By Tim Redmond

The soda industry is already launching an attack on the November tax on sugary beverages, using the unusual comments several supervisors made during debate on the issue – and even highlighting the words of one of the measure’s cosponsors.

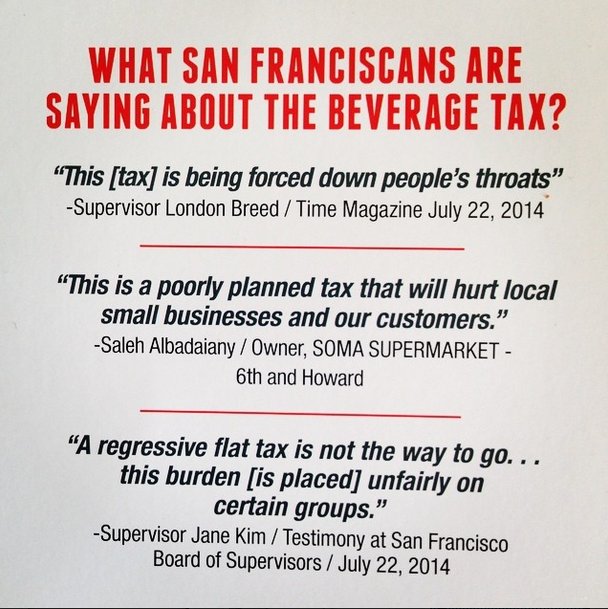

Not long after the Board of Supervisors voted July 22 by a narrow 6-5 margin to put the tax measure on the ballot, doorhangers from the American Beverage Association began appearing with quotes from Sup. London Breed and Jane Kim.

Kim’s opposition to the measure was a bit surprising – all of the progressives on the board backed it, and Kim has a long background as a youth organizer and School Board member.

She argued at the meeting that the two-cent-an-ounce tax on sugary drinks is regressive, since it’s a flat sales tax and will hit hardest on communities of color. She even argued against cigarette taxes, saying she didn’t support a statewide tobacco tax several years ago.

She’s right that any sales tax is regressive, and this one particularly so. She’s right that it, in essence, forces poorer communities to pay for the programs that will help fight diabetes and obesity.

But while I admit to a certain bias here – I am the parent of two teenagers, and I hate the fact that kids in my son’s school can buy 128-ounce “teen gulp” drinks at some convenience stores – the regressive argument rings a bit hollow.

Thing is, nobody needs to buy soda.

There are food deserts in the city, where people trying to feed their kids have no choice but to buy processed foods. But even if you’re stuck with mac and cheese and potato chips, and you can’t afford milk, you can drink water out of the tap. Or you can buy diet soda at the same price as sugary soda – and the tax doesn’t apply to diet drinks.

The cigarette companies have addicted generations of people to a drug that’s hard to quit. I can see how someone could claim that it’s unfair to the victims of the drug dealers to make them pay the penalty.

But Coke and 7-Up? Nobody needs it. Nobody. And, as Sup. Eric Mar pointed out, it’s poisoning communities of color. A full 50 percent of Latino and African-American ids will wind up with diabetes in their lifetimes – and while sugary drinks are the only cause, they are absolutely, certifiably a major factor.

I send Kim an email and asked her if she supports a higher gas tax – another regressive tax that serves a good social purpose – or a carbon tax, which would almost certainly hit low-income people in parts of the country where you need heat in the winter. I’m actually more conflicted about that than the soda tax; some people have to drive for work.

Kim told my by test that she would support a higher gas tax. I’m still waiting to hear by phone why she sees them as different. She’s out of town and we’ve both missed phone calls; as soon as we connect I will follow up with her comments.

There’s a much larger question here, or course: To what extent should we use taxes to discourage bad behavior – or, as in the case of taxes on gas, tobacco, and soda, to discourage behavior that has huge social costs? And who should pay those taxes?

Tax policy of late has often gone the other way – we use tax breaks to encourage businesses to move into depressed areas, to make certain investment and hiring decisions, etc. I could argue that those tax cuts are regressive, too – somebody’s got to pay the cost of government operations, and if Twitter and Tesla isn’t going to foot the bill, then the rest of us have to pay more.

And to make it more complicated, there’s only mixed evidence that corporate tax breaks are effective. But by any possible standard, the high taxes on cigarettes have done an exceptional job of cutting smoking.

Mar said he was “flabbergasted” by Kim’s statement, pointing out that the School Board and parents at SFUSD are big supporters of the measure. “And diabetes is regressive,” he said.

But Kim’s comments about a regressive tax are going to be a key part of the well-funded big-soda campaign against the measure, and you can see that from the door-hanger: It quotes Kim saying “a regressive flat tax is not the way to go …this burden [is placed] unfairly on certain groups.”

There’s also a quote from London Breed, who represents the Western Addition. She insisted that the tax “is being forced down people’s throats.”

Actually, no: This has been on the agenda for months. There have been hearings on the tax, lots of discussions, plenty of opportunities for everyone to have input … there have been in the past ballot measures that came up at the last minute, but this isn’t one of them. You can say a lot about this tax, but you can’t seriously question the long and credible process that brought it to the Board of Supervisors.

The Big Soda folks are also tweeting a comment from Sup. David Campos, who said “there is something Big Brother about this.” But unlike Kim and Breed, Campos voted in favor of the tax; he’s a consponsor. He may have concerns about the regressive tax, but on balance, he has endorsed it.

Yet the campaign against the tax is willing to take even the words of supporters to try to confuse the public and make the case against taxing a product that nobody needs and that causes serious health problems.

The tax is earmarked for programs that fight obesity and diabetes, so (through an odd and counterintuitive part of state law) it requires a two-thirds vote. That’s going to be really tough. Particularly since Big Soda will spend whatever it takes to crush the measure.

See, this is a bit like the rules against smoking in the workplace, the taxes on tobacco, and the public-health campaigns funded by the tobacco industry settlements: Once it gets started, it can become a monster. This one tax alone could reduce sugary soda consumption by 30 percent. We’re talking many, many millions of dollars.

And I have no hard evidence of this, but I think the impact of the tax will be less socioeconomic and more age-based. An adult who wants to buy a can of Coke – and nobody, least of all me, wants to ban the stuff; adults can make adult choices – will probably just suck up the 25 cents and buy it anyway. A teenager, who is going to be less concerned about the health impacts but more concerned about the price, may see that a “teen gulp: now costs $2.50 more, and give it a pass, or at least buy a smaller cup.

Of course, the real winners here will be the political consultants working for the industry, who will walk away with very sweet paychecks for using the words of the supervisors – even the ones who support the tax – to obscure the health issues.

And so far, they don’t have a single clear narrative, so they’re throwing everything at the wall to see what will stick.

Going to be a crazy campaign.