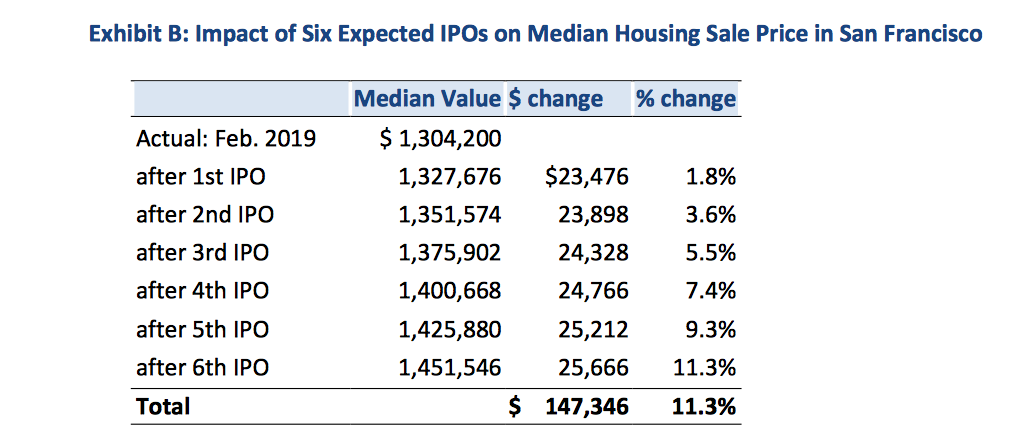

The six tech IPOs that are likely to happen in the next year could drive up housing prices as much as 11 percent – that’s $147,000 on the median house – and create even more dramatic economic inequality in San Francisco, a new city report says.

The report by the Board of Supes Budget and Legislative Analyst, was released as part of a hearing into the impact of the tech IPOs – and the information presented at that hearing spurred Sup. Gordon Mar to announce he wants to put a small tax on stock awards to help mitigate the impacts of the new wealth.

From the report:

-

IPOs can generate significant infusions of cash for growing companies and new wealth in a compressed time frame for IPO company founders, initial investors, and employees. However, this wealth does not necessarily benefit the entire community. Population, job, and income data show that income inequality persists in San Francisco even as the City continues to experience a sustained period of population, job, and wage growth, particularly for highly-paid technical occupations.

-

While not the sole cause of income inequality in San Francisco, the occurrence of up to six IPOs in 2019 will not improve San Francisco’s situation by adding a one-time injection of wealth to many well-paid workers, investors, and founders and likely experiencing some level of increase in housing prices.

Mar noted that during the past decade, an immense amount of wealth has been created in this city – “in part because of decisions in this chamber. We rolled out the red carpet for the tech industry, and when they threatened to leave we paid their ransom.”

Now, he said, it’s time to tax the wealth generated by these IPOs – at a very small level. His proposal would restore the city’s former 1.5 percent payroll tax to stock-based compensation, raising about $100 million for a “shared prosperity” fund that would pay for affordable housing and protections for vulnerable families and small businesses.

It’s not a radical concept to ask the growth pay for growth, or that the tech boom pay for the impacts of the tech boom. That’s been a basic philosophical tenet of city planning for years – although in San Francisco, its implementation has been so limited that Muni is falling apart, the streets are congested, and thousands of people have been thrown out of their homes.

And that impact has been profound: City economist Ted Egan testified that over the past decade, $134 billion in venture-capital money has poured into San Francisco. That’s a stunning number. Every year, more VC money has gone into startups than the entire size of the city budget. No wonder we can’t keep up with the resulting problems.

“This is a fairly unprecedented time,” Egan said.

Amanda Fried, policy chief for the Treasurer’s Office, explained how the city’s tax-law changes have helped the tech sector more than any other part of the business community. Under pressure from promoters of that one industry, the city shifted from a payroll tax to a gross receipts tax – and when that happened, tech-sector companies who had been paying $190 million a year in city taxes saw their bill drop to $165 million. That’s $25 million a year, a 14 percent cut – which other businesses had to make up with higher taxes.

“This was more of a reduction than we had expected,” she said.

On top of that, the city lost $70 million to the Twitter Tax Break.

So small businesses that are struggling, manufacturing that is under constant attack, retail, services … everyone else who makes San Francisco function pays more taxes now so that tech companies, which are richer than everyone else anyway, pay less.

That’s a remarkable revelation that the local news media have not reported.

Egan noted that companies might leave town, or start-ups go somewhere else, if this type of tax passed, but seriously: The impact on this vast new wealth would be tiny, almost irrelevant compared to, for example, the cost of office space and housing for employees in this city. San Francisco has already give away more in tax breaks than this new levy would raise.

Testimony at the hearing focused on the larger question of income inequality. “How is San Francisco going to rise to this challenge?” asked Emily Lee, representing the SF Rising Alliance.

It’s a bigger question than just a tax on IPO wealth. Sup. Sandra Fewer noted that “this is not just about IPOs, it’s about who we are as a city.”

Mar needs six votes to put his IPO tax on the November ballot. By introducing it, and forcing the issue, he’s created a critical test for local politicians.

Two years ago, under the late Mayor Ed Lee, the tech titans ruled City Hall. Airbnb, Uber, Lyft, the Google Buses – anyone could break the law with impunity if they had friends in Room 200. Ron Conway was the most powerful person in local politics.

But now there’s a progressive majority on the board, and I suspect Mar will get his six votes. And Big Tech will fight back, viciously. Will Mayor London Breed side with Conway’s crew, who strongly supported her, and oppose the IPO tax?

What about Breed’s pick for the Board of Supes, Vallie Brown, who is facing a challenge from Dean Preston, who told me he supports Mar’s tax?

This could be a defining issue in local politics: Who is on the side of tech tax breaks, and who is on the side of making the newly rich companies pay just a tiny bit to address income inequality?