In late 2015, a sign mysteriously appeared on the outside of San Francisco General Hospital dubbing the area in front of the main entrance “Wells Fargo Plaza.” This move by a public hospital to honor an international banking and financial services company was made without the knowledge or consent of San Francisco residents.

While hospitals often name space at facilities after individuals or groups who act in the public interest, Wells Fargo is hardly an exemplar of philanthropic graciousness. The company has been pilloried in the press recently for opening accounts on behalf of two million customers without asking or telling them, then hitting them with fees—a scandal that led to $185 million in combined fines. And Wells Fargo also has lesser-known ties to unsavory practices such as profiting from foreclosures, discriminating against black and Latino customers, promoting union busting, and backing LGBTQI “conversion therapy.” That record of attacking the very people served by San Francisco General Hospital makes Wells Fargo a curious choice for any honor, much less having its name attached to a hospital that serves the city’s most vulnerable residents.

Wells Fargo’s fake account scandal is an object lesson in big-money corruption, but while the $100 million penalty imposed by the Consumer Financial Protection Bureau is the largest such penalty ever, the amount is an insignificant blip on the balance sheet for a company that made $23 billion in 2015. And, while the 5,300 employees who were fired were likely given little more than directions to the unemployment office, ex-CEO John Stumpf may walk away from the scandal with about $120 million in pension, stock, and other earnings.

Wells Fargo’s business practices are not only unethical, but racist as well. In 2012, Wells Fargo settled with the U.S. Department of Justice for $184 million dollars for targeting African-American and Latino homebuyers for sub-prime loans. Such predatory lending resulted in foreclosures that contributed to the Great Recession as well as displacement and homelessness. But again, reward outweighed punishment: Wells Fargo received a $25 billion influx of taxpayer money in the recession’s financial services bail-out—money that didn’t trickle down to the predominately poor and non-white patients at San Francisco General Hospital.

And the company is becoming increasingly tied to far-right politics. Wells Fargo Executive Vice President Jeffrey Grubb is one of three trustees of the M. J. Murdock Charitable Trust, an organization that funds the virulently anti-LGBTQI, anti-reproductive rights Alliance Defending Freedom, the anti-evolution, anti-science Discovery Institute, and the anti-labor Freedom Foundation. Alarmingly, but perhaps not surprisingly, the Murdock Trust also funds attacks on the CFPB, the very agency that levied the fine on Wells Fargo in the fake account scandal.

San Francisco Mayor Ed Lee supports boycotting North Carolina for HB 2, the reprehensible anti-trans bathroom law backed by the ADF. But Lee has been silent about Wells Fargo’s human rights record and the unethical business activities that have contributed to homelessness in one of the wealthiest cities in the world. San Francisco residents are the ones paying more than $1 billion in municipal bonds for San Francisco General Hospital, and they may have appreciated being informed of where Wells Fargo’s money comes from—and where it goes—before providing advertising on their hospital.

If Mayor Lee was asked about taking money from an unethical company and putting its name on a public hospital, perhaps he answered like Donald Trump did when reaching out to black voters: “What the hell do you have to lose?” To which the destitute, un-housed residents who go through the garbage at “Wells Fargo Plaza” at San Francisco General Hospital might well respond: “Quite a bit.”

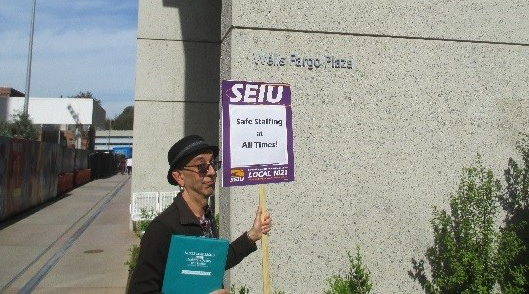

Sasha Cuttler RN, PhD is a nurse at San Francisco General Hospital and activist with the Service Employees Union International Local 1021

Yes, looking forward to that next phase. It won’t be easy, given that the SEIU and other public-sector unions are adamantly opposed to any changes (see their opposition to Jeff Adachi’s modest proposals a few years ago).

But the public-sector unions are starting to realize that all pensions will be lost unless reform makes headway. So I am hopeful.

Pension reform in California already started, in 2012. And Jerry Brown is working on the next phase.

Yes, it happens in the private sector. But private-sector workers and their employers take the hit. Taxpayers, and public services that lose revenues, take the hit when funds have to be diverted into the pension pots.

And S. Berdo, Stockton and Detroit are only the beginning. Pay attention. Because without pension reform, public-sector workers will lose their pensions in the future.

Oh for crying out loud, you are using two of the worst as examples – they mismanaged, they didn’t have adequate oversight, etc

Are you implying that doesn’t happen in the private sector? Because that is nuts.

Public-sector works are on defined-benefit pensions that assume 6-8% returns on investment annually. Nobody else, except corporate CEOs, enjoys such largesse. Us commoners do not.

This is the reason that San Berdo, Detroit and Stockton went bankrupt. It’s going to happen to many more municipalities in the future…unless public-sector workers see the writing on the wall and accept reform. When your pension gets blown up, nobody is going to cry in sympathy with you unless you see the light.

I worked in the East Bay and 8 years ago, nurse salaries there were topping $100k.

As for pensions, everyone should have one. Just like Congress complaining about ‘Cadillac health plans’ which are the health plans they have, EVERYONE SHOULD HAVE ONE.

Instead of trying to bring poverty to everyone, you should be working to get everyone a pension. If managed properly, they are a fiscally sound way of of giving employees a benefit and keeping them out of the poor house when they retire. That CalPers and many other pension systems were allowed to continue with no oversight is criminal, But many are on their way back to being fiscally sound.

And most people do not have the savvy to manage their own money in a 401k.

Yes, high-end (80K) may be valid in SF. The author of this piece gets nearly twice that, plus the high pension perk. Again, good for her. But the high wages/pension suck in money that should be spent instead on services for the public.

I am a Clinton supporter. Yes, the union has negotiated excellent defined-benefit pension plans for city workers that have created huge pension shortfalls that are unsustainable. My point: some of that money should be going straight into actual services instead: to schools, to infrastructure, to roadwork, etc.

And bankruptcy looms ahead unless there is reform.

great article

Nice summary of the situation.

BART pensions are higher because that is what the unions negotiated. And $75k in the Bay Area is nothing.

OTOH, the average PERS pension is $31,500.

You sound like a Trump supporter.

Yes, and as we’ve seen shortages of nurses several times over the years, the high end is often what people make.

Private sector unions contend with a boss who is going to be intereested in a balanced solution.

Public sector unions contend with a boss whom they often help put in power (electoral support). Thus, the fox guards the henhouse and there is little in the way of balance. Nominally, the boss represents the public or taxpayers (or both). But it rarely works that way.

Public sector unions should be prohibited from electioneering, endorsing, or contributing at election time. Yes, there is still need to make sure managers treat workers fairly. But putting pay/benefit decisions in the hands of politicians who are elected with the help of those same unions is a roadmap to ruin.

Your link says this:

Shifts: Day / Evening / Night, Weekends — you choose!

Compensation: $30 – $80

That’s $80 only at the high end.

“It’s a fucking gamble.”

Yes, it is a gamble. But public-sector workers don’t have to worry about that. Defined-benefit pensions mean: you take no risk. You get a guaranteed return that rises annually. Unsustainable.

The defined-benefit pensions that public workers receive (yes, BART retirees too) are generous, to say the least (medium pension about $75K annually). Some of that money should be put into infrastructure, schools, roads, etc., instead of the pension pot.

You shouldn’t expect private-sector workers, who have much lower defined-contribution pensions, to cover your pension too.

In any case, we’ll have pension reform or bankruptcy at some point. That’s the choice. If the latter, all those public-sector pensions will be wiped out. And the public will not be sympathetic.

And that nurse $70k salary for a nurse is very low (I used to work in healthcare).

Here is a listing on Criagslist:

http://sfbay.craigslist.org/eby/hea/5836631055.html

Top wage is $80/hour. Using a 12-hour shift, 15 days a month, that comes out to $173k/year.

I agree that everyone should have a pension. Most people with 401ks get decent company matches. The city isn’t funding BART’s pension. San Francisco is among the worst pension plan managers, but here are other pensions that are managed well or are getting better since people started noticing the gross mismanagement.

I get a pension. In my 45 year work life I contributed (from my paycheck) more than twice the amount to my pension (in 24 years) than I did in 45 years to Social Security. That is the way it is supposed to work.

Governor Brown implemented pension reform in 2013. That was a good start and it needs to be improved. But moving everyone to 401ks only enriches brokerages. I have those private accounts too and used supposedly conservative financial advisors. I lost just about everything in 1989, 1992, 2000, etc. It’s a fucking gamble.

Wrong, Turk. Unions are the backbone of American labor. Private-sector unions are a great boon for the American workforce. Public-sector unions are different, of course.

Glassdoor puts the average nurse pay package at about 70K:

https://www.glassdoor.com/Salaries/us-nurse-salary-SRCH_IL.0,2_IN1_KO3,8.htm

The author of this piece receives more than twice that, plus 31K in pension/healthcare inputs for a total pay package of $179K.

Regular pay: $147,856.72

Overtime pay: $0.00

Other pay: $250.00

Total pay: $148,106.72

Total benefits: $31,649.96

Total pay & benefits: $179,756.68

http://transparentcalifornia.com/salaries/2015/san-francisco/sasha-j-cuttler/

Granted, Sasha’s a hard worker and deserves a good deal. But the city should not be funding guaranteed-return pension costs. You can’t expect the rest of us, trying to save on 401K, IRA and SS, to be funding Sasha’s retirement as well.

It’s cheaper to pay overtime to the current workforce than to hire new employees, because public agencies have to pay into defined-benefit pension plans for public-sector employees, who receive guaranteed returns (no financial risks to them) and full healthcare coverage until death. The pension packages are weightyt, so better to pay the overtime than to hire more employees.

…yeah you are right…there shouldn’t be any unions…bosses should have complete, total authority to do anything they want…you’re a real beaut…

When you remove overtime, which is a management problem – either they don’t hire enough employees or they aren’t supervising – BART salaries are inline with the cost of living in the Bay Area.

https://www.glassdoor.com/Salary/Bart-Salaries-E13156.htm

Ah, good old SEIU Local 1021. Making certain that BART and several other entities are run by incompetent fools who are paid double what they should be and have no chance of being fired, even when lives are lost.