If governments around the world put an excess profits tax on the 2,690 billionaires whose wealth radically increased during the pandemic, it would raise enough money to vaccinate everyone on Earth and give $20,000 cash to every unemployed worker.

That’s the conclusion of a new study by the Institute for Policy Studies, Oxfam International, the Fight Inequality Alliance, and Patriotic Millionaires.

The study, released today, shows that billionaires saw their wealth increase by a collective $5.5 trillion since March, 2020. That’s a gain of more than 68 percent.

In other words: While much of the world was suffering with unemployment and scarcity, the very, very elite were getting richer and richer—in large part from the crisis.

“They made as much in 17 months as they had made in the previous 15 years combined,” Chuck Collins, an IPS staffer who wrote the study, told me.

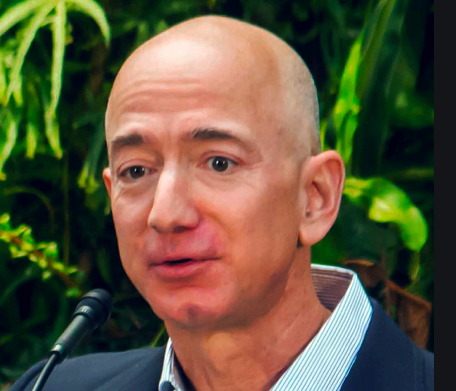

Some of that money came from things like online shopping (Jeff Bezos) and online meetings (Zoom’s Eric Yuan). “Some sellers benefitted from Main Street’s shut down,” Collins said. “It helps to have your competition gone.”

But others got rich simply because the stock market is betting on future winners in a post-pandemic world.

In many countries, including the United States, past global crises have led to policies like an excess profits tax. During World War II, it was horribly unpatriotic to take advantage of the war to make money; businesses that saw wartime upticks faced taxes of 90 percent.

The study authors suggest that a one-time 99 percent excess profits tax on billionaires would help address global inequality and injustice:

Billionaires have reaped an unseemly windfall at a time when millions have lost their lives and livelihoods. The pandemic has supercharged existing global inequalities, with the wealthy profiteering from the shuttering of the main street economies around the world.

In fact, 325 new billionaires were minted during the pandemic, while homelessness, massive debt, and often death awaited those at the lower economic levels.

From the study:

The one-time emergency COVID-19 billionaire tax would raise $5.445 trillion and still leave the world’s 2,690 billionaires $55 billion richer than before the virus struck (an average of $37 million per billionaire). Governments across the world are massively under-taxing the wealthiest individuals and big corporations, which is undermining the fight against COVID-19 and poverty and inequality.

In other words: None of these folks would miss a meal. They wouldn’t miss a yacht, or a fourth vacation house, or a private jet, or the fact that their great-grandchildren will never have to work.

They would still be really, really rich. But tens of millions of others might not have to die:

Less than one percent of people in low-income countries have received a vaccine, while the profits made by Big Pharma have seen the CEOs of Moderna and BioNTech become billionaires. The COVID-19 crisis has pushed over 200 million people into poverty and cost women around the world at least $800 billion in lost income in 2020, equivalent to more than the combined GDP of 98 countries. At the same time, 11 people are now dying of hunger and malnutrition each minute, outpacing COVID-19 fatalities.

Much of the wealth increase at the top end of the scale isn’t actually earned. It’s investment profits—money that you make by already having money. This is, Thomas Picketty (the most important economist alive, and one of the most important in history) argues, the fundamental issue facing the world today.

You can read the details of the study here. It’s part of a global movement to tax the very rich to fight economic inequality—and quite possibly, save the planet. (Yes, economic inequality and climate change are directly related.)

Let’s remember, too: The study only looked at people who have more than $1 billion. There are vastly more very wealthy people who have, say, $400 million in assets, who became, say, $100 million richer during the pandemic.

If we added in that class—say, start at $50 million net worth—the money involved becomes even more profound.

Fighting climate change is going to take a lot of resources in the short term, as we transition from a fossil-fuel economy. Massive public investments will be needed to make that change.

The US Senate is having a hard time with a fairly modest bill that would only take small steps. But with an excess profits tax on the very rich, the resource issue becomes moot.

This ought to be front-page news in every outlet in the country. So far, I’m not seeing it.