Political and tax policies supported by both Democrats and Republicans have cost 90 percent of Americans $50 trillion since 1975, a new study by the respected (and by no means left-wing) Rand Corporations shows.

This year alone, the rich have essentially stolen $2.5 trillion in income from everyone else, the study reports.

That amounts to about $42,000 a year in lost income for the average worker.

Yes: If you make $50,000 a year, you should be making $92,000 – and if you make $1.2 million, you should be making $540,000, which is still a whole lot of money.

The shift of income and wealth to the top ten percent is mind-boggling. These are numbers that are off the charts. If federal policies had not shifted to favor the rich, homelessness wouldn’t be an issue in American cities. Higher education and health care would be affordable. The list goes on.

This is, with all due respect to Bob Woodward’s book, by far the most important political story of the year – and most of the major news media have ignored it.

So have most of the candidates for office at every level.

Joe Biden has never mentioned the study. Kamala Harris hasn’t mentioned it. As far as I can tell, not one Democratic candidate for any statewide or national office has put out a press release or made it a big part of their campaign.

This was not front-page news (or as far as I can tell, any news) in the New York Times or the Washington Post. CBS gave it a few minutes. New York Magazine did a story.

The website that is all that’s left of Time Magazine had a piece.

The San Francisco Chronicle has ignored it. No White House reporter has asked Trump about it. No campaign reporter has asked Biden about it.

But this ought to be the defining issue in every political campaign in the United States right now.

The data is really hard to challenge. The Rand Corporation is not a liberal think-tank; if anything, it’s part of the political and economic elite.

It’s a dense read (which may be one reason so many political reporters, their ranks decimated by cuts, haven’t had time to dig into it.) Because they are economists, they present stuff like this:

Still, in about half an hour I was able to get the gist of what they study says.

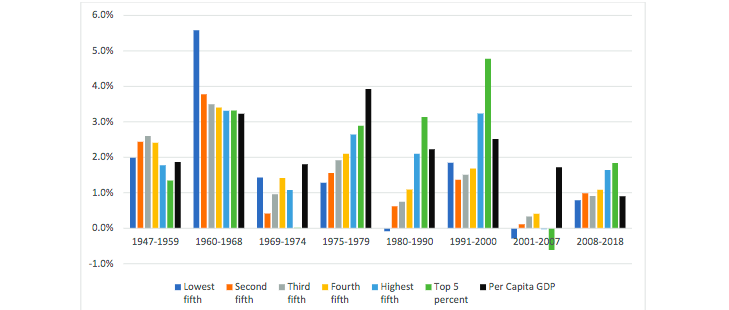

During the post-War era, most of the wealth created by the growth of the Gross Domestic Product was relatively evenly distributed. In fact, in the 1960s, more of that income and wealth growth went to the poorest 20 percent of the population.

That was in part because of the power of labor unions. It was also in significant part because of a tax structure that required that the really, really high-income earners – the top ten percent – paid as much as 80 percent of their marginal income to the government.

Which spent it, although not always well, on things like public education and infrastructure (that created good union jobs).

That tax structure also, I would argue, kept things like housing more affordable – if nobody is really stupid rich, then you can’t sell houses for millions of dollars.

This wasn’t random, as the study makes clear. Starting in 1978, Jimmy Carter, a Democrat, cut corporate income taxes. Two years later, Ronald Reagan, a Republican, began to dismantle the progressive tax code and give more money to the rich.

This continued for four decades, under both Democrats and Republicans. Bill Clinton didn’t restore the pre-Reagan tax rates. Barack Obama didn’t either. When Nancy Pelosi ran the House and the Democrats controlled the Senate, restoring taxes on the rich to 1975 levels wasn’t even on the agenda.

Imagine what this country would be like if the average worker’s salary was double what it is today. Imagine if Jeff Bezos and Bill Gates had to pay taxes at the level that John D. Rockefeller and John Paul Getty paid in the 1950s. (By the way, the Rockefeller and Getty families all these years later are still doing just fine, thank you.)

The amount of money that the rich took from the rest of us because of federal tax policies is unimaginable.

Thomas Picketty, the brilliant economist who has written the most important analysis of capitalism since Karl Marx, says that our current economic system can’t survive without an international consensus to tax great wealth, at a rate of at least two percent a year.

The world is on fire. Climate change is a threat not in the future, but today.

But we can’t address it without the New Deal side of the Green New Deal. And that means the very rich have to give something up to save the rest of the planet.

If we can’t fix this, we can’t fix anything. And it’s on almost nobody’s political agenda.