The Chron’s C.W. Nevius announced last week for all the honest world to see that the law of supply and demand is alive and well in San Francisco and that one needs only to look to the South of Market to see its reality.

Nevius, who believes that the sit-lie law solved homelessness, that Scott Wiener was the “smart money” winner in June, and that San Francisco is a center-right voting town that somehow elects progressives, asserts that:

So in places like SoMa lots of new housing was added and prices have come down, and in places like the Mission, where the new housing stock is low, prices are staying high. Sounds, to me, like supply and demand.

This SPUR talking point passing for reporting is based upon his rigorous economic analysis, which consisted of three conversations: one with a person “shopping the market”, and two realtors from one company.

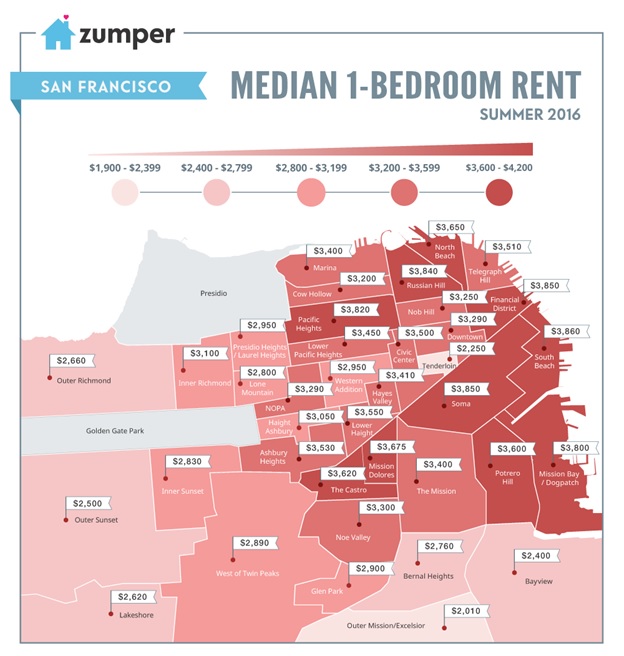

To be fair, he did mention that “real estate blog Zumper” reported that the southeast section of the city had “the highest rents in the city” based upon the tracking of hundreds of units of actual rents, but this mere fact did not keep him from his appointed rounds of announcing, by neighborhood, that where supply was constrained rents are high, where supply was added, rents are low, except where they are not.

Let’s take a look at what Zumper reported for August that C.W. mentioned but then dismissed.

Soma, at $3,850 median for a one-bedroom rent, was the tied with the Financial District for the second most expensive area to rent, second to South Beach, which had even more new construction of market rate housing than Soma.

So, gosh, Chuck, rents are highest in areas where the most new market rate development has occurred. And just so you know, big guy, a hell of a lot of market rate development has occurred in the Mission, which is why residents took over City Hall in protest.

Which neighborhoods have the lowest rents according to Zumper? Excelsior, Sunset, Pacific Heights, Inner Sunset, Bayview, Outer Richmond — that is neighborhoods which have had the least new development of market rate housing.

So it would seem that the actual facts are that that more market-rate development that occurs in a neighborhood the higher the rents are.

Looks to me that the facts show the “law of supply and demand,” at least as explained by Nevius, still don’t apply here.

Back to you, Chuck.