By Tim Redmond

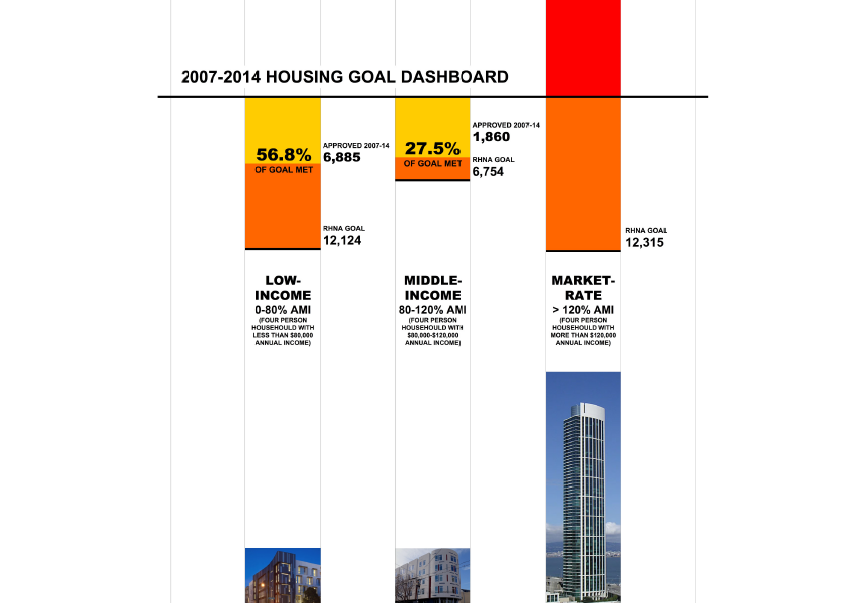

Sup. Jane Kim wanted the city to develop a housing “dashboard” – an ongoing report that would link the development of market-rate and affordable housing. Her idea, later toned down a bit in a compromise with the mayor, would have mandated that developers building luxury condos go through an additional planning process whenever the balance was out of whack – when affordable housing was below 30 percent of the mix.

Those figures, of course, already exist – the city keeps track of how much housing is approved, and what type of housing, and the folks at the Council of Community Housing Organizations have turned it into a nice, easy-to-understand, chart.

The news here is not so much that the city is only meeting 27.5 percent of its middle-income expectation and only 58 percent of its very-low income need. It’s that we’re building 211 percent as many luxury apartments and condos as we need.

The “need” is a bit of a fuzzy figure, but it’s based on what the Association of Bay Area Governments sees as San Francisco’s responsibility for meeting regional housing needs.

ABAG, of course, is trying to push even more housing on San Francisco, and there are plenty of issues around its projections.

But there are also pretty solid statistics on the population of San Francisco, the employment base, the standard salaries, and the projected growth of different industries.

Tech, of course, is a growth industry. But so is health care and hospitality – and, right now, to a more limited extent, government. And most of the jobs in those industries – which are critical to the city’s future, more critical than tech – pay salaries that don’t even begin to cover “market rate” housing.

So we know how much housing we need for the existing workforce, and we can project pretty well what we need for the workforce of the future – and the dashboard shows how radically out of connection the city’s current policy is with what the city actually needs.

Even if building 30,000 more units of housing, as the mayor has proposed, will bring down prices a little bit – and the city’s economist, Ted Egan, says we’d need more than three times as much new housing to make a serious dent in prices – the mayor’s plan isn’t going to make a new condo affordable to a hotel worker, a teacher, or a hospital technician.

A condo that might go on the market today at 1.5 million could wind up selling for $1.2, or even $1 million, if supply causes prices to dip (and again, all evidence indicates that prices won’t dip with more supply).

(I can see a future Ed Lee press release: “Mayor’s housing policy brings market prices down 10 percent.” Maybe it’s 20 percent. No difference; no matter what happens, unless there’s a catastrophic jolt to the city’s economy, that new condo will never sell for $350,000 or rent for $1,500 a month.

No: The only way housing for the existing and future workforce will be built is if it’s constructed as below market rate units in the first place. And the vast oversupply of market-rate housing is doing nothing for the crisis.

That’s what the dashboard shows – and it’s why Kim wanted to slow down the luxury condos until we can build enough affordable housing to catch up.