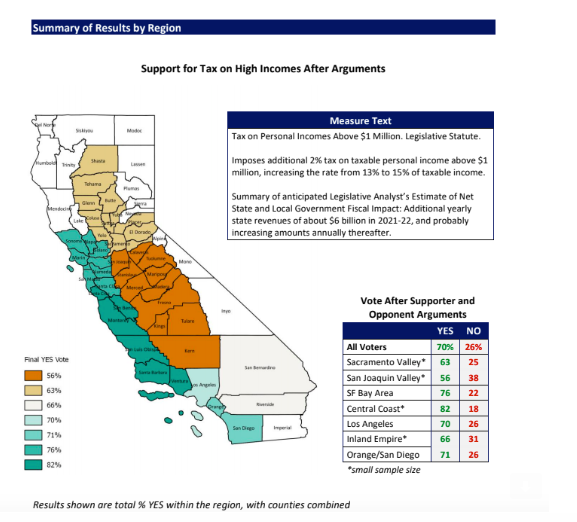

Some 70 percent of California voters would support a higher tax on income above $1 million, a new poll shows.

The survey, by the highly respected firm of David Binder and Associates, shows overwhelming support for the concept of making the richest Californians pay their share of the costs of recovering from the COVID-19 crisis.

The poll was sponsored by Build Affordable Faster California, an organization working for more affordable housing.

The results show strong support for a measure, either in the state Legislature or on the fall ballot, that would raise taxes on marginal income of more than $1 million from 13 percent to 15 percent. That would bring in about $6 billion a year.

It would also be a significant (if modest) step toward addressing the policies that have made California a leading example of the radical income and wealth inequality that are plaguing this nation.

“We need revenue,” Bobbi Lopez, who works with BAFC, told me. “This is clearly the most popular way to get it.”

There’s no specific bill or measure in the works to raise taxes on high incomes. But “it’s in discussion all over the state,” Lopez said. Advocates are meeting with legislators, and everyone from school boards to hospitals, labor and housing activists are looking at ways to make sure the burden of the state budget doesn’t fall entirely on the poor and working class.

An increase in the state’s income tax for the very rich (and only a small percentage of Californians earn more than $1 million a year – about 75,000 of the state’s 39 million residents, less than one tenth of one percent) and might get some traction. State Assembly Member David Chiu of San Francisco said in a press release that “with the pandemic, recession and $54 billion deficit, we need to reform our broken tax system, particularly after Trump’s regressive tax cuts, so every Californian has a shot at making it through these dark times.”

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

A lot of state legislators are talking about this.

There’s also the proposal that Sen. Elizabeth Warren made during the presidential campaign, for a modest wealth tax. I discussed this recently with Assembly Member Phil Ting, a former San Francisco assessor, who said he was interested, but wasn’t sure how it could happen.

It’s really pretty simple. California already taxes property – mostly real property, which means houses, offices, and land. If we changed the law to allow stocks, bonds, options, bank accounts, and other financial instruments held by the very rich to be taxed as property, we’d have a wealth tax.

If you just look at the top ten richest people in this state, they have a combined wealth of roughly $300 billion.

That’s ten people.

There are 155 other billionaires living in this state.

Let’s just wildly underestimate and say that the average wealth of those 155 is just $2 billion.

So we’re talking about $610 billion in wealth in the Golden State held by – not sure I can even do math this small, but it looks like just 0.0004 percent of the state.

A two percent wealth tax on that very small number of very rich people would bring in $12 billion a year. That’s enough to address much of the budget deficit now, and in the future transform the public schools, UC, CSA, community colleges … $12 billion a year could build enough affordable housing to end homelessness in California in five years.

From taking two cents on the dollar from 165 people. Who will still richer than anyone can imagine.

And we’re not even talking about those poor folks who only have $900 million in assets.

The poll shows that support for taxing the rich is not just limited to the more traditionally progressive parts of the state. Even in the most conservative Central Valley areas, more than 60 percent of the likely voters supported the concept.

A huge majority of voters – almost 80 percent – are concerned about the impacts of budget cuts to government programs. And 72 percent agreed with the statement that “with the state facing economic and health emergencies, now is the time to make the wealthiest pay their fair share.”

The margin of error is plus-or-minus four percent.

So as the state budget gets hashed out (right now, Democrats in the Legislature are arguing against cuts but depending on more federal help) the massive issue that has been ignored by almost everyone in federal, state, and local politics is finally on the table:

Taxing the rich.

We will see how far it goes.