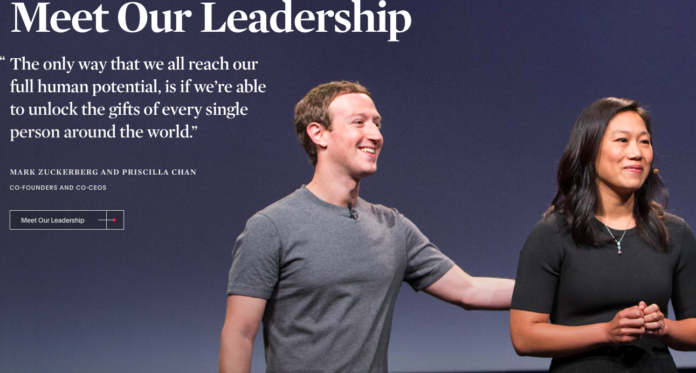

On January 24, 2019, the Chan Zuckerberg Initiative, the limited liability company founded by Dr. Priscilla Chan and her husband, Facebook CEO Mark Zuckerberg, and funded by a lifetime pledge of 99 percent of his Facebook shares (he’s given $3 billion so far), announced that CZI had helped to launch the Partnership for the Bay’s Future, “a new kind of public-private housing partnership….aimed at helping to solve the interconnected challenges of housing, transportation, and economic opportunity.”

Joined by the Ford Foundation, the Silicon Valley Community Foundation, other big philanthropies, and Facebook itself, the Partnership had already raised $280 million, with plans to assemble a total of $500 million over the next five years.

According to one account, the Partnership for the Bay’s Future “grew out of CZI’s interest in housing and an initial funding commitment” of $50 million. Ten of those millions will go to a “Policy Fund” led by the San Francisco Foundation that, the Partnership website says, will be disbursed to counties, cities, and community groups in San Francisco, San Mateo, Santa Clara, Alameda, and Contra Costa Counties to “protect families and individuals burdened by high rents…, preserve and produce affordable housing” and “enable more Bay Area residents to remain in their communities.”

Lost in the buzz of acclaim that greeted the Partnership’s founding was the fact that CZI had already donated hundreds of thousands of dollars to nonprofit organizations that have used their grants to shape public housing policy for the Bay Area. Those donations are not secret; they’re listed on the CZI website; and the foundation’s broader interest in housing policy has been noted in the media.

What hasn’t been reported:

- Some of CZI’s biggest grantees are promoting policies that, stated intentions notwithstanding, will inflate land values, boost rents, and force many of the Bay Area’s most vulnerable residents out of their homes, while instituting and reinforcing undemocratic forms of governance that benefit Big Tech and Big Property Capital.

- These CZI grantees often collaborate.

- They have clout in Sacramento, manifest in bills such as SB 50 (Wiener), SB 330 (Skinner)—both endorsed by Facebook—and AB 1487 (Chiu), endorsed by CZI, and their contractual and informal relationships with state agencies.

- Public records we have obtained show that this shadow government is being facilitated by CASA (the Committee to House the Bay Area), the secretive, ad hoc entitythat officially operated under the auspices of the Metropolitan Transportation Commission from June 2017 to December 2018, and whose members continue to lobby Sacramento, in at least one case with public funding from MTC.

What follows is the first in a series of reports on CZI grantees that merit immediate attention because of their efforts to influence, if not actually formulate, major housing bills that are currently advancing in the state Legislature.

Contrary to the Chronicle’s front-page, April 20 story claiming that “[w]hat’s left” after SB 50 was put on hold until next January “are more modest proposals,” several equally aggressive bills are moving forward in Sacramento. One such measure is Skinner’s SB 330. That bill has close ties to one of CZI’s big grantees, the Terner Center for Housing Innovation at UC Berkeley, the focus of this article. Subsequent installments will show how Terner participates in a network of CZI-funded power players in California’s housing politics. Like other members of that network, Terner has multiple sources of revenue. But CZI’s support is concerning.

For one thing, the Chan Zuckerberg Initiative is structured as a limited liability corporation, not a traditional charitable foundation. Writing in The New York Times in December 2015, Pro Publica’s Jesse Eisinger detailed some of the differences between the two:

Help us save local journalism!

Every tax-deductible donation helps us grow to cover the issues that mean the most to our community. Become a 48 Hills Hero and support the only daily progressive news source in the Bay Area.

An L.L.C. can invest in for-profit companies (perhaps these will be characterized as societally responsible companies, but lots of companies claim the mantle of societal responsibility). An L.L.C. can make political donations. It can lobby for changes in the law. [Zuckerberg] remains completely free to do as he wishes with his money. That’s what America is all about. But as a society, we don’t generally call these types of activities “charity.”

What’s more, a charitable foundation is subject to rules and oversight. It has to allocate a certain percentage of its assets every year. The new Zuckerberg LLC won’t be subject to those rules and won’t have any transparency requirements.

The LLC structure has additional discretionary advantages over a foundation, noted Bloomberg reporter Kerry Dolan:

Charitable foundations can’t make political donations; LLCs can. The Zuckerberg-Chan Initiative also will not have to disclose what it pays its top five executives, something that charitable foundations are required to do in their annual 990 filing which are public documents….Also, Zuckerberg will still control the Facebook shares owned by the Chan-Zuckerberg Initiative. If he had created a charitable foundation, he would lose control of those shares once he donated them to the foundation…

Zuckerberg’s and Chan’s decision to exploit the freedom from the public disclosure required of foundations structured as nonprofits elicited approving commentary from Inside Philanthropy. When the couple started CZI, wrote David Callahan in September 2017, “they took some heat for incorporating it as an LLC—since such entities can operate with little transparency.” In Callahan’s view, “look[ing] beyond the traditional foundation structure” was a smart move:

The LLC is a much better vehicle for the kind of multi-faceted approach to big problems that Chan and Zuckerberg favor….The fact that money can be moved anonymously if need be makes the LLC structure that more attractive. Mark Zuckerberg is running one of the most visible public companies in the world, and…it’s a risky thing to hold that kind of position while also putting money behind public policy causes. If CZI doesn’t want to leave any fingerprints, it doesn’t have to.

Callahan wasn’t worried, because “[s]o far…this fast-growing organization has been pretty open about its activities.” As evidence of CZI’s “spirit of openness,” he cited the announcement made by David Plouffe—yes, that David Plouffe—Head of Policy and Advocacy at CZI, of “$24 million in gifts to influence public policy on several controversial issues…”

To an extent, I agree. If not for the list of CZI grants posted on the Initiative’s website, this article and the ones that will follow would have been much harder to write. That said, CZI only publicizes the grants it’s made on an annual basis. You know about in-between awards only if a grantee has advertised them. Queried, CZI staff are forthcoming. But you have to ask, and you have to know what to ask.

Publicity aside, when it comes to Big Philanthropy, I second Stanford University Professor Rob Reich, who says that the industry—and it is an industry—deserves scrutiny, not gratitude.

Indeed, CZI’s entry into the public housing policy arena has a grim irony. Facebook, after all, is the company that, The New York Times reported in late March, was sued by HUD for having violated the Fair Housing Act by “engaging in housing discrimination by allowing advertisers to restrict who is able to see ads on the platform based on characteristics like race, religion, and national origin,” and having used “its data-mining practices to determine which of its users are able to view housing-related ads.”

Last year, Facebook opposed San Francisco’s Proposition C, which would have taxed the city’s highest-grossing companies to fund homeless and housing services. Under the aegis of sf.citi, Zuckerberg’s firm and 28 other Bay Area tech companies backed the No on C campaign. Thanks to the unexpected intervention of Salesforce CEO Marc Benioff, who gave $2 million to the proposition’s supporters, the measure got more than 61 percent of the vote.

But the city is now being sued by business groups claiming that C needed two-thirds to pass, and the money—potentially $3 million a year—is tied up until the legal fight is resolved. If Facebook and its tech brethren had supported the measure, it might well have gotten a two-thirds approval.

CZI stresses the Initiative’s distinctiveness from Facebook, emphasizing that the two entities are separate organizations with a common founder. But that may be a distinction without a difference, given the exceptional discretion that the LLC structure affords its founder and the founder’s sense of entitlement.

In a May 23 press conference following Facebook’s release of its latest biennial transparency report, Zuckerberg dismissed calls to break up his company. The report stated that Facebook had removed a record 2.2 billion fake accounts in the first quarter of 2018. Contending that the company’s size was a virtue, Zuckerberg asserted: “I think the amount of our budget that goes toward our safety systems—I believe is greater than Twitter’s whole revenue this year … So we’re able to do things that I think are just not possible for other folks to do.”

That is true—and very scary. Concentrated power is inimical to democracy. Facebook’s predominance, coupled with its resistance to public regulation and—far more important and damning—public officials’ failure to regulate the company (not to say, the tech sector at large) for the public’s benefit is frightening enough. Add CZI’s magnitude, California officials’ ready collaboration with CZI grantees at the state and regional levels, and you have an alarming power grab.

CZI grants to UC Berkeley’s Terner Center for Housing Innovation: $1,443,520

CZI has given the Terner Center two grants. The first, totaling $443,520, was for work to be done in 2018-2020. CZI’s website lists the grant without specifying its date; the award was reported by several news outlets on February 6, 2017. Terner, says the CZI website, “uses policy research and practice innovation to advance bold strategies to house families in vibrant, sustainable, and affordable homes and communities.”

On May 23, 2019, Terner sent out a press release announcing the inauguration of Housing Lab, billed as “the nation’s first startup lab focusing exclusively on lowering the cost of housing” and funded by CZI. There’s nothing on the Initiative’s website about such an award, so I emailed CZI asking if this was a new grant. The reply: yes. The Initiative has pledged $1 million for Terner’s new project. According to the Terner website, five “ventures” will each receive $100-150K in “non-dilutive philanthropic capital,” along with “customized in-person summits and virtual programming,” “introduction to diverse capital providers,” and “industry expert advising.” Applications will be accepted starting June 10.

We won’t know exactly what kind of “ventures” Housing Lab is supporting until early September, when the five winners will be announced. And when I asked Terner to what uses it put its first grant, I was told only was for “general operating support toward our mission.” My follow-up question—yes, but how has that money been used?—has gone unanswered.

But there’s ample information online about the sort of “bold strategies” that Terner advances. Since its 2015 launch with $2.34 million in donations from big developers and major bank foundations, Terner has churned out recommendations to roll back local and state barriers to growth, using housing as a proxy for growth. (Appropriately, it calls its blog “No Limits.”) In March 2019, the Center published the first in a series of studies of land use regulation, undertaken with the California Association of Realtors’s Center for California Real Estate.

Terner’s founder and director is UCB Professor of Affordable Housing and Urban Policy Carol Galante, a former Bridge Housing CEO and, under Obama, Federal Housing Administration commissioner and assistant secretary of HUD. A fixture on the high-level housing policy circuit, Galante is a vociferous opponent of the California Environmental Quality Act. She’s also a Yimby fan: In January 2017, she filed an amicus brief in support of BARF leader Sonja Trauss’s lawsuit of Lafayette.

Terner director Galante lauds Nancy Skinner’s SB 330

In late April, Galante flaunted her anti-democratic, pro-growth politics in a Bay Area News Group op-ed extolling a bill just as draconian as SB 50: SB 330, authored by Senator Nancy Skinner, whose district includes Richmond, Berkeley, Oakland and other cities on the 880 corridor. Galante wrote the op-ed with UC Berkeley Professor of City and Regional Planning Karen Chapple, who’s also a Terner Faculty Research Affiliate and the founder of UCB’s Urban Displacement Project.

Published in the East Bay Times and the Mercury News under the headline “California isn’t full; we could provide housing for everyone,” Galante’s and Chapple’s piece identifies “the root of the housing crisis” as “the many ways California communities have sought to resist change in the name of protecting their residents”: exclusionary zoning, downzoning in the 1970s and 1980s, “a complex array of housing regulations and fees that slow or prevent development,” and “well-meant attempts to democratize development approval processes by mandating public hearings.”

However well-mentioned, these measures are, say the co-authors, misguided:

Ours [sic] and others’ research has shown that these practices tend not only to make development prohibitively costly, but also to exacerbate inequalities within a region. Exclusion by affluent communities creates challenges for low-income and middle-class families in accessing resources such a high-quality schools and park, as well as opportunities for upward mobility. Ironically, policies such as downzoning and public hearings, initially meant to protect existing residents and exclude outsiders, are now also making it impossible for residents to stay in their own communities.

The solution? Pass State Senator Nancy Skinner’s “gutsy” SB 330, which would “take away the many tools used by the state’s affluent communities to exclude newcomers” by

- prohibiting cities from downzoning [reducing intensity of land use], instituting new parking and design requirements, and imposing new fees on housing development

- capping public hearings at three to a project

- suspending fees on affordable housing development

- banning demolition of affordable housing “unless the new development maintains or increases current densities, and the developer provides relocation benefits and right of first refusal for tenants, ensuring they can stay” (as if displaced tenants are going to return years after they’ve been forced out of their homes).

The UC Berkeley professors conclude by “applaud[ing] Senator (and rocket scientist) Skinner for her move to transform California towards more equitable development.”

To be sure, SB 330 would be transformative—but toward less, not more, equitable development. As distinguished geographers Michael Storper and Andrés Rodríguez-Pose explain in their new paper, in hot markets such as the Bay Area, a deregulatory—or more precisely, market-friendly re-regulatory—supply-side approach will “principally unleash market forces that serve high income earners” and “are therefore likely to reinforce the effects of income inequality rather than tempering them.” If we want equitable development, we need a “delicate and complex policy mix” that includes “high public subsidies for construction of affordable housing,” i.e., housing for low-income people.

SB 330’s “bludgeon approach”

Instead of delicacy and complexity, SB 330 offers what San Francisco Supervisor Hillary Ronen has aptly called “a bludgeon approach to what we all agree is a true crisis.” Ronen made that charge in an April 18 letter to the ABAG/MTC Housing Legislative Working Group. By prohibiting “any change in zoning, new design standard, increase in fees, or moratoria on construction after January 1, 2018, on land where housing is an allowable use,” SB 330, Ronen wrote, will

inflame hot-market areas, disincentivizing less profitable development opportunities in the suburbs and focusing all housing investment in very popular areas of the Bay Area that are already reeling from gentrification and displacement.

At the same time, its protections

for existing tenants are too limited and too weak to truly protect communities that that the San Francisco Planning Department has flagged through our Community Stabilization Strategy as communities at-risk of displacement or facing ongoing and advanced gentrification.

Ronen is correct, first, about the weakness of SB 330’s protections for economically vulnerable communities. The proposed protections—allowing residents to occupy their units in a building slated for demolition until six months before the start of construction activities, offering relocation benefits to occupants of affordable residential units, and giving those occupants a right of first refusal for units available in the new housing development affordable to the household at an affordable rent—are empty gestures and worse: SB 330 allows developers to use relocation fees and rights of first refusal to existing tenants as credit toward inclusionary housing requirements. In other words, a relocation fee would substitute for an onsite affordable unit or an affordable housing linkage fee.

In a more insidious move, SB 330 puts tenants at risk by allowing owners of an “occupied substandard building or unit in which one or more persons reside that an enforcement agency finds is in violation of the California Building Code to request a delay of enforcement up to seven years….on the basis that correcting the violation or abating the nuisance is not necessary to protect health and safety.” As Los Angeles community activist Hydee Feldstein observes:

Creating a nuisance to force out tenants without formal eviction and to depress adjacent property values for easy purchase is a well-known tactic of unscrupulous developers. SB 330 enshrines these shady tactics as a right, giving license to the worst kind of behavior by absentee landlord and does so without any provision for tenant self help, rent abatement, city clean-up with lines to attach to the property or any other remedies that are necessary to avoid slumlords, greed, displacement, and deliberate blight.

So much for SB 330’s tenant protections.

Ronen is also correct about how SB 330 targets the Bay Area. SB 330 would apply to cities, including charter cities, in “an urban core…for which”—stay with me—“the Department of Housing and Community Development determines that the percentage by which [both] the city’s average rate of rent exceeded 130 percent of the national median rent in 2017,” and “the percentage by which the vacancy rate for residential rental units is less than the national vacancy rate” are “greater than zero.” SB 330 would apply to counties “in which at least 50 percent of the cities located within the territorial boundaries of the counties are affected cities.” [Section 65913.3 (a) (1) and (2)].

To state what ought to be obvious, it’s absurd to base land use policy for California and for the Bay Area in particular on nationwide conditions.

But SB 330’s “bludgeon approach,” to borrow Ronen’s term, goes far beyond that absurdity. There’s also its sweeping curtailment of democratic voice in land use. Following up on the provisions just cited, Section 65913.3 (a) (3) states:

Notwithstanding any other law, for purposes of any action that this section prohibit an affected county or an affected city from doing, “affected county” and “affected city” includes the electorate of the affected county or affected city, as applicable, exercising its local initiative or referendum powerwith respect to any act that is subject to that power by other law, whether that power is derived from the California Constitution, statute, or the charter or ordinance of the affected county or affected city. [emphasis added]

Along the same authoritarian lines, SB 330 proposes that

if a proposed housing development project complies with the applicable, objective general plan and zoning standard in effect at the time an application is deemed complete, a city or county shall not conduct more than five de novo hearings…in connection with the approval of that housing development project,”

each of which must be scheduled “within 30 days following the request by the applicant, or an earlier date if otherwise required by law. And “[t]he city or county shall not continue any hearing subject to this section to another date.” [Section 65905.5 (a)]

Five hearings may sound like a lot. But consider that SB 330 defines “Hearing” to include “any public hearing, workshop, or similar meeting conducted by the city or county with respect to the housing development.” [Section 695905.5 (b) (2)] The vagueness of the language is troubling: what constitutes a meeting “similar” to a public hearing or workshop? Indeed, what constitutes a workshop, a meeting that, to my knowledge, and, crucially, unlike a noticed public hearing, has no legal definition or status? Testimony taken at a public hearing can be used as the basis of a lawsuit. To my knowledge, that is not the case of testimony at a workshop or “similar meeting” (whatever that means).

The prior version of SB 330 specified a limit of three de novo public hearings; it said nothing about a workshop or “similar meeting.” I wonder if Skinner upped the number to five in response to criticism from the California chapter of the American Planning Association. Cal APA called three “an arbitrary limit” that “may not be enough for particularly large or controversial projects” and suggested that “requiring a specific time requirement instead would still allow the local agency flexibility to complete all necessary hearing and is a fairer process.” Adding “workshop” and “similar meeting” to the definition of hearing, plus mandating that each so-called hearing occur within 30 days of an applicant’s request, makes a mockery of APA California’s concerns.

Skinner ignored another serious objection that the state’s professional planners association raised to her bill. SB 330 prohibits “a moratorium or similar restriction on housing development, including mixed-use development…other than to specifically protect against an imminent threat to the health and safety of persons…” [Section 66300 (b) (B) (i)] Commenting on April 3, APA California Vice President for Policy and Legislation Eric S. Phillip wrote:

An imminent threat is an impossible threshold. The purpose of a moratorium is to prevent anticipated problems before they threaten the health and safety of residents, such as a moratorium for jurisdictions without water allocations or other legitimate health/safety issues such as a potential wildfire threat. Such issues are not imminent, but they are clearly legitimate reasons for a moratorium until measures can be put in place to deal with them.

Skinner’s insistence on tying moratoria to an imminent threat bespeaks a disquieting ignorance about or, worse, disregard for, the purpose and nature of planning.

Besides the Terner Center, SB 330’s supporters include Bridge Housing, the California Association of Realtors, California Yimby, SPUR, Facebook; and the following CZI grantees: California Community Builders, Enterprise Community Partners, Hamilton Families, PICO California, Silicon Valley@Home, the San Francisco Foundation, and the Urban Displacement Project.

Opponents include the California chapter of the American Planning Association, the Association of California Water Agencies, the League of California Cities, Livable California, and the South Bay Cities Council of Governments.

On May 28, SB 330 passed on the Senate floor by a vote of 28-7.

Terner’s $360K worth of contracts with CA’s top housing agency

The Galante-Chapple op-ed is as notable for what it omits as for what it says. Besides sanitizing SB 330, the piece fails to mention that Terner has a contract with the California Department of Housing and Community Development for a report whose recommendations may well show up in the final version of the bill.

A clue to that connection appears in State Senate staffer Alison Hughes’ April 24 analysis of SB 330. Under “Fees.,” Hughes wrote:

As part of the 2017 Housing Package, the Legislature passed AB 879 (Grayson, Chapter 374), which requires HCD to complete a study to evaluate the reasonable of local fees charged to new developments. The study, which is due to the Legislature by June 30, 2019, must include findings and recommendations regarding amendments to existing law to substantially reduce fee for residential development. HCD is on track to deliver that report to the Legislature on time.

As of April 24, SB 330 prohibited an “affected city or county” from imposing a variety of development fees. Hughes commented:

Moving forward, the author may wish to consider whether it is premature to prohibit certain fees when a study is already underway to provide overall policy recommendations for reducing housing costs.

On April 21, the Senate removed those prohibitions from the bill. It remains to be seen whether future iterations of SB 330 will incorporate recommendations from the study from HCD.

But what can be said right now with certainty is that the aforementioned study is being written by the Terner Center. The California Public Act Request that I made to HCD in late April asking to see any contracts that Terner has with the agency yielded a “Professional Service Agreement” dated September 12, 2018, in which HCD promises to pay Terner $200,000 to prepare a report on “the imposition of impact fees” on developers that “will inform the [HCD] report to the legislature pursuant to AB 879….” The project’s “long-term objectives” are “to propose policy responses to improve the transparency of fee assessment, establish potential uniform guidelines for nexus studies, and discuss alternative financing options for city infrastructure to potentially decrease reliance on impact fees.”

This report has yet to be published. But we can anticipate its likely thrust: My CPRA request yielded a second contract, dated July 6, 2018, in which HCD agrees to pay Terner $162,051 for a “detailed review of local land use policies in California to inform policy-makers wishing to expand the supply of housing for households at all income levels.” Included among the “key deliverables” is a case study “that focuses on exemplifying strategies and opportunities used to minimize fees levied on housing development.” In April, Terner posted the case study, which treats Sacramento’s revised fee program.

Terner: how to reduce development impact fees

The paper illustrates the shrewd wordsmithing that Terner uses to advance its pro-growth agenda. The authors (unnamed) begin disarmingly, acknowledging that “the increasingly high fees that cities charge for new development….are often necessary to meet expanded need for infrastructure.” They then note that “[i]n the 1970s, 1980s, and 1990s, Californian enacted a series of anti-tax ballot measures and initiatives that drastically limited the property tax that can be collected by the state”—Propositions 13, 62, and 218. One consequence was

the dramatic restructuring of municipal finance statewide. Jurisdictions had previously relied on revenue generated by property taxes to fund the infrastructure improvements that would serve a growing population. But with more limited source of tax revenues, local administrators have increasingly placed the burden of infrastructure financing directly on new development.

All true (though not the whole truth).

Given this introduction, you might think that the best way to relieve the burden on new development would be to revisit those initiatives. Instead, this is the last we hear of California tax law. The rest of the Terner paper focuses on impact fees themselves—how they burden developers and how they can be cut à la Sacramento—and it does so in some disingenuous ways.

“In the current paradigm,” we read,

housing development is largely expected to “pay its own way” in the form of fees that cover both the jurisdiction’s development approval process and the impact that the new development will have on infrastructure, schools, and transportation systems, among other factors.

No footnote here, and for good reason: in fact, new housing rarely pays its own way.

As for fees’ specific burdens on developers: Impact fees vary greatly both within and among California cities. Terner researchers report that city officials have trouble estimating fees in their own jurisdictions. That results in “a clear challenge for researchers and policymakers trying to better understand and streamline the fees at a statewide level.” What the paper doesn’t say: It’s also a challenge for developers, who have to spend time—meaning money—to work with each jurisdiction.

The Terner paper homes in on another drawback of impact fees: They “can really add up,” particularly in California. The study quotes a 2015 report noting “that, overall development fee in California were almost three time the national average.” This is the same sort of irrelevant comparison of California to a national average as SB 330’s comparison of California rents and vacancy rates to national averages. (The cited report was written by a private impact-fee consultant, Clancy Mullin, whose firm, Duncan Associates, says its “philosophy is that the best zoning is zoning that removes unnecessary regulatory and procedural obstacles and that achieves desired results.”)

The case study also flags housing affordability: Developers tack the costs of impact fees on to the purchase price or rent of a home. But then the Terner authors lament the fact that unlike construction in a previously unbuilt area, infill development cannot

make use of creative infrastructure financing tools, such as Mello-Roos Community Facilities Districts (CFDs), to fund the additional infrastructure needed to support them. CFDs allow master developers to pass the cost of new infrastructure on to future home purchasers in the form of special taxes.

Thanks to Prop. 13, “[s]uch a financing tool is less readily available for infill developers[,] as two-thirds of existing residents”—to be precise, voters—“would need to approve the special tax.” When it comes to infill, then, the problem is not diminished affordability, but greater difficulty in offloading the cost of new infrastructure onto the local electorate.

The Terner paper’s rhetorical maneuvers also include the subtle association of market-rate private housing development with the greater good and an attendant valorization of housing developers’ motives. The foregoing cited reference to developers’ “paying their own way” exemplifies this tactic. Similarly, we read near the start: “The following case study examines the steps taken by the city of Sacramento to restructure fees to better suit the collective interests of city administrators, developers, and residents.” The implication is that the three named parties constitute a collectivity—a dubious idea. After noting that “California stands out as a state with exceptionally high fees,” the Terner paper comments that

the addition of fees can restrict housing supply if the project’s costs exceed the amount a developer can pay while still achieving a minimum desired profit (i.e. the profit ceases to “pencil”).

Neither the footnoted reference, a 2018 Terner study on “the cost of housing development fees in seven CA cities,” nor the impact fee paper indicate what developers consider “a minimum desired profit” or offer any example of how the fees imposed on any specific project rendered the project financially infeasible. And what is the meaning of “desired”? How should developer desire count in the formulation of public policy? No specifics are provided, thereby implicitly legitimating the profits that developers seek.

Jumping ahead, perhaps my favorite instance of Terner’s artful argumentation appears under “Lessons Learned:”

“Engaging the public, interest groups, and developers in the overhaul process can bring forth ideas that might not emerge internally…” So developers are not an interest group? Who is, then? We’re not told.

After this buildup, you won’t be surprised to learn that the case study approvingly cites these changes that Sacramento made in its impact fees:

- Instituted a uniform process for all fees

- Established a fee deferral program in which developers could delay payment of certain fees until completion of construction.

- Created incentive structures that favor infill development: reduced the number of park acres for each development; devised finance plans to mitigate the uncertainties of infrastructure financing in infill areas; and lowered fee rates in housing incentive zones, in the central city, and near transit.

- Established a fee estimation service: for a nominal fee, developers can obtain a projection of the total anticipated project fees they will incur.

- Waived development fees on affordable housing projects.

In land-use regulation as in so much else in life, the devil is in the details. Unfortunately, the Terner paper provides only one detail about Sacramento’s new fee program: When possible, fees are now calculated using square footage rather than on the number of units or bedrooms, a shift that could “encourage more units in the same area by lowering the cost of dense multi-family [housing] relative to single-family home construction.”

Otherwise, it’s all generalities. Indeed, the square footage criterion itself is really a generality. How much is the city charging per square foot, and to what extent does that cover infrastructure costs? (The answer to the second question is going to be less than if the fees were based on number of units or bedrooms, which offers a clearer measure of the demands that the occupants of new housing will make on public service utilities.)

The Terner study’s lack of specifics makes it impossible to develop an informed opinion about Sacramento’s program. But as already indicated, it’s quite possible to develop an informed opinion about the study itself and its goals. The latter are neatly summed up in one of the “Lessons Learned” from Sacramento: “Design fees to support housing priorities”—meaning, growth priorities. In fact, that was not a lesson learned from inquiry, but rather the assumption that drove the inquiry.

You could argue in Terner’s defense that it was just carrying out the assignment it got from HCD, and you’d be right. But therein lies a problem. Ensconced in the University of California, Berkeley, Terner proceeds under the imprimatur of one of the most eminent research universities in the world. That dispensation connotes scholarly detachment. Here, however, Terner was very attached to the object of its inquiry—and not only by the $360,000 worth of contracts with HCD. More specifically, the Center researchers took their cues from their state patron.

The last page of the paper is devoted to “Acknowledgements” [sic] of those who assisted the preparation of all the case studies for HCD. Besides recognizing Terner staff and “local officials and stakeholders,” the nameless writers thank HCD:

We’re deeply grateful to the California Department of Housing and Community Development for the funding that made this work possible, as well as for their guidance and insights on which policies and case studies to select.

Such reliance on the object of inquiry fails the academic detachment smell test.

But what about paying for infrastructure?

The Center’s relationship with HCD looks even more questionable once you examine the legislative record of the enabling law, AB 879. Authored by Concord-based Assemblymember Tim Grayson, a former construction contractor and Republican who became a Democrat before running for the Assembly in 2015, the bill was sponsored by the League of California Cities.

That seems incredible, until you find out that the impact fee reduction provision did not appear in the original 2017 measure. After it was added, in mid-July, along with major new requirements for cities’ Housing Elements, the League put out a floor alert to members of the Senate (the bill had already passed the Assembly) asking them to vote No and to remove the new amendments. Co-signed by APA California, Rural County Representatives of California, the California State Association of Counties, and Urban Counties of California, the alert laid out the League’s objections. It’s worth citing in full. AB 879, it said:

PROPOSES AMENDMENTS TO SUBSTANTIALLY REDUCE FEES FOR RESIDENTIAL DEVELOPMENT WITHOUT PROVIDING OTHER FUNDING SOURCES FOR SERVICES AND INFRASTRUCTURE TO SERVE THAT NEW DEVELOPMENT: The bill grants new power to HCD to complete a study to evaluate the reasonableness of local fees charged to new developments, including new amendment to the Mitigation Fee Act to “substantially reduce the fees for residential development.”

On what basis will HCD evaluate the “reasonableness” of fees given the current requirements in the Mitigation Fee Act?

- The existing Mitigation Fee Act is in place to ensure that cities and counties apply fees fairly to only cover the cost of the mitigation and services, and to ensure every project pay its fair share.

- If fees are “substantially reduced for residential development” without an alternative funding mechanism to make up the difference, where will the funding come from to pay for infrastructure and services needed to serve the new development?

- The real problem is the chronic underfunding of infrastructure—a blanket statement to “substantially” reduce fees will add to the infrastructure and services deficit.

The League memo raised vital questions. An objective study of impact fee reduction would pursue those questions. The Terner paper ignores them.

The CASA Connection

What links CZI’s grantees is their participation in and commitment to CASA, short for the Committee to House the Bay Area, the 50-odd “stakeholders” who were covertly assembled in mid-2017 by former Metropolitan Transportation Commission Executive Director Steve Heminger. Agents of Big Tech, Big Philanthropy, and Big Real Estate Capital dominated the roster, which included ten nonprofits that have received CZI awards: the Terner Center, the San Francisco Foundation, Silicon Valley @ Home, TransForm, The Nonprofit Housing Association of Northern California, the California Housing Partnerhip, Enterprise Community Partners, California Community Builders, Habitat for Humanity, and Hamilton Families.

Many of the participants already had working relationships; the CASA project formalized their ties and mutual commitment to an agenda of growth, centralized governance, “densification,” and market-oriented re-regulation of land use. The group toiled for a year and half, mostly in secret, to produce its “Compact,” a 31-page “15-Year Emergency Policy Package to Confront the Housing Crisis in the Bay Area.” Finalized in December 2018, the Compact is now being shopped in the state Legislature by lobbyists paid by MTC. CZI is committed to implementing its recommendations.

The Chan Zuckerberg Initiative was represented on CASA by Caitlyn Fox, who directs CZI’s Justice and Opportunity Initiative. She was joined by Facebook Director of California Public Policy Michael Matthews. Facebook Strategic Initiatives Manager Maya Perkins was part of the 42-person CASA entourage that secretly traveled to New York City in early December for a three-day “Learning Session” with bigwigs in NYC’s public and private housing finance scene.

Terner Center personnel were also directly involved in CASA. Ophelia Basgal, a Visiting Scholar at Terner, sat on the Committee. Like other Committee members, Basgal was not paid for her participation. But MTC paid the Terner Center $133,400 for “consultative services” rendered to CASA by Galante and Chapple, public records show.

Despite its name, the CASA Compact advances policies that have been incorporated in bills applying to all of California, including SB 330. Skinner’s bill directly descends from Compact Element #6, “Good Government Reforms to Housing Approval Process.” Under “Desired Effect,” we read:

Research by the UC Berkeley Terner Center for Housing Innovation demonstrates that local government impact fees and inclusionary requirements, when combined with regulatory uncertainty and record-high construction costs, have made it economically infeasible to build a standard mid-rise housing project in many parts of the Bay Area.

The recommended policies include provisions that are in Skinner’s bill, including

- a prohibition on building moratoria except in the face of “an immediate crisis”

- limiting public hearings on a zoning-compliant residential application to three (amended to five in the latest iteration of the bill)

- and locking in rules, fees and historic status at the date of application completeness.

Watch to see how much of the Element #6 shows up in the report on impact fees that Terner is preparing for HCD. Meanwhile, of the 26 supporters listed on Senate staffer Alison Hughes’ May 22 analysis of SB 330, 15 had a representative on CASA.

CASA exemplifies the operation of California’s 21st-century growth machine: working hand-in-hand with benighted public officials, powerful private interests are directing public housing policy so as to benefit themselves rather than the public at large. There’s nothing new, of course, about the backroom influence of Big Capital on public institutions, including the University of California (for starters, see the final chapter of Gray Brechin’s Imperial San Francisco.) Carol Galante’s Terner Center, now evolved into a housing development “startup,” could be seen as just the latest chapter in UC Berkeley’s long history of “marketization.”

What’s new is the marketeers’ attack on local democracy—specifically, on local governance of land use; the professoriat’s aggressive participation in and legitimation of that offensive; its facilitation by state officials; and the tech sector’s unapologetic supporting role in the onslaught.