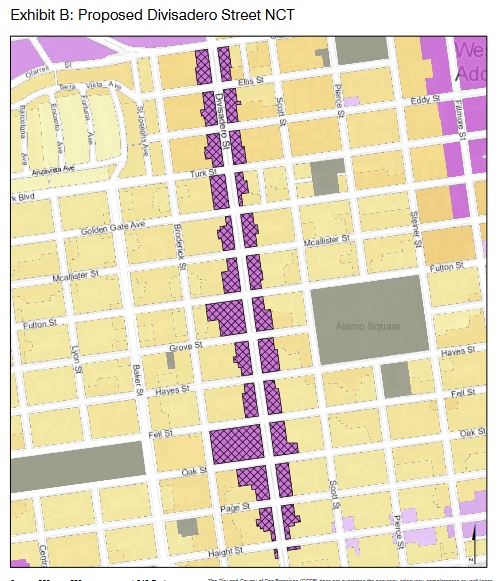

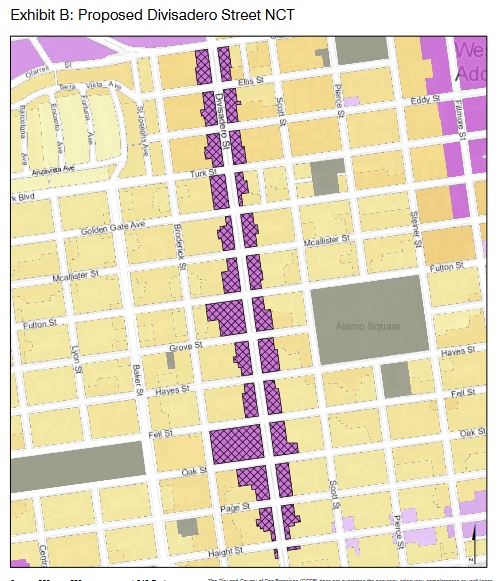

The plan to allow developers to pay less for affordable housing in the Divisadero Street Corridor is back at the Board of Supes Land Use Committee Monday/10.

Under Sup. London Breed’s plan for Divisadero, developers will get to build more density — that is, more units, which means more money — but the mandates for affordable housing don’t match those generous allowances.

The measure is part of this move on the board to create more “middle-class housing,” which is defined as housing for people making more than 120 percent of the Area Median Income (that’s $129,000 a year for a family of four). In fact, the definition goes up to 140 percent of AMI, which amounts to $150,000 a year.

Now: That sounds like a lot of money, and in most parts of the world it would put someone well above the middle class, but this city is so expensive (thanks to Mayor Lee’s policies) that $150,000 doesn’t seem like that much when you get into the housing market.

Two public school teachers, who live together and both have advanced degrees and 15 years of experience, fall into the 120 percent of AMI category. We desperately need housing for teachers (although two first-year teachers together would make only about $100,000 and thus wouldn’t qualify for the higher-end housing that Breed is proposing.) An teachers aren’t thrilled with the idea of setting aside housing for wealthier people at the expense of lower-income people.

We also desperately need housing for hotel workers, restaurant workers, nonprofit workers, government workers, health-care workers, and a lot of other people who make this city function every day. (The biggest employers in San Francisco are government, health care, and hospitality. Tech is way down the list.)

I still don’t understand why “middle-class housing” means a jump from 55 percent of AMI to 120 percent; there are lots of people in between who are ignored in this plan.

But let’s go back to the developers.

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

The way affordable housing works, a developer who sets aside, say, 15 percent (the city’s old standard) of units for people earning 55 percent of AMI (a family of four with $51,000 a year income) has to subsidize the difference between market-rate rent and the amount that family can pay. It’s a chunk of money – as we noted last week:

One of those differences, as Dean Preston, a tenant lawyer who challenged Breed last fall, noted, is that burden on the developer. Let’s assume these are rental units that could be priced at $4,000 a month. Longstanding federal policy puts “affordable” housing at 30 percent of a person’s income. So if some of the units have to be rented to people who make $51,000 a year – and thus can afford $1,275 a month in rent – the developer is on the hook for what amounts to a $32,700 a year subsidy.

But if those units only have to be affordable to someone who makes 140 percent of AMI, and can thus afford $3,700 a month rent, the subsidy is only $3,600 a year. That’s a huge savings for the developer.

“You don’t see a chamber full of developers here saying this is too much of a burden,” Preston said. “What Breed suggests is tripling the rents that those folks will pay and adding to the profits of developers.”

I have no problem with setting aside some affordable housing for people who earn the salaries of teachers and bus drivers and nurses. But if the developer is getting “affordable housing” credit for paying almost nothing, then the city’s getting a bad deal.

And remember: The developers are getting the right to build more units in the same space, a benefit that helps their bottom line.

How about this: You want to count housing for people who make $150,000 a year as affordable. But that’s less money out of your pocket than you pay for the first permit fees (far less than you pay your lawyers and lobbyists and agents). It’s decimal dust in the project’s financing.

So you shouldn’t get away with making only nine percent of the units “affordable” at this level. How about 40 percent, or 50 percent? It’s not the much below market-rate anyway.

How about we say this: You build a 100-unit building. The city gives you added density, so you can make more money. Setting aside 15 percent of your units for low-income people will cost you about 490,000 a year. (Is that too much for developers to afford? Apparently not, since many of them have agreed to it in the past, and the buildings have still gone up, the investors have been paid, and nobody seems to be missing any meals.)

So sure, let’s move some of that money around. Say only ten percent of units get the full subsidy, making them affordable to people who earn less than 55 percent AMI; that means you have used up $320,00 in subsidies. There’s $170,000 left.

You want to subsidize people at 140 AMI? Each apartment costs you $3,600 a year. If my math is right, you can make 47 percent of the remaining units “affordable.”

Bounce it around how you want, the bottom line is that the developers get a big break every time you raise the “affordable” level. That’s nothing but a giveaway.

The percentage of “affordable” units needs to go up, a lot, every time we raise the level of rent those units can go for.

The same calculus, of course, goes for affordable condos. You sell for less than market value and you are giving the city a subsidy. That’s part of the price you pay for the right to build immensely lucrative housing in SF. Let’s price that subsidy out and spread it around, instead of cutting the amount developers pay in the name of building middle-class housing.

REPEAL COSTA HAWKINS. Let’s cut to the chase and support AB 1506 the Costa Hawkins repeal bill. The only way to solve the rent and eviction problems us to take the matter out of the hands of the state and let the local authorities change the rules as they economy shifts. Rents are supposed to be covered by 30% of income in a healthy economy. That is not the case here. We have to return to a safer economy.

Developers aren’t building as much as they could, by choice. What they are building isn’t what the City needs, by choice. It’s simply how they see the market.

I don’t see anyone advocating for the lower level housing, as you’re suggesting is the better plan.

We’re depending on the free market, and it’s not demand driving the prices, it’s the class of new development built, and their expectations. 70% of $5,000 is likely to happen, and yet it’s still too high.

Builders aren’t going to take a bath. You’re correct there’s no cabal of landlords, but the YIMBY crowd speak of shadowy cabals of SFH owners.

I would start by Googling ‘the scientific method’, ‘statistics’ and for good measure, the Merriam-Webster definition of ‘glut’. And at the risk of furthering your notion of how Science works, I will reply with a meaningless anecdote: the units at the new development on Market and Sanchez are renting at a good clip.

But data will never trump common sense, so I wouldn’t lose too much sleep counting apartment listings. Landlords are rational actors, and will adjust rents to whatever makes sense. They are not part of a dark cabal whose sole objective is to keep low-income people out of San Francisco, regardless of the cost to themselves…

And then she announces the terrible and flawed Divis/ Fillmore legislation, aka another giveaway to developers.

We’re already wrestling with our very own supervisor who promised to double truly affordable housing for her constituents. It’s been 16 months since she introduced the Fillmore/Divis legislation.

Breed’s campaign mantra was “I’m a renter just like you.” She also promised D5 voters that she would double the amount of affordable housing to “the highest level ever in the city and county of San Francisco.” She promised voters an “affordable housing blueprint.” None of these promises have been kept. Instead since winning the election by a paltry 4%, Breed has once again snuggled up to developers and realtors at the expense of her constituents. That’s odd: most of them don’t live in D5 and never will.

They don’t squeeze anything out by building necessary housing. How are you harmed if you get more neighbors.

Its a good question. How much SHOULD developers pay for the extra bonus of an additional 48 units?

Should be easy enuf. What is the expected margin for each. Then require a portion of that to be build at varying BMR levels. Give the developer some incentive to build those extra 48 units (cuz they’ll be “affordable” to someone, some time). But not so much that they walk away and don’t even build the 16U they coulda.

Here’s where pious folk gets to wrestle with *greed*.

Yeah, the glut of 2 BR $700/ is almost gone. The others will fill up as well. They might have to come off the $4000/ to $3838/ whatever, but they will fill.

However, you might consider the developers are hedging their bets. David Chiu’s bill, due back next session, to allow Vacancy Control on SFH & condo’s might just make offering a teaser rate self defeating. And we can see that getting someone in – like Rev Lowery in Oakland – and then getting them out again (even for non-payment) can have unintended headaches and consequences both.

Like my brother said “four dollar 2×4’s? what is this world coming to”.

A cursory online search reveals available units at The Civic, The Alchemy by Alta, 450 Hayes, and the Avalon Hayes Valley. All of these developments have come to the market in the past 1-2 years; all have plenty of empty market rate units. Trulia, Zumper, and apts.com all show a glut of new market rate units. That’s the data. Go ahead: Google it. We’ll wait.

Seize the apartments and kill the landlords! Oh. Wait. We’re a constitutional democracy and not a Leninist wet-dream.

Also, you are mistaken – there is no such glut, and rents adjust to demand. 70% of 5,000/month is better than 0$/month, and developers (unlike many people here) can count.

Those poor, poor developers continue to make astronomical profits. Meanwhile, the old and young, new grads, teachers, nurses, firefighters, families with kids, artists and skads of people cannot find truly affordable places to live in SF. There is a glut of unoccupied “market rate”/ luxury units because people can’t afford the rents. It’s time to find solutions and to create and preserve truly affordable housing. Now.

San Francisco should pay for whatever social housing it wants to provide.

It should not steal it from landlord via rent control and or from developers and ‘market-price’ buyers via mandates. If the Supreme Court grew a pair and ruled all this nonsense unconstitutional taking of property, as it should, we could start having a serious conversation about public policy and how to fund it.

$150k is the 95th percentile for income in the US. I don’t care what the rationale is, the fact that we’re subsidizing housing for that level of income is insane.

If we just built enough housing in the first place we wouldn’t be having this discussion.

What if developers focused on how much they could help the communities they build in, rather than how much they can squeeze out of them?

Wait……what if we focused on how much BMR housing we can get developers to build instead of how difficult can we make life for them?

It is falling into place exactly how they have planned it. Supervisor Breed is a developer’s wet dream.

From real estate lobbyist Tim Colen to development scion Patrick Szeto, 10/27/2015:

“Affordability: Your current plans are to provide the below-market-rate (BMR) homes on site,

totaling 12 percent of the total units. However, you expressed interest in providing more BMR

homes at a greater range of affordability. We would encourage you to use the “dial,” which

would help you to achieve this goal. Legislation to accomplish this will be introduced shortly.

Likewise, the density bonus would enable you to provide homes in the 120 to 140 percent of area median income range. The SF Housing Action Coalition is happy to be a resource in connecting you to these proposals.”

And here’s a summary of how it’s going down:

Szeto buys property at 650 Divisadero from Alouis for about $13M, a price relevant to the fact that the site can allow a maximum of 16 units. Breed — without notifying her constituents — passes zoning changes and the project increases to 66 units with a promise of more affordable units. Land use committee changes “affordability” parameters to benefit developers. Szeto family erects mixed use building.

It’s really not that complicated. The moral of the story? Patrick Szeto is one slick cat, and he played Breed beautifully on this one.

http://www.sfhac.org/wp-content/uploads/2015/10/650_Divisadero_Letter_Final.pdf