeptic key claim: Building market-rate housing does not make housing affordable to the lowest income households. At the same time, they distort the arguments of the skeptics they reference, a group that includes 48 hills editor Tim Redmond and San Francisco’s Council of Community Housing Organizations. They debunk positions that skeptics do not take, ignore positions that skeptics do take, commend supply-side precepts lacking crucial evidence, and hype supply-side arguments that divert attention from skeptic claims.

All the while, they suppress the political context in which “Supply Skepticism” was written and published: The bitter fight over then-New York Mayor Bill de Blasio’s upzoning plans, a struggle in which Been, as de Blasio’s housing and planning commissioner, contended against widespread skeptic criticism of the plan.

A preponderance of bluster

Given their jab at supply-side experts who discount their critics, you might expect that Been, Ellen, and O’Regan would begin by attending to skeptic claims. Instead, they go on the defensive. The first main section of “Supply Skepticism” opens with the assertion that “[d]espite the arguments raised by skeptics, there is a considerable body of empirical research showing that less restrictive land use regulation is associated with lower prices.” In a footnote, BEO footnote venture that “[m]ost of the studies are framed as accessing whether stricter land use regulations are associated with higher prices…but [they] could just as easily be framed as examining whether relaxing regulations is associated with lower prices. See Furman (2015) for a review.”

That’s a dubious proposition, rendered all the more questionable by the absence of any such review in the referenced document. Author Jason Furman, then chair of Obama’s Council of Economic Advisors, says only that, having “found that while house prices have been rising since 1950, construction costs and quality improvements in housing stock drove this appreciation between roughly 1950 and 1970,” the authors of a 2005 study “conclud[ed] that after around 1970, more stringent regulations played a much bigger role proportionally [in boosting house prices], implying that relaxing zoning constraints could bring house prices more in line with construction costs.”

More importantly, BEO’s opening claim is a hedge: association is not the same as causation. In other words, the cited studies don’t prove that regulation affects housing prices.

Next, BEO reference three studies that “use instrumental variables to try to more clearly assess the causal effects of regulatory restrictions on housing supply and prices.” The operative term here is “try.” The first two studies get most of their data about regulatory restrictions from surveys of multiple jurisdictions (one also draws on data from the National Register of Historic Places, a famously limited source of information the effects of land use regulation.) As Kee Warner and Harvey Molotch observed more than two decades ago, “[t]his approach blurs great differences in the content of various local policies, not to mention how well policies are carried through in daily administrative practice.”

The authors of the third study, Christian Hilber and Wouter Vermeulen (HB), distinguish their work “from the U.S. literature, which relies on either survey data…or shadow prices.” To measure regulatory restrictiveness, they used “a unique new dataset that includes direct information on actual planning decisions” taken by 353 local planning authorities in England between 1974 and 2008. Their “preferred measure of regulatory restrictiveness” was the refusal rate for major residential projects. “Alas,” they write,

this measure, like all other direct measures of regulatory restrictiveness, is endogenous. One concern is that refusal rates are higher during boom periods when housing demand and hence house prices are high. ‘Ambitious’ projects may only be put forward during boom periods and bureaucrats may be overwhelmed with large piles of applications and so unable to deal with all of them. NIMBYs may also try harder to block new developments during boom times. We address these particular endogeneity concerns by using the average refusal rate over the entire period for which we have data; 1979 to 2008.

In the end, then, the information that Hilber and Vermuelen used was hardly direct. Moreover, like any procedure that, as Warner and Molotch wrote, “lump[s] together all places that have some [new] way of regulating growth,” their method blurs local differences.

Undaunted by or perhaps impervious to the limitations of the studies they cite, BEO conclude that “[i]n sum, the preponderance of the evidence shows that restricting supply increases housing prices and that adding supply would help to make housing more affordable.”

Misreading the skeptics: The urban land market

BEO then turn to what they designate as the four key skeptic arguments, citing texts that ostensibly illustrate each of the four. They begin with Zoned Out: Race, Displacement and City Planning in New York City, a 2016 collection of essays edited by activist planning scholars Tom Angotti and Sylvia Morse. According to BEO, the book “argue[s] that the normal rules of supply and demand don’t apply to housing because housing is tied to a specific plot of land, and unlike other inputs into the production of housing that may be in plentiful supply, the supply of land is limited in many jurisdictions by existing development and by geographical constraints like coasts or mountains.”

In his essay “Land Use and Zoning Matter,” Angotti does dispute the assumption that “the driving force behind housing development” is “the strict market principle of supply and demand,” and the corollary that “zoning regulations inhibit housing development by limiting the amount of buildable space and housing costs.” By these lights, upzoning—allowing greater building heights and density—can only lower housing prices.

The problem, Angotti argues, is that “this simplistic version of neoclassical economic theory….fails to take into account the role of housing subsidies, tax policy and, most importantly, the land market.” For one thing, “land in New York is very expensive, and much of it is already developed.”

BEO mention only the physical limitations of urban land supply. Angotti’s reference to cost introduces the land market factor. Moreover, for him, the scarcity and high cost of land is just one factor in New York’s housing affordability crisis. He contends that by permitting more development on a parcel, including a developed parcel, “[u]pzoning increases the future value of land, and land value increases are what drives new development.” Angotti thus reverses the supply-side position: in a hot market, relaxing constraints on development pushes prices up, not down. Central to the position argued by all of Zoned Out’s contributors, that analysis is ignored by Been, Ellen, and O’Regan.

BEO also ignore Angotti’s criticism of Been for pushing upzoning when she was de Blasio’s housing preservation and development commissioner, an office she held from February 2014 to June 2017. In 2015, the de Blasio administration launched a controversial plan to upzone 15 neighborhoods. That plan supplied the motive for Zoned Out, whose contributors argue that it would exacerbate existing gentrification and the displacement of poor communities of color.

Angotti reports that in January 2016, Been “testified that the proposed rezoning of East New York to promote new development would actually help solve the crisis of affordable housing in the neighborhood.” Some people, she said, “were falsely claiming that the rezoning would displace 50,000 people.” Clarifying that the plan’s Environmental Impact Report showed that “50,000 people were already at risk of displacement,” Been opined that “the new affordable housing was therefore in great need.” (The full text of Been’s speech is here.] Agnotti demurs:

[S]he did not address the fact that the real estate speculation that had placed many people at risk was stimulated by DCP’s [Department of City Planning’s] talk of a rezoning that began some two years prior to the actual proposal. She also made a facile assumption that any new affordable housing would be affordable to those who were displaced and available in a timely manner.

BEO never specify mention the political context within which they wrote “Skepticism.” Once that setting comes into view, it’s hard not to read their essay as a tacit attempt to settle scores with Been’s adversaries and vindicate de Blasio’s upzoning program.

Misreading the skeptics: Filtering (New York)

Just so, when BEO turn to the second skeptic argument, a critique of filtering, they first cite an article published by City Limits in February 2016 whose authors take exception to Been’s avowal, voiced three days earlier, that “‘rents are rising because of lack of supply.” Writing on behalf of an East New York neighborhood coalition of tenants, homeowners, Ana Aguirre, Bishop David Benke, Michelle Neugebauer, and Robert Santiago (ABNS) don’t use the term filtering. But their claim that “[t]he only increase in housing supply that will help to alleviate…[the] affordable housing crisis is housing that is truly affordable to low-income and working class people” [emphasis in original] suggests that they believe that housing markets in East New York are, to use the plannerese, firmly segmented. Citing only that categorical statement, Been, Ellen, and O’Regan cast supply skeptics as dogmatists.

That characterization is belied by ABNS’s citation of ample evidence that supports their position. The four authors note that

East New York (ENY) has long been a haven for working-class families in the city. As other neighborhoods have become increasingly unaffordable, ENY’s importance as a community accessible to lower-income residents, immigrants, and people of color has only grown.

They agree with the de Blasio administration that New York needs more affordable housing. But they have “grave concerns about the city’s current plans, and [about] claims that the city can address the affordable housing crisis and prevent displacement of ENY residents by dramatically increasing the community’s overall supply of housing.” By “overall,” ABNS mean housing at all income levels, and at the highest in particular. That approach, they argue,

ignores that significant new building may increase local market pressures, adding fuel to the fire of gentrification; that dramatically increasing development rights is especially dangerous in communities with lots of unregulated housing, such as ENY; and that building “affordable” housing at levels above the reach of current residents will not help them stay in the community.

Directly countering Been’s insistence that “‘if we don’t build, displacement will be even worse,’” ABNS observe that “in ENY, land prices and rents—which had been stable for years—skyrocketed after the city completed a prior planning initiative, and again after the city announced the [new] rezoning.” It follows that to “deter investors from overpaying for land and buildings and driving up prices in the expectation of high-cost rentals and sales,” “[a]ggressive housing preservation efforts must happen before or as part of planning initiatives, and the city should identify affordable housing as its main goal.”

The city plan included a Mandatory Inclusionary Housing requirement that about a quarter of all new housing be permanently affordable and the use of Housing and Planning Department subsidies to lower rents. That sounds good, but “the devil is in the details.” For starters, “MIH would require just 25 percent to be permanently ‘affordable,’ to households making over $50,000 a year—well above the community’s median income of $34,520.” The city had also proposed that about half of the new housing would be market-rate, meaning that “at least half of the housing will not be affordable” to ENY families. Furthermore, the subsidies are voluntary; “[a]s the market in ENY strengthens, developers will be less interested in taking them.”

Space does not permit me to cite all of ABNS’s concerns. But I would be remiss if I didn’t note that they conclude with an overview of their coalition’s alternate proposal. The de Blasio administration envisioned 6,500 new apartments in East New York. Keeping “the needs of current residents at its core,” the coalition plan required at least 5,000 new apartments at rents affordable to current residents, including 30 percent of all units permanently affordable at 30 percent of neighborhood households’ area median income. It also included “strong anti-displacement policies to protect current low-income tenants and homeowners.”

Misreading the skeptics: Filtering (San Francisco Bay Area)

Been, Ellen, O’Regan disregard the devilish details in the ABNS brief, much as they ignore Agnotti’s analysis of the urban land market. By contrast, they veer between corroborating and contesting skeptic empirics, when they address the second text that, in their view, exemplifies skeptic opposition to filtering: a 2016 infographic from the Council of Community Housing Organizations (CCHO—sounds like choo-choo) entitled “The Filtering Fallacy.” That publication, BEO contend, shows that supply skeptics “reject the idea that building housing at one price point has any significant effect on the price of housing in other submarkets.” Confusingly, they add: “Even if they acknowledge that [new market-rate] units may age and filter down to lower-priced market segments over time, critics note that it will take many decades to do so.”

That’s exactly CCHO’s point: “Research from UC Berkeley indicates that in a city like San Francisco, with geographic limitations and historic housing stock, filtering could take at least 30 years to produce affordability for households that are middle- or low-income.” Without referencing CCHO, BEO echo that finding, stating that “the heterogeneous” nature of housing means that [h]ousing markets are more segmented” than other goods, and that the direct filtering of new homes down to lower-priced submarkets therefore can take decades.”

Having conceded two of the skeptics’ key objections, BEO embark on another scattershot defensive. Bewilderingly they invite the reader to “imagine a city with no new construction.” Next, they argue that “as prices increase in the higher end of the market, owners will find it more attractive to maintain or upgrade existing housing units that otherwise would have aged out of this submarket, slowing the movement of units to less expensive submarkets through downward filtering. Research provides some evidence that filtering up occurs in tight markets.” [emphasis in original].

If anything, this finding reinforces Angotti’s analysis of the land market in New York City. Without so much as a glance at their own acknowledgment of filtering’s lengthy time-release workings, BEO advise policymakers “not [to] be so short-sighted as to overlook [filtering’s] long-term effects,” holding that due to housing’s longevity, “most housing filters down or loses value as it ages, representing new supply in submarkets at lower price points.”

They follow that undocumented claim with the assurance that

[e]mpirical research shows that filtering is not just a theory posited on the pages of economic textbooks, but in fact occurs in real housing markets. Indeed, recent research shows that filtering was the primary source for additions to the affordable rental stock between 2003 and 2013, whereas new construction was the largest contributor for the higher priced rentals[,] and tenure conversion was the largest source for moderately priced rentals.

Their source, Harvard’s 2015 study of America’s rental housing, does make those findings. But BEO leave uncited the researchers’ observation that “[a]t the same time, though, these gains were offset by a similar share of lowest-cost rentals that were permanently removed from the stock,” because “housing units with such low rents are vulnerable to deterioration to deterioration and demolition.”

They reference a 2016 report showing that “23.4 percent of the rental units that were affordable to very low-income renters in the U.S. in 2013 had filtered down from higher rent categories in 1985,” a finding that reinforces the UC Berkeley conclusion that it takes least thirty years for filtering to result in housing that’s affordable to lower-income households. Nevertheless, BEO reiterate that “new construction is crucial for keeping housing affordable, even in markets where much of the new construction is itself high-end housing that most people can’t afford.”

Now BEO backtrack. They caution “that allowing more market-rate construction will not address the housing needs of all neighborhoods,” and that “[f]or at least the lowest income households, even the moderation of rent increases that result from expanded supply”—a moderation they have yet to demonstrate—“will likely be insufficient to make homes affordable to them. Housing subsidies, of some form, are still needed as well.”

What forms such subsidies might take are unspecified until much later in their essay and then relegated to a single sentence: “To ensure that a range of income groups are seeing the benefits of the jurisdictions’ growth through new housing, local governments may want to use subsidies, together with a variety of housing policy tools such as density bonuses or mandatory inclusionary zoning, to achieve visible additions to supply at a variety of price points.”

To make sure their backtracking isn’t confused with backsliding, in a footnote to the above-cited passage, BEO clarify that their top priority is the production of market-rate housing:

Inclusionary zoning programs have to be designed and calibrated carefully to ensure that they increase the supply of affordable housing without increasing the costs of market-rate housing….Regulatory relief measures, such as design flexibility and fast-track permitting programs, may need to accompany inclusionary zoning mandates.

Misreading the skeptics: Induced demand for affordable housing

For all their equivocation, when BEO discuss filtering, they mostly stick to the topic. Though partial, their citations of skeptic texts still reflect a firsthand encounter, however fleeting, with the documents under review. The same can’t be said for their treatment of the text that they associate with the third argument they attribute to skeptics: “Even if additional supply could help make housing more affordable in the short run, it won’t in the long run because the additional supply will induce more demand especially among buyers or renters wealthier than the existing residents in the neighborhood.

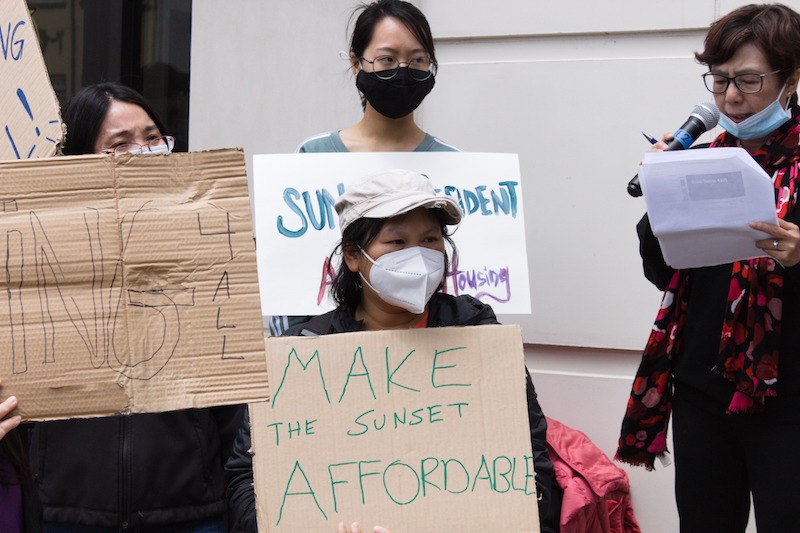

To illustrate this position, they cite Tim Redmond’s article “Why market rate housing make the crisis worse,” posted by 48 hills in June 2015.

As indicated by his article’s title, Redmond is not talking about “additional supply” across the board; he’s talking about the effects of new market-rate housing. Building luxury housing, he writes, attracts people who can afford it, and who need services, “creating a demand for jobs—restaurant workers, grocery clerks, cops and firefighters, bank tellers…and those people will also need a place to live.” He cites a study commissioned by San Francisco’s Planning Department, according to which

every time the city allows 100 new high-end housing units, it needs to build between 20 and 43 new affordable units—just to keep the housing balance the way it is now….If the city demands 15 percent affordable set-asides, then every market-rate building adds more demand for affordable housing than it supplies. That means every new building makes the housing crisis worse.

Remarkably, BEO propose that Redmond’s “claim is analogous to the argument that building more highways will not reduce congestion because the lower cost of travel will simply cause more people to drive or to take that particular route (Gorham, 2009).” To be clear, Gorham was writing about induced demand for travel, not housing.

BEO continue:

Further, [Redmond’s] argument goes, lower rents and prices may also induce latent demand—people who are living with roommates or family members may choose to form their own households (Ellen & O’Flaherty, 2007) or people may choose to invest in pied-a-terres in a city. That additional demand will drive prices back up until supply can again respond, causing housing to be more affordable, at best, only cyclically, according to the argument…”

That is not Redmond’s argument. He says nothing about lower prices and rents. Rather, he distinguishes the effects of people moving into “affordable units” from those moving into market-rate housing, maintaining that “building affordable housing doesn’t generate the kind of demand that market-rate housing does.”

Compounding the confusion, BEO then observe that “building additional highways does appear to induce more demand,” but “moving homes is not like driving a few extra miles.”

Correct—so why bring it up? They go on to mark barriers to mobility—“personal and economic constraints,…restraints on immigration and uncertainty”—and the recent decline in mobility rates. Again, how does this relate to Redmond’s argument?

They conclude:

Thus, in the long-run, whereas some additional households may be drawn from outside (or from within the city) to buy or rent homes as supply increases, it is highly unlikely that prices will end up at the same level they would have reached absent new supply. Finally, as noted above, the empirical evidence shows that allow more supply leads to lower prices.

I don’t see such evidence—only misrepresentation of another skeptic argument, multiple digressions, the now-expected conflation of new and market-rate housing, and a parroted insistence on the deflationary effects of new construction at all income levels.

Misreading the skeptics: Rents

Been, Ellen, and O’Regan describe the fourth skeptic argument as follows: “Many renters in neighborhoods where market rate housing is proposed express concern that the construction of new housing will actually make their affordability problems worse by raising rents or house prices, fueling gentrification, and potentially displacing existing residents.” This is really a restatement of the positions advanced by Zoned Out and the four East New York activists, with the caveat that, contra BEO, skeptics do not use market rate and new construction as interchangeable terms.

BEO don’t say so, but we’re back in New York. One of the two cited texts is a protest against de Blasio’s proposed upzoning of East Harlem, published by City Limits in August 2017 and written by Afua Atta-Mensah, Esq., the executive director of statewide New York group, Community Voices Heard. Speaking in behalf of a coalition of “private- and public-housing tenants and homeowners,” Atta-Mensah argues that

the developer-first scheme would not create nearly enough of the affordable housing units so badly needed by the community, nor would not stop the relentless attacks on the dwindling supply of affordable housing that still exists. Low-income families will continue to be driven out by rising rents and unscrupulous landlords, who harass tenants with cruel tactics, like cutting off the heat in the dead of winter. Tenants in privately-owned buildings will be left defenseless dealing with landlords who try to push them out of their rent-stabilized or rent-controlled apartments, so they could replace those tenants with higher-income renters, or sell off their land to developers.

Like the East New York activists, the East Harlem coalition had prepared an alternative plan. Atta-Mensah accuses City Hall of ignoring the grassroots proposal, whose priorities included “creat[ing] direly-need units of truly affordable housing that meet the income constraints of neighborhood residents” and “preserv[ing] the existing stock of affordable housing.”

The other text, headlined “Bitterness and Division at Inwood Rezoning Hearing” and published by City Limits in September 2017, is a news story written by Abigail Savitch-Lew. Recounting heated disputes between elected and appointed officials on the one hand and their Inwood constituents on the other, Savitch-Lew reports that some Inwood residents voiced support for the proposed rezoning, but that “the vast majority of those who attended the hearing expressed deep concerns about the plan,” with many arguing that “rezoning would greatly exacerbate existing gentrification by resulting in an influx of mostly luxury housing.”

As is their wont, BEO mention none of the specifics in either of their cited skeptic texts. Instead, they effectively write off the criticisms as unsubstantiated by scholarship. First they contend that “[t]here is little empirical evidence about the net effects new market rate housing has on the prices or rents of nearby homes, and what exists may not be causal.” Going further, they say that“[u]nfortunately, we found no study examining impact on rents…”

That’s surprising: Zoned Out contains three investigations that examine the localized effects of upzonings undertaken by Michael Bloomberg, de Blasio’s predecessor in the New York Mayor’s office: “Williamsburg: Zoning Out Latinos,” by Philip DePaolo and Sylvia Morse; “Harlem: Displacement, Not Integration,” by Sylvia Morse; and “Chinatown: Unprotected and Undone,” by Samuel Stein. In each case the researchers found that home values and rents soared to heights far beyond the reach of incumbent low-income households.

BEO also overlooked the 2015 report from then-New York City Comptroller Scott Stringer analyzing the impact of the proposed Mandatory Inclusionary Zoning on housing affordability in East New York. Stringer’s report is prospective, but it bears so closely on the question of market-rate development and affordability that it deserves citation. Among its findings:

- 84 percent of residents in East New York and the surrounding communities will be unable to afford the market rate housing units proposed under the rezoning, and 55 percent will be unable to afford the affordable units.

- There are currently 21,788 market-rate units—non-NYCHA [New York City Housing Authority] units that are not subject to rent stabilization—which are home to 49,266 low-income residents in East New York and surrounding communities. The rezoning would place these residents at an increased risk of displacement by creating new rental pressures on existing residents through the introduction of thousands of new higher income residents.

The report backed up these findings with detailed figures on the impact of rents in new construction on households with a range of annual incomes.

Disregarding these studies, BEO flout their warning to take supply skeptics seriously.

How to assess evidence

In the abstract that introduces “Supply Skepticism,” BEO say that they will do two things: answer questions posed by “[g]rowing numbers of affordable housing advocates and community members” about “the premise that increasing the supply of market-rate housing will result in housing that is more affordable”; and “argue further that there are additional reasons to be concerned about inadequate supply response and assess the evidence on these effects of limiting supply, including preventing workers from moving to areas with growing job opportunities.” The second assignment undercuts the first, insofar as bringing up “additional reasons” in favor of the supply-side premise diverts attention from skeptics’ questions about affordability.

Thus, in the penultimate section of their essay, BEO argue that besides “rais[ing] housing prices,” “limiting housing supply….imposes environmental and other costs related to automobile dependence”; “may exacerbate income and racial/ethnic segregation”; and “reduces economic productivity and increases inequality.” To be sure, claims about segregation and inequality bear on the affordability issue. But BEO present such claims in a way that sidesteps skeptic challenges: They renege on their offer to “assess the evidence.” Assessment involves entertaining alternative positions. BEO only adduce evidence in support of supply-side rationales.

They grant that it’s “difficult to test whether density restrictions heighten segregation, and the little empirical work that does exist is cross-sectional and therefore cannot prove causation.”

The cross-sectional caveat pertains to the reports they cite. But it does not apply to the three case studies in Zoned Out. Ignored by BEO, each report examines the yearslong effects of upzoning on a community of color: Williamsburg (Latino), Harlem (Black), and Chinatown (Asian, Latino, and Black). The Zoned Out researchers found that in each case, income and racial/ethnic segregation were exacerbated by loosening restrictions on housing development.

The unanswered questions

The last section of “Supply Skepticism” is bookended by claims that, taken together, embody BEO’s habitual feint: The downplaying or dismissal of skeptics’ concerns is extenuated by a profession of respect for them. BEO open the section by stating that “[t]he arguments skeptics advance in opposing increases in the supply of housing are inconsistent with the evidence.” (12) They close by declaring that “the rich set of research questions surfaced by supply skepticism could contribute directly and concretely to efforts to make housing more affordable.”

Between these dissonant avowals, Been, Ellen, and O’Regan designate topics whose further investigation would in their view close key gaps in current research. These include subjects flagged by skeptics: rents, filtering, gentrification and displacement, and the extent of and effects of new construction at different price points. Missing is the disproportionate demand for below-market-rate housing generated by new market-rate construction housing. Non-skeptic topics include “the need to refine environmental review impact processes “to better take into account the costs of not building” and an examination of fair housing requirements. BEO also specify previously unmentioned themes: “the efficacy of the various ways states have sought to encourage additional supply,” balancing downzonings with upzonings, assessing infrastructure needs created by new development, and the effectiveness of regional housing efforts in moderating price increases.

It’s hard to gainsay calls for more research. But some inquiries are more urgent than others. “Supply Skepticism”’s high repute among supply-side academics signals a dire need to carry out its authors’ first assignment: Answer questions posed by “[g]rowing numbers of affordable housing advocates and community members” about “the premise that increasing the supply of market-rate housing will make housing more affordable.”

Been, Ellen, and O’Regan bungle that task. To aid its accomplishment, I offer this account of their missteps, with the proviso that if supply siders don’t answer their critics, by which I mean genuinely engage their questions, supply skepticism will keep growing.

Editor’s note: We invite Been, Ellen, and O’Regan to respond.