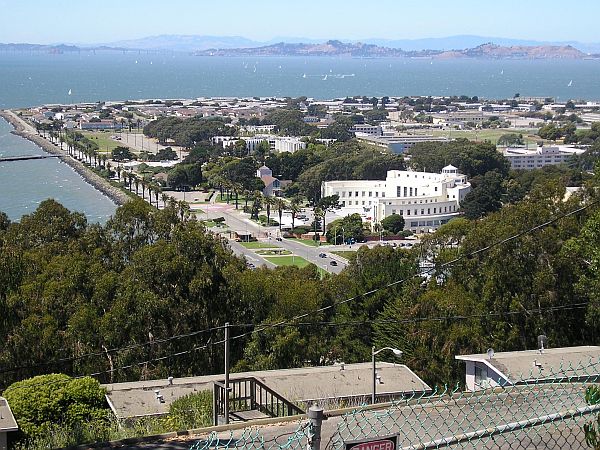

The Treasure Island/Yerba Buena Island development is in trouble. Don’t take our word for it, see the Stockbridge/Wilson Meany v. Kenwood lawsuit where the members of the development group are suing each other for position in the cue to claim their share of the project’s shrinking profits.

The nearly 30-year history of this redevelopment project has been plagued by incompetent planning, lack of accountability and more Mulligans than a Trump golf tournament.

So now the developer consortium, known as Treasure Island Community Development LLC, and the Treasure Island Development Authority—the independent agency overseeing the economic redevelopment of the former Naval Station Treasure Island—with the political backing of Mayor London Breed and Supervisor Matt Dorsey (District 6 includes Treasure Island) have agreed to change the terms of the Disposition and Development Agreement of 2011, the contract between the city and the developer group that delineates each sides’ obligations in completing the project.

The new arrangement (dubbed “Alternative Financing” — think Kellyanne Conway’s “Alternative Facts”)—is so unusual and complex even the professional staff presenting it to the Planning Commission struggled to answer questions.

But the key elements are a direct result of money shortages for the developers and include a $115 million bailout “loan” backed by the city’s general fund, letting the TICD off the hook to cover shortfalls in the operation budget required by the original DDA, and pushing back the construction of needed facilities by seven years.

The proposed plan’s considerable costs would shift from the TICD to the current and future residents the island, and ultimately to the residents and businesses of the City and County of San Francisco, rewarding the developers with a bailoutrequired by their failures.

“It is not a good deal for the city,” Sup. Connie Chan, who heads the Budget and Finance Committee, told us.

That committee will hear the proposal Wednesday/17.

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

Of course, in the story that the developers and TIDA officials are telling, the culprits are “this challenging economic period,” “the constraints of the project,” and “the difficulty to secure traditional financing,” that is, causes without human agency — certainly not them.

The proposed changes

These consequential decisions are embedded in a series of changes, being referred to as “updates” as if they were just minor tweaks to the Disposition and Development Agreement of 2011 and not major changes to who pays for it.

Among the details:

—The proposed DDA Amendment (you can read the Budget and Legislative Analyst report here) has the city providing $115 million from Certificates of Participation—a type of bonds backed by the General Fund— to finance the second phase of the island’s infrastructure buildout.

This was originally to be financed by TICD with proceeds from selling vertical development rights to other developers.

After multiple attempts to do so by TICD, the market reaction was – no thanks! Savvy investors wanted no part of it. This new bailout loan is proposed to be paid back by offering to investors COPs that unlike municipal bonds, don’t need voter approval, as well as some already approved Infrastructure and Revitalization Financing District, and CFD Community Financing District bonds estimated to generate only $550,000 a year.

However, the new COP “bond” offerings by the city will have to cover the remaining 20 years of payments at $11.7 million a year (assuming interest rates remain at current levels). The total the cituy will have to pay will reach $245.9 million over 20 years.

Among other things, this will use up all of the city’s borrowing capacity for the next three years. “So if you have a leaking firehouse roof or the lights go out in a rec center, there’s no money to pay for it,” Chan told us.

—The DDA amendment relieves the developer team of the obligation to cover shortfalls in TIDA operation budget required by the original DDA, currently $5 million a year. This turns the relations of TICD and TIDA on its head: TICD had to cover TIDA’s shortfall. Now TIDA has to cover TICD’s shortfall. Without that backfill, TIDA is in even more financial peril because it has lost much of its commercial lease revenue due to demolition of existing buildings. There is also a gradual exodus of east side residents as TIDA makes the future of current resident housing options uncertain, further reducing TIDA’s residential lease revenue.

—The DDA amendment pushes back by seven years the construction of what is referred to as “the community benefits” that home buyers and renters have long been promised would be included in the price of their residency. These include a new police/fire station, as well as a K-5 school. Their absence will not only make the community less safe, less desirable and less valuable to potential home buyers and renters on the island for the foreseeable future, it will extend the many car trips island parents make taking their kids back and forth on the bridge to school on the city mainland every day. And one of the lessons of the last decade of delays has shown us is that it makes everything — materials, labor and interest rates — more expensive and possibly prohibitive.

—The amendment proposes to push out the building of more of the affordable units into the 2030s. With the projected 8,000 total units, to meet city’s mandated affordable goal (27.2 percent of the total housing units) requires 2,175 affordable units to be built. Currently, there only has been 290 units built with another 200 projected in the next couple years.

This is classic YIMBY policy a la state Senator Scott Weiner— give developers free rein and kick the affordable housing can down the road with no guarantees that the city will not then be required to bail out the developers again if and when they claim they cannot afford to build the affordable housing at the end of the development.

Why the rush to bailout the developers? Well, Mayor London Breed is unlikely to want to admit that one of the biggest housing developments in the city might fail in an election year where she’s facing serious opposition.

The root of the problem started more than 20 years ago. The initial TI/YBI reuse committee appointed by then-Mayor Willie Brown and the Board of Supervisors in 1996 recommended no residential housing, citing the problem of access on and off the island via the Bay Bridge. Then the developers, using the argument over and over again that more residential units were needed for the project to pencil out, got the city to amend the plan in 2002 to build 2,800 housing units on the island.

Then, using their same profitability argument, TICD and TIDA agreed to increase that to 5,500 units in 2006 and then to 8,000 units in 2010. This begat the proposal to deal with auto congestion on the island and the bridge by putting a toll on the island, a fundraising gimmick to make island residents, business owners and visitors pay for local improvements instead of the developers.

Incredibly, as an additional gift to the developers, Breed and Supervisor Matt Dorsey (who represents District 6 which includes Treasure Island) are now proposing to raise the number of units to 9,000 (most of them expensive luxury housing).

There is still no feasible transportation plan.

Doubling down

These changes are a road map of some of the biggest blunders the developers and the city made together and a continuation of them, a “doubling down” (the gambling term developer Chris Meany of TICD developer Wilson Meany used to describe the risk involved in the DDA amendment) on the mistakes they keep making that are costing the city hundreds of millions of dollars.

The amendments are also an admission of their previous errors, and the prevailing arrogance of these “professional” planners and politicians that don’t feel as if they have to or should listen to the real experts on creating a livable neighborhood — the residents and business owners who have been living, and eking out a living, on the island for 20 years or more.

From the beginning, when in 1996 the military base closure policy then sweeping the country, or at least by 1997 when newly elected Mayor Brown took over City Hall and the development, community participation has been discouraged. City leaders were led around by the developers Brown chose, and those people determined the project’s direction.

They have maintained control by holding the majority of the meetings of TIDA at City Hall during the afternoon in the middle of the work week. Only one or two of the monthly meetings each year are held in the evening and on TI were residents can walk to them instead of having to cross the bridge. Those are usually the only ones attended by more than a smattering of the affected residents.

The meetings are made unwelcoming. Residents only get two minutes to speak on agenda items, and if a speaker goes just a couple seconds past the two minute buzzer, their mic is cut off in mid-sentence. Agendas and voluminous supporting documents are not available till three days before the meeting, are often incomplete or missing, are filled with bureaucratic language and unexplained acronyms, and documents and exhibits are regularly not available. Lengthy Power Point presentations are soporific, testing your attention span and your coffee’s caffeine. To actually understand and participate in the future of the island requires a tremendous commitment.

You can watch the meetings on the SFgovtv channel, but recently the Board of Supervisors eliminated the remote telephone testimony, leaving you as only a passive observer if you can’t attend the meetings in person.

At the end of last February 14’s TIDA Board meeting, when board members discuss the next month’s agenda items, its president, Fei Tsen, informed the board it would be seeing and voting on these new “updates” for the first time at the March meeting. But the public would not get them until 72 hours before then.

The staff report presented to the Planning Commission for its

April 4 hearing included an executive summary (usually a condensed version) with Planning Code, Design for Development and development agreement amendments that run 290 pages.

Still, in the Planning Commission’s report recommending approval of the DDA Amendments, it cited a “robust community outreach program” throughout the development of the Project. Tellingly, the report notes that the department has not received any letters in support or in opposition to the project.

When the Treasure Island Organizing Committee, a coalition of island residents and business people, proposed to the TIDA Board several years ago that the DDA should be changed so that it doesn’t mandate the toll as TIDA Executive Director Bob Beck had insisted, Beck countered that it couldn’t be done since the toll is “baked into” the DDA and can’t be changed. The TIOC argued that, as a contract, it could be changed if both parties agreed. Beck said not this one. But he and the Breed administration are following their advice now that it suits them.

Likewise, when the TIOC proposed that the money the toll would have raised for other transportation needs should instead be taken out of the city’s general fund since no other neighborhood in the city has had to pay for its own transportation infrastructure, Beck also said the arrangement with the city mandated that TI projects must pay for themselves, that no general fund money could be used. Again Beck, Breed and Dorsey are now echoing the TIOC position when it suits their program of using the general fund (or at least its bonding authority) to give hundreds of millions of dollars to the developers.

Note that while the city touts its “robust” community process, there hasn’t been a single forum to inform island residents of the DDA amendment and how they will be affected by it, or to solicit their input. From the program’s announcement in March to its projected vote at the Board of Supervisors May 7, the city has focused on jamming it through the process without informing islanders.

Held in bond-age

Fortunately, there are still some guardrails left.

Even if the DDA Amendment passes the BoS, bond underwriters likely would spend the next eight or nine months structuring the bonds, Lee Lewinsky of the City’s Office of Employment and Workforce Development told the Planning Commission at its April 4 meeting.

Underwriters are separate, independent financial companies that actually evaluate the feasibility of the bonds. Since their business model is to receive a cut of the money raised through the sale of the bonds, they have a real incentive to make sure the funding mechanisms are sound, and assumptions are realistic as they calculate projections out 40 years into the future.

To convince the underwriters of their due diligence, city staff did a new Fiscal Impact Analysis two years ago. But those have been an eventful two years. Since then, the developers in TICD, through their lawsuits, have acknowledged their financial weaknesses. Inflation and spiking interest rates have taken a toll on the economy’s stability. The city’s deficit is approaching $1.5 billion and counting. Property and transfer tax revenues are down sharply.

These could all affect the city’s bond ratings negatively, increasing the city’s debt service burden. Since the bonds are backed by the general fund, this could become a problem for all San Franciscans.

Among the guardrails are the anti-fraud provisions of the federal securities laws. The City and TIDA are “required to ensure that the POS (Preliminary Official Statement) and the final Official Statement must contain information that is accurate and complete in all material respects. This obligation attaches to the individual members of the governing bodies approving the document, as well as City staff charged with preparing the document.”

This means that if there is a substantial likelihood that the information would have actual significance in the deliberations of the reasonable investor when deciding whether to buy or sell the bonds, all involved have an obligation to get it right.

This Alternative Financing could become a dangerous precedent. If the developers are struggling now, it could be only a matter of time before they come back again to the taxpayers of the San Francisco with hat-in-hand for another bailout.

“They will make their case on Wednesday,” Chan told us. “They will argue that the low-income residents of the island need more reliable electricity, and that’s true. But if I end up supporting this it will be with great trepidation.”

Steve Stallone is a retired journalist and a founding member of the Treasure Island Organizing Committee.