A bill making its way through the state Legislature would allow some undocumented Californians to claim the state’s earned-income tax credit – widely considered an effective anti-poverty program.

The bill, AB 1593, Assemblymember Eloise Reyes, could help as many as 1.1 million California workers and children, and it’s cleared the Assembly.

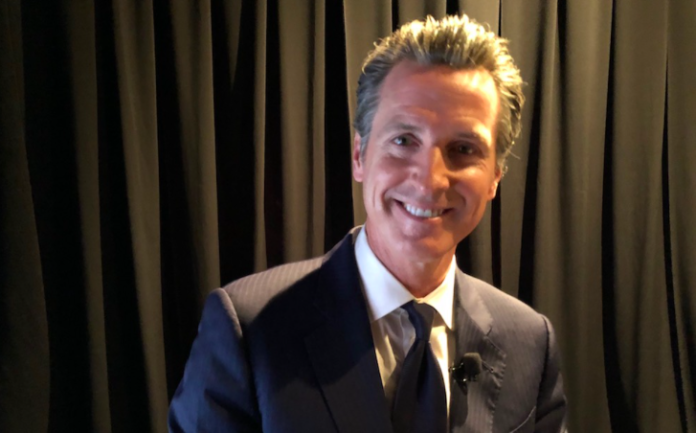

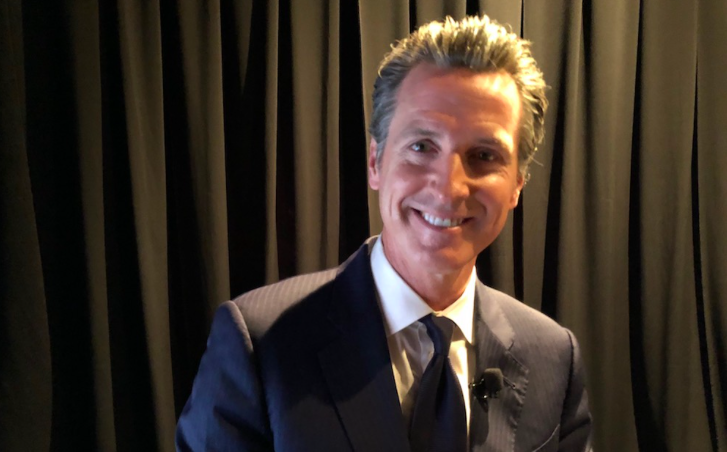

But even if the state Senate approved the measure, supporters are worried about Gov. Gavin Newsom. “I talked to him about it this weekend,” Sarah Souza, a member of the SF Democratic County Central Committee, told me. “He did not seem that strong about supporting it.”

Souza, who works at the California Reinvestment Coalition, is also president of the Latino Democratic Club. She is the author of a state party resolution that would allow undocumented Californians to participate fully in party activities.

Reyes argues that the bill would help some of the most economically vulnerable Californians. The EITC can provide as much as $2,400 a year to a parent with two children – and more to larger families:

The California Earned Income Tax Credit is a fantastic tool that has been used to lift communities across California out of poverty. Despite its noted success however, there are critical populations who continue to be left behind, one of which are immigrants who file their taxes using an Individual Taxpayer Identification Number.These individuals are taxpaying members of our communities who, despite contributing to their local economies, cannot access a critical tool to help work their way out of poverty. AB 1593 extends eligibility of CalEITC to these communities, creating a more inclusive and equitable system.

Hundreds of thousands of California residents file taxes every year although they aren’t legal residents and don’t have Social Security numbers. Current state law requires an SS number to clain the credit.

The credit is a direct tax refund – which eligible workers can get even if they have not tax liability.

If every eligible person used this to claim the EITC, it might cost the state $60 million. The current budget surplus is $25 billion.

And of course, that $60 million will be spent in the state, generating more local economic activity, since putting cash in the pockets of low-income people is one of the most effective boosts to local economies.

The governor’s press office has not responded to my questions about AB 1593.

Another bill that is generating little new media interest but could have a huge impact on everything from affordable housing to climate change is AB 857, which would allow for the establishment of local public banks in California.

The measure by Assemblymember David Chiu of San Francisco emerged from the Assembly floor with the minimum 41 votes, and is opposed by the banking industry, which makes the following (stunning) claim:

AB 857 infers that banks are not serving their communities, an argument repeatedly made by public bank activists in a variety of forums. There are 155 banks operating in California, which combined, originate more than $100 billion in new loans annually. Proponents for the creation of a public bank have failed to identify how the current marketplace is not meeting the public’s financial needs.

If that’s the best argument they have — that existing banks are doing just fine serving the public interest — it’s going to be a hard sell.

The bill doesn’t require the establishment of a public bank – it just creates the legal authority for cities to move in that direction if they want to.

Both bills are now in the Senate Rules Committee awaiting assignment. We’ll keep you posted.