Economists who believe in free-market solutions generally don’t like rent control, because – by definition – it distorts the market. So we’ve seen a long list of academic economists – including even Paul Krugman, who ought to know better – arguing that rent control hurts tenants.

The latest salvo in this battle comes from Stanford University, where two assistant professors of economics, Rebecca Diamond and Tim McQuade, and grad student Franklin Qian, have authored a report on rent control in San Francisco.

Their conclusion, not surprisingly given the tendencies of academic economists, is that rent control drives up housing prices. We have heard this hundreds of times.

But it’s rare to see an in-depth study and a single city, much less San Francisco, so the data and analysis will no doubt be cited as the housing wars continue to heat up.

So far, the Stanford study hasn’t gotten much mainstream press, although Curbed picked it up. I suspect that’s in part because it’s pretty hard to read, as most academic economics papers are. If you enjoy equation sets like this

You will have a blast reading Diamond’s and McQuade’s piece of work.

But its conclusions are pretty clear – and from my perspective, some of them tend to support rent control.

The authors find that tenants in rent-controlled buildings stay in their units longer – and that’s particularly the case for older households. That means rent control helps preserve existing vulnerable communities and allow seniors to age in place – something that most of us can agree is good for a city and for society as a whole.

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

The problem comes when they look at the impacts of rent control on housing costs as a whole.

On average, we find that in the medium to long term, the beneficiaries of rent control are between 10 and 20 percent more likely to remain at their 1994 address relative to the control group. These effects are significantly stronger among older households and among households that have already spent a number of years at their current address. This is consistent with the fact both of these populations are less mobile in general, allowing the accrue greater insurance benefits.

On the other hand, for households with only a few years at their current address, the impact of rent control can be negative. Perhaps even more surprisingly, though, the impact is only negative in census tracts which had the highest rate of rent appreciation. This evidence suggests that landlords actively try to remove their tenants in those areas where the reward for resetting to market rents is greatest.

The authors propose that the government provide some sort of rental insurance to help tenants stay in place – as opposed to requiring landlords to keep rents at a stable level.

We find that rent control offered large benefits to impacted tenants during the 1995-2012 period, averaging between $3100 and $5900 per person each year, with aggregate benefits totaling over $423 million annually. These effects are counterbalanced by landlords reducing supply in response to the introduction of the law. We conclude that this led to a city-wide rent increase of 7% and caused $5 billion of welfare losses to all renters. The substantial welfare losses due to decreased housing supply could be mitigated if insurance against large rent increases was provided as a form of government social insurance, instead of a regulated mandate on landlords.

The study looks at buildings with four or fewer units that until 1994 were exempt from rent control. Those buildings constructed after 1980 still are exempt.

That, Diamond told me, provides a credible database: “We take advantage of the quirky 1994 laws that allowed us to compare rent controlled buildings to similar ones not under rent control.”

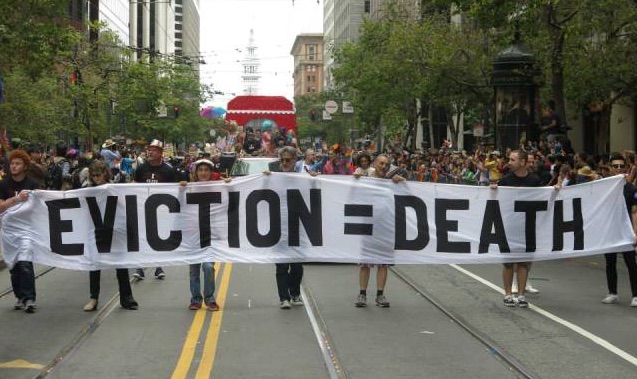

There are some stunning findings: “absent rent control,” the study notes, “essentially all of those incentivized to stay in their apartments would have otherwise moved out of San Francisco.”

Which tells me that rent control has prevented massive displacement.

But the crux of their argument is that rent control drives landlords to force out tenants so they can raise the rent — and that drives up costs for everyone.

In the process, they point out that rent control has been a significant transfer of wealth from the landlords to the tenants in the city.

We find that rent control offered large benefits to impacted tenants during the 1995-2012 period, averaging between $3100 and $5900 per person each year, with aggregate benefits totaling over $423 million annually. Over the entire period, tenants received cumulative benefits of around $7.6 billion. Most of these benefits came from protection against rent increases and transfer payments from landlords.

A lot of economists who look at cities would say that’s a good thing: In general, shifting money from people who are most likely to save or invest it (landlords) to people who are more likely to spend it (tenants) increases economic activity, particularly for small local businesses.

It makes sense: the richer you are, the less likely you are to take an additional $100 in income and go buy groceries or shoes for your kids. That money instead goes into the financial sector, where taxes are lower and economic impacts are slower. You don’t improve the economy and create jobs by giving more money to the rich.

Not all landlords are rich, of course; not all tenants are poor. But overall, the landlord sector is wealthier than the tenant sector, especially these days when more and more residential property is owned by larger corporations.

So what’s the problem? The Stanford economists say that rent control gives landlords incentives to evict their tenants or turn apartments into TICs, raising overall housing prices:

However, we find losses to all renters of $5 billion due to rent control’s effect on decreasing the rental housing and raising market rents.

The study lists all the ways landlords get around rent-control – Ellis Act evictions, owner move-ins, buyouts, etc. The idea: If you limit rents, landlords will find some way to get around the law and raise prices.

A new report from Tenants Together, a statewide renter-advocacy group, notes that the Stanford study blames the rise in housing costs on rent control – not on the loopholes in the law that speculators use:

The authors blame rent control, rather than speculator creation and abuse of loopholes around rent control, for the displacement of tenants. That is a political choice, not an academic one.

More:

The authors refuse to entertain the possibility that rent control is not functioning fully due to loopholes, without which these landlords would have had not few, but no ―ways of removing tenants‖ for speculative gain. It is worth noting that all rent control laws, including San Francisco’s, already allow landlords to evict tenants who fail to pay rent or otherwise violate terms of their leases, as well as allowing ―owner move-in evictions where landlords seek to move into the home. What is at issue here, and the authors seem fine with, is the idea that landlords should have even more ways to evict tenants for speculative gain amidst a housing crisis.

There are a lot of reasons why rents have been soaring in the Bay Area – not just in cities that have rent control, but in cities that don’t. One big reason is that San Francisco and Peninsula cities have approved (and encouraged) a massive increase in tech office space and thus jobs – without any concern for the fact that the region had nowhere near enough housing for those jobs.

But the Stanford folks still want to blame rent control.

I emailed Diamond and asked her whether the problem might be the loopholes in the law, not the concept of rent control:

What if the state and the city closed the loopholes you mention (owner move-ins, the Ellis Act, and buyouts) and the city imposed rent controls on vacant apartments? Would SF not get all the benefits of rent control without the negative impacts you found?

Her response:

In a world where a city prevented all types of evictions, prevented condo conversions of all kinds, and even went so far as to limit rents on vacant apartments, landlords would still find some legal alternatives to mitigate their huge financial losses. Granted, my research papers looks at hard data and is not based on interpretation or speculation. However, to think about what would happen in this alternative scenario of extreme rent control, I must speculate since there is no data to look at.

There would be zero maintenance and upkeep of the apartments. Likely many apartments would simply be left vacant, as the meager rents would not even compensate landlords for simple maintenance, taxes, and costs to screen tenants to rent. Further, in the long run, some tenants will move out of their rent controlled units for personal reasons, and at this time owners could sell of the units for owner occupants, even without evictions or formally converting to condos. Further, no developer would ever consider building new rental housing in this environment, since these extreme rules would signal that new development would likely be brought under rent control in the future. This would lead to the few apartments available for rent to cost extremely high prices.

Actually, we do have data on this. In the 1980s, Berkeley and Santa Monica had rent controls on vacant apartments. None of the things Diamond talked about happened. I was here.

That’s because there’s another factor at play: The price of rental housing (as any market-fearing economist should know) is based on the likely return. If you make it possible for speculators to buy rent-controlled property, evict the tenants, flip it, and make a fortune, the price of housing will go up.

If you strictly control rents and evictions, the value of that housing goes down. So does its price.

Landlords in Berkeley were not impoverished by effective rent control. They simply made less profit than they would have in a speculative environment. They made, for the most part, a reasonable return on investment – since the price of the property reflected the existing and future (stable) rents, the (stable) property taxes, the (stable) mortgage costs and the (predictable) maintenance. If the rents weren’t high enough to create a profit, that building simply sold for less. And the landlords who had owned for years had very low property taxes thanks to Prop. 13, and had set their original rents at a level that would allow them a reasonable return.

Diamond told me that

Yes, Berkeley and SM had vacancy control, but still Ellis Act evictions were allowed, as were condo conversions and owner move ins.

Actually, I don’t think we saw a lot of Ellis evictions in Berkeley in the 1980s. What we saw were stable rents and a lot less displacement.

Dean Preston, director of Tenants Together and an author of that group’s study, told me that

Unfortunately, her response confirms that this professor doesn’t have a clue about rent control and substitutes industry generated talking points for facts.

Specifically, she speculates that with real rent control “landlords would still find some legal alternatives to mitigate their huge financial losses.” She assumes “losses.” Why would there be any reason to believe landlords would suffer losses? Landlords made plenty of money under vacancy control before Costa Hawkins. Moreover, the cost of rental housing would reflect the regulated rents, so landlords would not need to pay so much to buy property under such a system. What she really means is that landlords would suffer losses by not earning the maximum amount of profit they otherwise would, a common real estate industry talking point to oppose any regulation.

She next claims that with real rent control “there would be zero maintenance and upkeep of the apartments.” This didn’t happen in cities with stronger rent control. Whether repairs get made is usually more a function of the strength of state habitability laws and local code enforcement than the rents. Landlords operating slum housing across the state, especially in non-rent control cities, are making a killing right now and do not invest it back in the property absent strong code enforcement. As a general matter, landlords make repairs when they are forced to.

Next she argues, “likely many apartments would simply be left vacant, as the meager rents would not even compensate landlords for simple maintenance, taxes, and costs to screen tenants to rent.” Perhaps she is not aware that every rent control law, as required by the state constitution and Supreme Court cases, requires that landlords get a fair return on their property. So the situation she describes is not only unlikely, it is pretty much impossible. Landlords who couldn’t afford taxes or maintenance because of the rents would get relief from the local rent board or court.

What real, effective rent control does is treat housing as a regulated utility. Landlords have the right to make a reasonable return on their investment – but not to make a killing because speculators find ways to evict tenants. It’s a transfer of wealth from the land-owing class to the renter class — which a lot of us would define as a move toward economic equality.

That’s the real argument here – and the professors at Stanford seem to be missing it.