Tom Ammiano, who served four years on the Board of Education, 14 years on the Board of Supes, and six years in the State Assembly, saw a lot of budgets in his time. And years ago, he gave me a great piece of advice:

“Whenever you try to do something good in public office, they always say there isn’t the money. But there’s always the money. It’s maybe hidden somewhere, in some closed-door budget deal, but the idea that ‘there isn’t the money’ is usually a lie.”

Yep: When powerful people want a tax cut for rich people or for tech companies or for political friends, the money’s never a problem. But when budgets are tight and, say, low-level workers want to keep the raises they were promised, it’s a horrible crisis and will bankrupt the city.

So after all the doom and gloom from the Mayor’s Office, including sharp criticism of union workers (but not the cops, who got everything they wanted) it turns out the city actually has a budget surplus right now. That’s mostly due to higher property taxes and taxes on the sale of high-end properties – and federal money that is expected under the Biden Administration.

Of course, the Chron still says “deficits loom.”

We have no idea what the post-COVID SF or California economy will look like. The Business Times says we are headed for disaster unless we (where have you heard this before?) cut taxes on business. That has never worked.

(I keep hearing people say that the rich are moving to Austin, Texas because of lower taxes and better local services, but Texas has no Prop. 13 – property is assessed every year at its full value. Which means Texas has some of the highest property taxes in the country. If, for example, you bought a house in Austin 25 years ago for $250,000 and now, thanks to all the Californians moving there, it’s worth $850,000, your property taxes have gone from about $4,500 a year to about $15,000 a year. And they go up every year with the value of your property. In San Francisco, that house is still taxed at about $3,000 a year.)

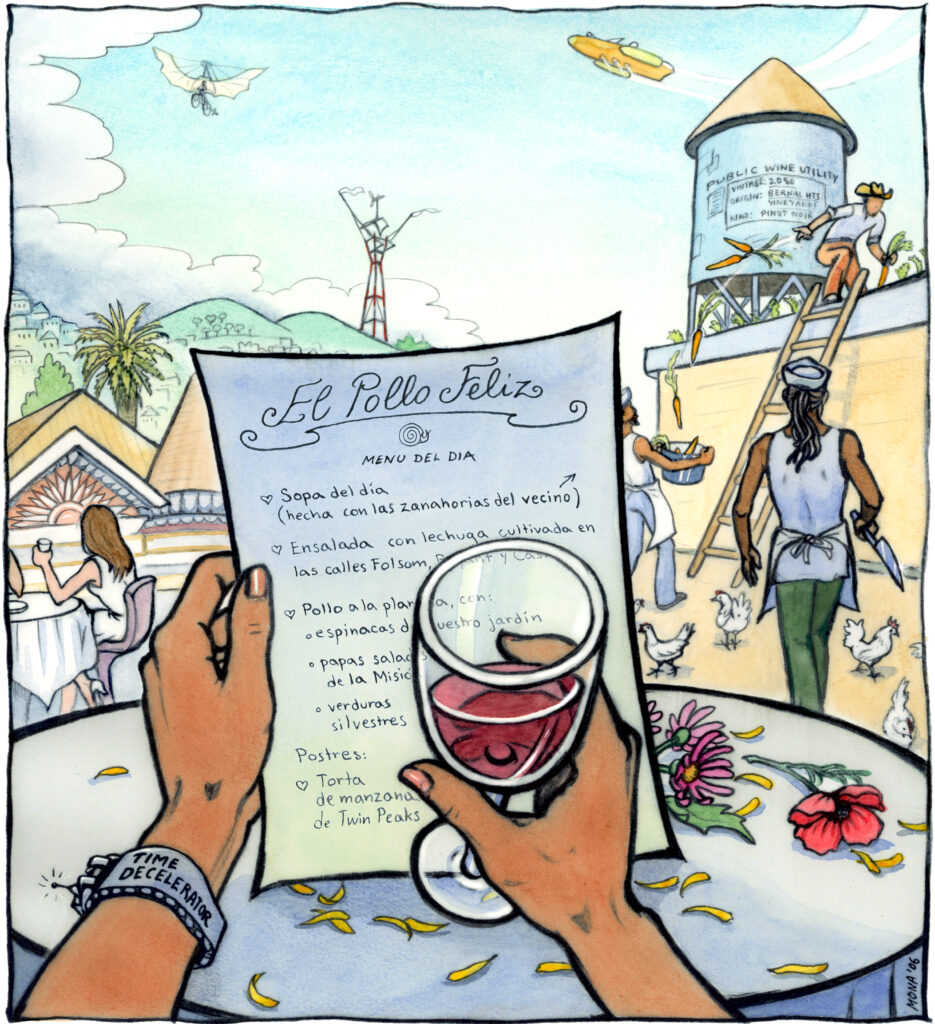

I am not hearing much from the Mayor’s Office about how to plan for post-COVID. There are so many options; we could, for example, seek to repurpose empty downtown office space as space for the arts. We could, instead of offering tax breaks to big rich tech companies, offer cheap studio, rehearsal, and performance space to artists, writers, performers, musicians … and tell the world that if what you need is low-cost space and low rent, San Francisco wants you.

Attracting 50,000 new artists to a city where 50,000 tech workers have left might actually be a good idea. Musicians need to work together, and have audiences. Painters can’t work online. Stage performers need each other to be in the same space. This could be a perfect post-COIVD economic development strategy. (Artists buy coffee and go to restaurants, too – but they don’t tend to displace existing businesses because they don’t tend to be rich. So the cool old places with cheap food might survive.)

This, of course, would not be as good for the landlords. But for half a century, everything we have done in economic development has been a benefit to property owners and bd for tenants. So maybe we try a different approach.

At any rate, Sup. Matt Haney has called for a hearing on the “city’s economy, financial condition, and other issues,” which might help us get a better picture of the present and future. In my experience, mayors have always tried to make budgets look bleak so they can cut what they don’t like at will, and they have made it as difficult as possible to figure out whether the money “is really there.”

That Wednesday/17 hearing before the Budget and Appropriations Committee starts at 1:30.

Oh, and while we are talking about money: After years of legal wrangling (that has probably cost the city hundreds of thousands of dollars in work by the City Attorney’s Office) San Francisco is finally set to pay out $2.5 million to a man who was framed and wrongfully convicted by the actions of the SFPD.

MissionLocal has been doing an excellent job on this story, pointing out that even though Maurice Caldwell has been exonerated by the courts after 20 years in prison, the City Attorney’s Office has been fighting any payment.

Now, as the case was heading to trial, the city is apparently ready to cut its losses. The Government Audit and Oversight Committee will hear Thursday/18 a proposal to settle the case. The officer who the courts agree framed him retired years later at the rank of commander, without any disciplinary action.

And the San Francisco taxpayers will foot the bill.

Sup. Hillary Ronen is concerned that the city’s Right to Recovery Fund – which pays $1,285 to anyone who tests positive for COVID and has to quarantine and miss work – is underfunded and not providing the benefits that it promised. She’s asked for a hearing at the Budget and Finance Committee

to discuss how many times the program has paused because of lack of funds, how many eligible individuals have failed to receive this economic assistance since the program began, how much money is currently available to assist COVID-19 positive residents in the program, how much estimated additional funding would be needed to fully fund the program throughout the duration of the pandemic, the impact of the program on the individuals who received funding and the public health at large.

That Wednesday/17 meeting starts at 10:30am.