Rent debt is one of the huge, looming issues of the pandemic, and policymakers at every level of government are talking about it. Gov. Gavin Newsom has promised to set aside more than $5 billion to pay back rent – although that won’t be enough to prevent widespread evictions.

But there’s another type of rent debt that isn’t getting much attention.

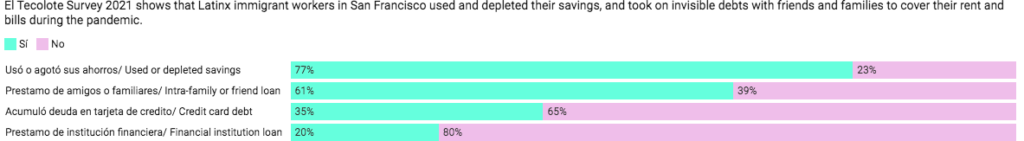

As El Tecolote, the legendary bilingual newspaper in the Mission District has found, many Latinx families avoided rent debt by spending down their savings and borrowing from family and friends – and now there’s no relief for them.

Many also put their lives at risk by continuing to work during the worst of the pandemic because they didn’t want to fall behind on rent.

An El Tecolote survey found that many families were desperate to avoid rent debt – so instead, the COVID pandemic has stripped them of any wealth, savings, and security.

The survey of 391 Latinx residents of BayView/ Hunters Point, Visitación Valley, Tenderloin, Mission and the Excelsior found that immigrants mostly kept their rent debt low during the pandemic. More than half of the respondents owed no back rent, and roughly 75 percent owed less than three months.

But that came at a price.

More than 80 percent of the respondents said they lost income during the pandemic. And more than 56 percent said they suffered extreme or high stress over paying their rent.

The fear of eviction was overwhelming, even though the city and state had an eviction moratorium. Some residents were undocumented; many lived in situations where the landlord was in essence a master tenant.

Many of the respondents said they did not want to be saddled with huge debts in the future.

So they depleted their savings and did informal borrowing from friends and family.

According to El Tecolote:

The true cost of rent in the pandemic: Latinx immigrants in San Francisco were stripped of their wealth to cover the rent. More than 75 percent depleted most of all of their savings. … COVID-19 is “the largest wealth-stripping event that we’ve ever seen. And likely ever will see,” says Ernesto Martinez, Director of Asset Building Programs at the Mission Economic Development Agency (MEDA).

From one of the newspaper’s stories:

The eviction moratorium, then and now, only promises a stay on evictions for tenants experiencing COVID-19 related financial hardships, if they can pay 25 percent of the rent owed before a certain date. The stay on eviction also only works, ifthe landlord does not sue the tenant later for the other cumulative 75 percent back rent once the moratorium is lifted. In the new extension, tenants have until October 1st, 2021 to pay 25 percent of any back rent owed between September 1, 2020 and September 30, 2021.

The problem is that by extending the moratorium in the exact same terms, lawmakers and policymakers failed to account for the stressful housing insecurity of low income Latinx immigrants that drove them to work in the pandemic, in the first place. The lesson taught by the pandemic is that Latinx immigrants cannot afford to accumulate formal debt that puts them at risk of eviction, lawsuits or in an unending cycle of debt.

More:

In short, there is no City or State program to help those Latinx essential workers, the most impacted population in the pandemic, who depleted their savings or took on intra-family debt or other debt to keep up with the rent and bills.

This is part of the hidden cost of the pandemic. There’s been a vast and increasing shift in wealth in this country in the past year: The top one percent, particularly the billionaires, have seen their net worth increase radically. And the working people have, it appears, seen what little wealth they have stripped away.