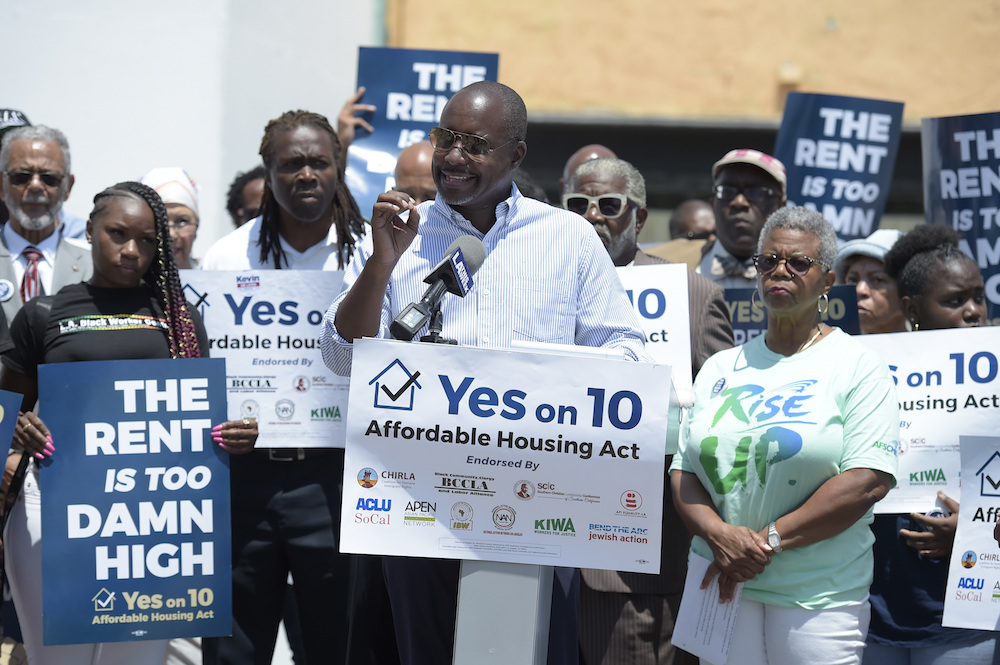

The battle over state Proposition 10, which could dramatically slow evictions in cities like San Francisco, is going to dominate the fall ballot, with both sides spending millions of dollars.

And for the landlord lobby, one of the most pervasive arguments is going to be a study by Stanford Business School professors that says rent control leads to gentrification and is bad for renters.

If that sounds counter-intuitive, it is: A new study released by supporters of Prop. 10 shows that the Stanford study was not only flawed but misses some of the key points in the rent-control debate.

The Stanford study, authored by Rebecca Diamond and Tim McQuade, has been citied repeatedly in the news media. The Chron give it big play. Curbed SF wrote about it; the official No on 10 website cites it. Politico talked about it. Calmatters called it “groundbreaking.” The Mercury News treated it like gospel.

You get the picture.

But the Yes on 10 campaign analyzed the data and found some serious problems – starting with the fact that

Diamond is a former Goldman Sachs asset manager, while McQuade previously worked for UBS Investment Bank. Their research has long sought to downplay the harms of gentrification, and their work has even argued the drawbacks of building low-income housing in richer neighborhoods.

Their conclusion that “rent control causes gentrification” is at odds with reality, the new report says:

First, the study does not consider and address the many other historical and economic factors responsible for gentrification in the Bay Area, let alone throughout the U.S. Among the most significant drivers of gentrification in cities across the country is the extreme wealth divide that has increased exponentially over recent decades, combined with the real estate speculation and deregulated financialization of housing that this has directly fueled. The three richest people in the U.S. now own as much wealth as the bottom half of the population, or 160 million people (Collins and Hoxie 2017). Since 1980, the richest one percent’s share of wealth has steadily climbed (Mishel et al. 2015). Meanwhile, during this same period, median wages have stagnated – and even declined for the bottom 50 percent (Mishel et al. 2015). Real estate serves an arena for the uber wealthy to invest their monstrous wealth, while the renter majority is easily swept aside by rising prices. Los Angeles, for example, was recently voted by international investors as the number one site in North America for real estate investment — as one investor put it, L.A. “still has room for rents to rise,” (Vincent 2017).

As for San Francisco rent control, the Prop. 10 study says,

On top of this, San Francisco’s limited rent control has gaping loopholes allowing for condo and “tenants-in-common” (TIC) conversions. Dampening market pressures and plugging these loopholes would have helped stem the conversion problem, but the authors choose to ignore this entirely.

But beyond the study and its flaws, there are larger issues here that Peter Dreier, an eminent writer and thinker on urban issues, discussed in an interview with me.

Dreier is professor of political science and director of the Urban and Environmental Policy Project at Occidental College. He is widely regarded as one of the leading experts on the economics of urban development and land use in the nation.

He was among those who reviewed the Yes on 10 report, and he said he supports its research, methods, and conclusion with no reservations.

The Stanford study, he said, was so wrong that it has no credibility at all.

But what I really wanted to talk to Dreier about was the upside of rent control – not just for the tenants but for local economies.

The central issue with Prop. 10 is allowing cities to extend rent controls to vacant apartments. In the 1980s, cities like Berkeley, Santa Monica, and West Hollywood had those rules, called “vacancy control.” Rent was set at a level that allows a landlord to get what the state Supreme Court calls “a reasonable return on investment.” Then the cities limited annual rent increases – on all apartments, occupied or vacant.

When a tenant moved out, the next tenant paid the same controlled rent.

Then in 1994, the state outlawed that practice. The Legislature passed the Costa-Hawkins Act, which gives landlords the right to raise rents to whatever the market will bear whenever a unit becomes vacant.

That, of course, gives landlords a huge incentive to evict long-term tenants so they can raise the rent – and make not just a fair return on investment, which is required by state law, but a huge windfall, which is not.

The landlords – and the Stanford Business School profs – say that if you impose rent controls on all apartments, you’ll get blight, vacant buildings, and urban decline. As Diamond put it to me:

There would be zero maintenance and upkeep of the apartments. Likely many apartments would simply be left vacant, as the meager rents would not even compensate landlords for simple maintenance, taxes, and costs to screen tenants to rent. Further, in the long run, some tenants will move out of their rent-controlled units for personal reasons, and at this time owners could sell of the units for owner occupants, even without evictions or formally converting to condos. Further, no developer would ever consider building new rental housing in this environment, since these extreme rules would signal that new development would likely be brought under rent control in the future. This would lead to the few apartments available for rent to cost extremely high prices.

But Dreier, who was the head of housing in Boston when the city had real rent control, said the evidence shows otherwise:

“Under credible rent-control laws, landlords are allowed a reasonable across-the-board rent increase every year, but to get it they have to demonstrate that they are maintaining their properties. In fact, we found the rent control improves the quality of housing.”

As for the doom-and-gloom predictions?

“You could drive through Berkeley and Santa Monica and you didn’t see any abandoned buildings,” he said.

So no, real rent control doesn’t cause problems. But it does, Dreier said, help local small businesses.

That’s because rent control is, in effect, a transfer of wealth from the landlord class (which, more and more, is big absentee investors) to the tenant class, which is more likely to be low-to-moderate income.

When you put money in the pockets of rich investors, they tend to suck it out of town and put it into other investments. If you put money into the pockets of working-class people, they tend to spend it in town.

“The money from lower rents goes back into the local economy,” Dreier said. “If it weren’t for their ideology, the Chamber of Commerce should be supporting Prop. 10.”

The other element of rent control that helps local business: If you hold down the cost of housing, you allow small employers to hire and keep workers. We are already seeing businesses scrambling to find workers and to pay the wages necessary to allow their employees to find housing.

There’s a good argument that real rent control – which in effect treats housing as a human right and regulates it like a public utility – makes cities, communities, and local economies more healthy.

That’s what the Prop. 10 debate should be about.

Read Peter Dreier’s testimony to the state Legislature here.